Mortgage Interest Deduction: Definition, Limit, & Example

KEY TAKEAWAYS

- The mortgage interest tax deduction allows homeowners to deduct the cost of the interest paid on their mortgage each year from their taxable income.

- It is available to anyone who has a mortgage on a primary residence, secondary residence, and some rental properties that meet certain requirements.

- Homeowners with loans issued before 2017 can deduct interest paid on up to $1 million of loan debt. For loans after 2017, interest can be deducted on up to $750,000 of loan debt.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformAs a homeowner, you unlock all kinds of new ways to save on your taxes. Many of the expenses associated with your home are tax deductible, including the interest paid on your mortgage. This is known as the mortgage interest tax deduction, and is available to any homeowner who itemizes deductions and meets a few qualifying factors.

Read on to learn all about the mortgage interest tax deduction, how it works, who qualifies, and how it can affect your taxable income.

What Is the Mortgage Interest Deduction?

The mortgage interest deduction is a tax-saving deduction that applies to homeowners who make mortgage payments and itemize their tax deductions. With this deduction, homeowners can deduct the total amount of interest they pay on their mortgage from their taxable income.

As it pertains to the mortgage interest deduction, mortgage interest includes any interest on loans used to buy, build, or improve a primary or secondary home.

How the Mortgage Interest Deduction Works

In order to take the mortgage interest deduction, you’ll need to itemize your deductions. The IRS’s standard deduction for the 2025 tax year is $15,750 for single filers and $31,500 for married filing jointly. If your eligible deductions exceed that amount, itemize your deductions instead. Using IRS Schedule A, list all eligible tax deductions, including the cost of your mortgage interest.

The home mortgage interest deduction can apply to a few different property types, including:

- Primary residences

- Second homes

- Rental properties that you use as a residence for at least 14 days each year, or 10% of the total rented days, whichever is longer.

Remember that the mortgage interest tax deduction only includes the interest paid on your loan, not the loan principal amount or your property tax, which is deductible under the property tax deduction. Refer to IRS Form 1098, provided by your mortgage lender, to find the amount of interest you paid.

Mortgage Interest Deduction Limit

A $750,000 mortgage interest deduction limit has applied since 2017, and that limit has been permanently extended as of the 2025 tax year. This means that homeowners can deduct the interest on up to $750,000 of mortgage debt for mortgages issued after December 15, 2017.

Mortgages issued prior to that date are grandfathered into the prior mortgage interest deduction limit of interest on up to $1 million of your mortgage debt.

If you’re married filing separately, the mortgage interest deduction limit drops to interest accrued on up to $375,000 of mortgage debt.

What Types of Loans Qualify?

A wide range of loan types qualify for the mortgage interest tax deduction, including:

- Traditional mortgages: Traditional home mortgages with fixed and adjustable mortgage rates (ARM) qualify.

- Home equity loans and HELOCs: For tax years 2018 through 2025, HELOAN or HELOC interest could only be deducted as long as these loans were used to buy, build, or improve your home. However, for tax years before 2018 and after 2025, interest you paid on borrowed funds may be deductible up to a certain dollar limit regardless of how the funds are spent.

- Construction loans: Deduct the mortgage interest of your short-term loan from your taxable income.

- Refinanced mortgages: In the case of refinanced mortgages, the interest deduction limit is based on the date of your original mortgage.

- Non-QM: Non-QM home loans also qualify for MID.

The following loan types do not qualify for the mortgage interest tax deduction:

- Personal loans: Whether from a bank, credit union, or online lender

- Cash-out refinances: Unless the funds are used to buy, build, or substantially improve your home, you cannot deduct any interest paid on a cash-out refinance from your taxable income.

Who Qualifies for the Mortgage Interest Deduction?

