Griffin Funding vs Rocket Mortgage: 2025 Mortgage Lender Comparison

KEY TAKEAWAYS

- Griffin Funding specializes in complex loan scenarios. We excel with self-employed borrowers, investors, and non-traditional income situations that larger lenders often decline.

- Rocket Mortgage prioritizes speed and automation. Their digital-first approach can close loans quickly for borrowers with straightforward financial profiles.

- Griffin Funding offers personalized service with human loan officers, while Rocket Mortgage provides 24/7 online convenience.

- Understanding each lender’s closing costs and rate offerings is essential for comparing total loan expenses.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformFinding the right mortgage lender can have a huge impact on your home-buying experience. With so many options available, it’s crucial to understand how different lenders stack up against each other. This comprehensive comparison between Griffin Funding and Rocket Mortgage will help you decide which lender best fits your unique financial situation.

What Is Griffin Funding?

Griffin Funding is a California-based national mortgage lender that has built its reputation on serving borrowers who don’t fit the traditional lending mold. Founded with the mission to make homeownership accessible to more people, Griffin Funding specializes in conventional, government (VA and FHA), and alternative loan products like non-QM loans. We focus heavily on providing personalized service through experienced loan officers who understand complex financial situations.

We’ve grown significantly by focusing on borrowers that larger institutional lenders often overlook, including self-employed individuals, real estate investors, and anyone with unique income documentation needs. Our approach combines modern technology with human expertise to navigate challenging loan scenarios.

What Is Rocket Mortgage?

Rocket Mortgage, owned by Rocket Companies, is a Michigan-based national lender that revolutionized the mortgage industry with its fully digital loan application process.

The company built its business model around speed and convenience, offering borrowers the ability to apply, get approved, and close on their mortgage entirely online. Rocket Mortgage has consistently ranked as a top lender in terms of volume.

Loan Products Offered

Both lenders offer a range of mortgage products, but their specializations differ. Understanding these differences can help you decide between Griffin Funding vs. Rocket Mortgage for your specific needs.

Griffin Funding Loan Products

Griffin Funding’s loan portfolio reflects our commitment to serving diverse borrower profiles. We offer:

- Conventional loans: Traditional 15- and 30-year fixed-rate mortgages with competitive terms for qualified borrowers.

- VA loans: Comprehensive veteran lending program with expertise in complex VA scenarios and jumbo VA loans.

- Investment property loans: Specialized programs for real estate investors, including DSCR loans that qualify based on rental income rather than personal income.

- Non-QM loans: Alternative documentation loans for borrowers who don’t meet traditional lending criteria.

- Self-employed mortgages: Bank statement loans and profit-and-loss statement programs designed specifically for business owners and independent contractors.

- Jumbo loans: High-balance mortgages for luxury properties and expensive markets with flexible underwriting guidelines.

- Refinance loans: Rate-and-term refinances and cash-out refinancing options for homeowners looking to lower payments or access equity.

- HELOCs and home equity loans: Flexible credit lines and fixed-rate second mortgages that allow homeowners to tap into their property’s equity for renovations, investments, or other financial needs.

Rocket Mortgage Loan Products

Rocket Mortgage focuses on mainstream loan products with streamlined processing. Rocket Mortgage home loans include:

- Conventional loans: Standard Fannie Mae and Freddie Mac conforming loans with automated underwriting.

- FHA loans: Government-backed loans for first-time buyers and those with lower down payments.

- VA loans: Basic veteran lending services with standard VA loan programs.

- Refinance and home equity loan options: Streamlined refinancing process for rate-and-term and cash-out refinances, plus home equity loan products for accessing existing home equity. Rocket Mortgage does not offer home equity lines of credit (HELOCs).

- Jumbo loans: High-balance loans in expensive markets, though with more restrictive qualifying criteria than specialty lenders.