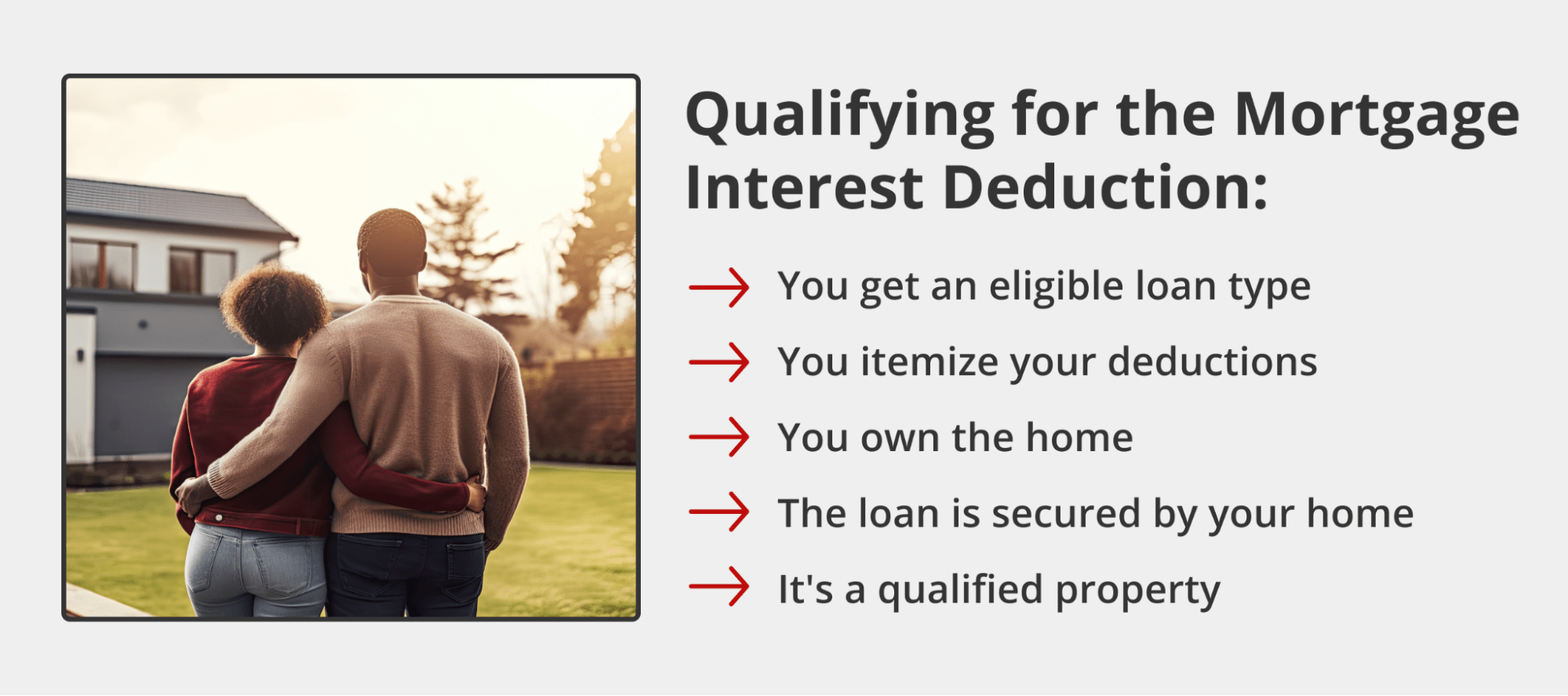

In order to qualify for the mortgage interest deduction, you must:

- Itemize deductions: All tax deductions must be listed on Schedule A in order to qualify for this tax saving. Anyone who takes the standard deduction is ineligible for a mortgage interest deduction.

- Own a qualified property: You must have an ownership interest in the mortgaged property and you must use it as a residence.

- Have secured debt: Your home must be used to secure your loan.

Mortgage Interest Deduction Examples

Let’s look at a few examples of the mortgage interest deduction in action.

Example 1

In 2010, you took out a $1 million loan to purchase your home. In 2025, you paid $30,000 in interest on that loan. Because this loan is grandfathered into the earlier mortgage deduction limit, you can deduct the full $30,000 from your 2025 taxable income.

Example 2

In 2020, you took out a $1 million loan to purchase your home. In 2025, you paid $30,000 in interest on that loan. Because this loan was taken out after December 15, 2017, the mortgage deduction limit is $750,000.

That means you can only deduct the portion of the $30,000 interest that corresponds to the first $750,000 of your loan. Thus, you would not be able to deduct the full $30,000.

How Recent Legislation Affects the Mortgage Interest Deduction

Recent tax policy changes in 2025 have implications on the mortgage interest deduction. Prior to the passing of the One Big Beautiful Bill, the $750,000 mortgage deduction limit was set to expire at the end of 2025, at which point it would revert back to $1 million. Since the passing of the bill, the limit is now permanent.

Additionally, the One Big Beautiful Bill modified eligible mortgage interest, starting in the 2026 tax year. This includes:

- Private mortgage insurance now qualifies: Borrowers with down payments of less than 20% often need to take out this type of insurance on their loan. Premiums for PMI will now be considered deductible as mortgage interest.

- Interest on mixed-use properties is partially deductible: If you own a property used for both personal and rental purposes, the OBBB puts in place clear guidelines for how to prorate the deductible interest based on personal versus rental use.

Maximize Your Tax Benefits as a Homeowner

As a homeowner, you become eligible for a range of different tax benefits that help you save money on your taxes. The mortgage interest tax deduction is just one of many deductions that can help you get the most out of your tax benefits.

Not yet a homeowner? Tax benefits are one of the many great reasons to become one. Download the Griffin Gold app today to start making more informed financial decisions that help you on your way to home ownership.

If you’re looking to buy, refinance, or simply explore your mortgage options, reach out to Griffin Funding today. Contact us to speak with a member of our lending team or get started online.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Is mortgage interest tax deductible in 2025?

- Itemize deductions: You’ll need to itemize all tax deductions to take the mortgage interest deduction

- Own a qualifying residence type: Your mortgage is on your primary residence, secondary residence, or rental property that you use as a residence for at least 14 days each year, or 10% of the total number of rented days.

Should I claim the mortgage interest deduction?

Can I deduct mortgage interest as well as property taxes?

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...