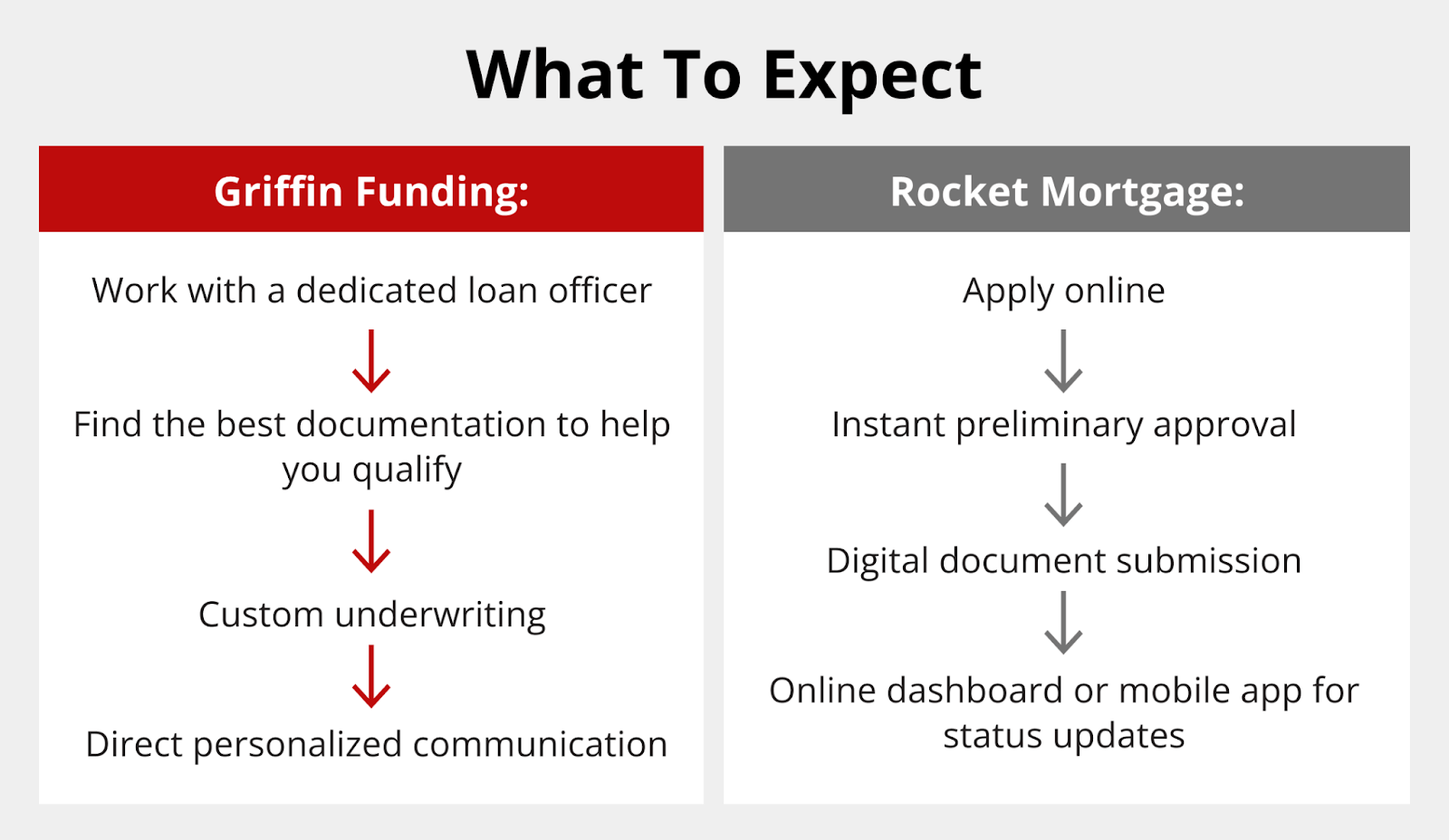

Application & Approval Process

The application experience differs significantly between these two lenders.

Griffin Funding Process

Griffin Funding emphasizes personalized service throughout the loan process:

- Human-centered approach: Each borrower works with a dedicated loan officer who provides guidance from application through closing.

- Flexible documentation: Loan officers work with borrowers to find alternative ways to document income and assets for complex situations.

- Custom underwriting: The manual review process allows for exceptions and creative solutions that automated systems might reject.

- Regular communication: Borrowers receive personal updates and can speak directly with their loan officer about concerns or questions.

Rocket Mortgage Process

Rocket Mortgage built its reputation on digital efficiency. Their process includes:

- Online application: A complete mortgage application can be finished in minutes through their digital platform.

- Automated pre-approval: Instant preliminary approval for many borrowers with straightforward financial profiles.

- Document upload: The digital document submission and verification process reduces paperwork hassles.

- Status tracking: Borrowers can monitor loan progress 24/7 through online dashboards and mobile apps.

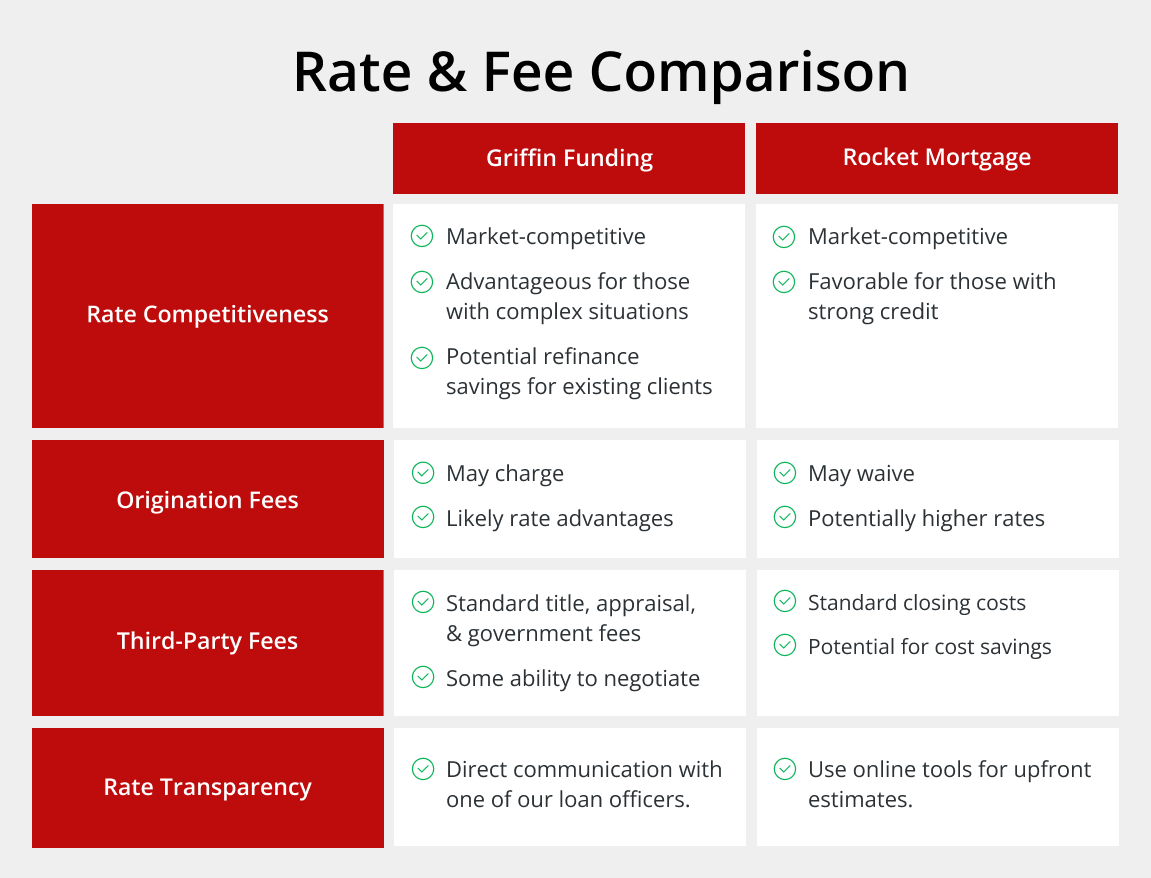

Rates & Closing Costs

Mortgage rates and fees vary significantly between lenders, making cost comparison essential when evaluating Griffin Funding vs Rocket Mortgage.

Griffin Funding Fees

Griffin Funding’s fee structure reflects our specialized service model.

- Competitive base rates: Griffin Funding mortgage rates are typically competitive with market averages, especially for complex loan scenarios.

- Origination fees: May charge origination fees depending on loan type and complexity, but these are often offset by rate advantages.

- Third-party costs: Standard title, appraisal, and government fees apply, with some ability to negotiate based on loan size.

- Refinance rates: Griffin Funding refinance rates are competitive, with potential cost savings for existing clients.

Rocket Mortgage Closing Costs

Rocket Mortgage’s cost structure emphasizes transparency and automation:

- Rate competitiveness: Generally offers market-competitive rates for borrowers with strong credit and standard loan profiles.

- Origination fees: May waive origination fees for certain loan products, but this can be reflected in slightly higher rates.

- Third-party fees: Standard closing costs apply, though their volume purchasing power may result in some cost savings.

- Fee transparency: Online tools provide upfront estimates of all Rocket Mortgage closing costs before application.

Customer Experience & Reviews

Customer satisfaction varies between these lenders based on borrower needs and expectations.

Griffin Funding Reviews

Griffin Funding customers frequently praise the company’s personalized approach:

- Personal service: Testimonials consistently highlight the value of having dedicated loan officers who understand complex situations.

- Problem-solving ability: Borrowers appreciate our willingness to work through challenging loan scenarios that other lenders decline.

- Communication quality: Customers report feeling informed and supported throughout the loan process.

Rocket Mortgage Reviews

Rocket Mortgage reviews often focus on speed and convenience:

- Digital convenience: Customers appreciate the ability to complete most loan tasks online without scheduling phone calls or meetings.

- Processing speed: Many borrowers highlight fast closing times compared to traditional lenders.

- Technology satisfaction: The online platform and mobile app receive positive feedback for user-friendliness.

- Mixed service experiences: While many customers praise the efficiency, some report challenges when complex issues require human intervention.

Rocket Mortgage Reddit discussions often reveal both positive experiences with straightforward loans and frustrations when loans become complex or require manual review.

Technology & Tools

Both lenders invest in technology, but with different focuses and user experiences.

Griffin Funding Technology

Griffin Funding combines technology with human expertise, offering:

- Griffin Gold app: Mobile platform that allows borrowers to track loan progress, submit documents, and communicate with loan officers.

- Digital document collection: Secure online portal for uploading and managing loan documentation.

- Personalized dashboards: Custom interfaces that reflect each borrower’s unique loan scenario and requirements.

- AI-powered non-QM underwriting: An automated underwriting system for non-QM loans, such as DSCR and bank statement loans, automates the non-QM process. Loan Intelligence Assistant (LIA) makes processing non-QM loans more efficient.

Rocket Mortgage Technology

Rocket Mortgage leads the industry in mortgage technology innovation, offering:

- Comprehensive digital platform: End-to-end online experience from application through closing document signing.

- AI-powered verification: Automated income and asset verification through bank account and employment data connections.

- Real-time status updates: Instant notifications about loan milestones and required actions.

- Mobile optimization: Full-featured mobile app that provides complete loan management capabilities.

Griffin Funding vs Rocket Mortgage: Which Should You Choose in 2025?

The choice between these lenders depends heavily on your specific financial situation and priorities. Consider the differences between a local lender vs Rocket Mortgage when making your decision.

- For first-time buyers: Rocket Mortgage offers excellent educational resources and streamlined processes for straightforward purchases, while Griffin Funding provides more hand-holding for buyers with complex financial situations.

- For veterans: Both offer VA loans, but Griffin Funding’s specialized expertise in complex VA scenarios and jumbo VA loans gives us an advantage for military borrowers with unique needs.

- For self-employed borrowers: Griffin Funding clearly leads with our bank statement loans, DSCR programs, and expertise in alternative income documentation that traditional lenders often struggle with.

- For speed and simplicity: Rocket Mortgage excels for borrowers with clean financial profiles who value digital convenience and fast closing times.

- For investment properties: Griffin Funding’s specialized investor programs and DSCR loans make us the better choice for real estate investors.

When weighing Rocket Mortgage vs. a local lender, consider whether you value personalized service and complex loan expertise over digital convenience and processing speed. The Rocket Mortgage vs Griffin Funding or local lender debate ultimately comes down to your specific needs and comfort level with digital-only interactions.

Doing Business with a Broker Who Uses Rocket Pro vs Going Direct to Griffin Funding

When you work with a mortgage broker who sends loans to Rocket Pro TPO — Rocket Mortgage’s wholesale division — you’re effectively adding an extra layer between you and the lender. This structure can influence your interest rate and overall loan costs.

Here’s how it works:

- Rocket Pro Wholesale Margin: According to Rocket Companies’ most recent SEC filings, its year-to-date average gain-on-sale margin was about 2.84% (284 basis points) for 2025 as of Q2. This figure represents the profit Rocket earns when it sells or securitizes loans across all channels, including both Rocket Mortgage retail and Rocket Pro wholesale.

- Broker Compensation: Independent mortgage brokers who originate loans through Rocket Pro typically earn up to 2.75% (275 basis points) in lender-paid or borrower-paid compensation — the federal maximum under current lending regulations.

- Combined Impact: When the wholesale lender’s margin (≈2.84%) is layered with broker compensation (≈2.75%), the total economic margin can approach 5.5%–6.0% (550–600 basis points). In most cases, the higher the combined margin, the higher the rate or cost a borrower ultimately pays.

By contrast, Griffin Funding operates as a direct lender — not a broker. We fund loans ourselves and work directly with borrowers from start to finish. This eliminates the extra markup layer, which can result in:

- Lower total margins and more competitive rates,

- Faster communication and a streamlined underwriting process, and

- Personalized advice from experienced loan officers who know complex loan programs inside and out.

In short: A broker who sends loans to Rocket Pro must build in both the broker’s compensation and Rocket’s gain-on-sale margin. Working directly with Griffin Funding often means a leaner structure — and that can translate to lower rates and closing costs.

Take the First Step Towards Pre-Approval

Choosing the right mortgage lender is one of the most important financial decisions you’ll make. While Rocket Mortgage offers impressive digital tools and fast processing for straightforward loans, Griffin Funding’s specialized expertise and personalized service make us the superior choice for borrowers with complex financial situations or unique loan requirements.

Griffin Funding’s commitment to serving self-employed borrowers, real estate investors, and those with non-traditional income sources sets us apart. Our experienced loan officers work as true partners, finding creative solutions and guiding you through every step of the mortgage process.

Ready to experience the Griffin Funding difference? Get started online today to discuss your homeownership goals and discover which loan program best fits your needs.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Is Rocket Mortgage or Griffin Funding better if I want personal guidance through my loan?

Rocket Mortgage is built for automation — you apply, upload documents, and track progress online. It’s fast, but mostly self-directed.

Griffin Funding takes a more personalized approach. Every borrower works directly with an experienced loan officer who specializes in complex scenarios like self-employed income, real estate investments, and non-traditional documentation.

If you prefer a human advisor who tailors your loan strategy instead of a call-center experience, Griffin Funding offers the hands-on support Rocket Mortgage can’t match. As of October 26, 2025, Rocket Mortgage typically holds approximately 4.0-4.5 stars across major platforms and a notably low 1.27/5 on the BBB from 581 reviews. Meanwhile, Griffin Funding posts around 4.7 stars on Google profile reviews and maintains an A+ BBB accreditation.

Are Rocket Mortgage’s rates always lower than a direct lender like Griffin Funding?

Not necessarily. While Rocket Mortgage advertises competitive base rates, those rates often assume perfect credit, standard documentation, and automated underwriting.

Griffin Funding, as a direct lender, structures rates around your full financial profile, including programs that Rocket may not offer, like bank statement loans, DSCR loans, or jumbo VA options. In many cases, borrowers with unique income or property types find Griffin Funding’s actual offered rate is lower once their scenario is fully underwritten.

What’s the main difference between getting a mortgage from Rocket Mortgage vs Griffin Funding?

The difference comes down to automation versus advisory. Rocket Mortgage is a national retail lender focused on digital speed and volume. Griffin Funding is a specialized direct lender focused on strategy, flexibility, and long-term relationships. Rocket serves straightforward borrowers who fit into conventional loan boxes; Griffin Funding serves clients who need expert guidance — entrepreneurs, veterans, and investors — to structure financing that fits real-world goals.

In short: Rocket Mortgage is fast. Griffin Funding is flexible and personal.

What’s the difference between working with a Rocket Pro Broker and going directly to Griffin Funding?

When you use a Rocket Pro Broker, you’re actually working with two companies. The broker originates the loan and sends it to Rocket Pro TPO (Rocket Mortgage’s wholesale division) to fund it. That means both the broker and Rocket each earn a margin on your loan — the broker’s compensation (up to 2.75%) plus Rocket’s own gain-on-sale margin (about 2.84% based on Rocket’s 2025 SEC filings).

Those layered margins can raise the total cost of your loan. By contrast, Griffin Funding is a direct lender, not a broker. We underwrite and fund our own loans, eliminating the middleman markup and allowing us to offer more competitive rates, faster decisions, and fully personalized guidance than a Rocket Pro Broker.

Why should I choose Griffin Funding over a Rocket Pro Broker?

With a broker, you’re one step removed from the actual lender — the broker doesn’t control underwriting, approval speed, or pricing once the file is submitted to Rocket Pro. At Griffin Funding, you work directly with the decision-makers. Our loan officers have complete control over the process, communicate directly with underwriting, and tailor creative financing options to your needs.

Because there’s no broker in the middle, you avoid paying two layers of profit, enjoy greater transparency, and get a lender who’s invested in your long-term success — not just a one-time transaction.

Recent Posts

Net Operating Income: Definition, Formula, & Examples

What Is Net Operating Income (NOI)? Net operating income measures how much money your investment property gene...

Best DSCR Lenders: Griffin Funding vs Angel Oak vs Kiavi vs Visio vs Lima One vs Easy Street

What to Look for in a DSCR Lender Choosing the best DSCR lender for your unique situation means evaluating sev...

Cash on Cash Return in Real Estate: Definition, Formula, & Examples

What Is Cash on Cash Return? Cash on cash return (CoC) is a metric that measures the annual income you generat...