First-Time Home Buyer Programs Explained

KEY TAKEAWAYS

- You don’t necessarily need to be purchasing your first-ever home to qualify for many first-time home buyer programs, as most define “first-time” as not having owned a home in the past three years.

- Many programs offer down payment assistance that can reduce the upfront costs of buying a home, making homeownership accessible even with limited savings.

- Federal programs like FHA, VA, and USDA loans offer competitive interest rates, lower down payment requirements, and attractive terms specifically designed to help first-time buyers enter the housing market.

- State and local first-time homeowners programs often provide additional benefits tailored to specific regions, including grants and tax credits that don’t require repayment.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformBuying a home for the first time can be overwhelming. Fortunately, numerous first-time home buyer programs are designed to make homeownership more accessible. These programs offer financial assistance, reduced down payments, and educational resources to help you purchase your first home. Keep reading to learn more about first-time home buyer programs.

What Is a First-Time Home Buyer Program?

A first-time home buyer program is specialized financial assistance that helps individuals and families purchase their first home. These programs reduce common barriers to homeownership by offering benefits like lower down payments, reduced interest rates, tax incentives, and closing cost assistance.

Contrary to what the name suggests, you don’t always need to be buying your very first home to qualify. Most first-time home buyer programs define a “first-time buyer” as anyone who hasn’t owned a primary home in the past three years. This means if you previously owned a home but sold it years ago, you might still qualify for these beneficial programs.

First-time home-buying programs work by connecting eligible buyers with various forms of assistance through government agencies, nonprofit organizations, and private lenders. These programs typically have specific eligibility requirements related to income levels, credit scores, and property locations, but they all share the common goal of making homeownership more attainable for those just entering the housing market.

Types of First-Time Home Buyer Assistance Programs

Finding the right first-time home buyer assistance program can make homeownership more affordable. These programs come in several forms, each offering unique benefits to help you achieve homeownership. Let’s explore the main types of assistance available:

Down Payment Assistance

Down payment assistance programs are among the most popular forms of help for first-time buyers. These programs address one of the biggest obstacles to homeownership: saving enough money for a down payment.

Down payment assistance typically comes in two forms: grants and forgivable loans. Grants are essentially gifts that never need to be repaid, while forgivable loans are gradually forgiven over time as long as you live in the home for a specified period. If you move or sell before that period ends, you may need to repay a portion of the assistance.

Many states and cities offer their own down payment assistance programs. For example, California’s CalHFA program provides up to 3.5% of the purchase price to eligible first-time buyers, while Texas offers the My First Texas Home program with down payment assistance of up to 5%. These programs often have income limits and require completion of a homebuyer education course.

Low-Interest Mortgage Programs

Several government-backed mortgage options offer competitive interest rates and flexible qualification requirements specifically designed for first-time buyers:

- FHA loans: These loans allow for down payments as low as 3.5% with credit scores as low as 580. FHA loans are especially beneficial for first-time buyers with limited savings or less-than-perfect credit.

- VA loans: First-time buyers in the military have unique advantages through this program. For military service members, veterans, and their families, VA loans offer no-down-payment options with competitive interest rates.

- USDA loans: These home loans offer zero-down-payment loans for homes in qualifying rural and suburban areas. This program is designed to promote homeownership in less densely populated regions and can be an excellent option for first-time buyers looking outside major urban centers.

Many buyers are surprised to learn that they can also qualify for conventional and non-QM home loans like bank statement loans for first-time buyers if they’re self-employed or have non-traditional income sources. These loans use bank deposits rather than tax returns to verify income, making them ideal for entrepreneurs and gig workers entering the housing market.

First-Time Home Buyer Grant Programs

First-time home buyer grant programs offer money that typically doesn’t need to be repaid, making them one of the most advantageous forms of assistance.

Federal grants for first-time buyers are often distributed through state housing finance agencies. For instance, the Good Neighbor Next Door program offers eligible teachers, law enforcement officers, firefighters, and emergency medical technicians up to 50% off the list price of homes in revitalization areas.

Nonprofit organizations and private foundations also offer grant programs for specific groups of first-time buyers. For example, the National Homebuyers Fund provides grants up to 5% of the loan amount to help with down payments and closing costs.

State-based grant programs vary widely but can provide substantial assistance. For example, New York’s First Home Club offers matched savings incentives up to $7,500 for eligible first-time home buyers who participate in savings programs.

State and Local First-Time Home Buyer Programs

While federal programs provide a foundation, state and local first-time homeowners programs often offer additional benefits tailored to their regions’ specific housing challenges and economic conditions.

State and local programs frequently provide more generous assistance than federal options, with benefits like higher grant amounts, more flexible eligibility requirements, or additional tax incentives. These programs are typically funded through state housing finance agencies, city housing departments, or local nonprofit organizations.

To find these programs, you can visit HUD’s website, which maintains a directory of state-specific resources. Local housing counseling agencies can also provide personalized guidance on programs available in your area.

Here are some examples from major states:

- California: California offers the CalHFA first-time buyer program, which combines competitive mortgage rates with down payment assistance of up to 2.5% of the purchase price. The state also provides tax credits that can reduce your federal tax liability.

- New York: This state offers the Homes for Veterans Program with down payment assistance and below-market interest rates for military veterans. New York also provides the Graduate to Homeownership Program specifically for recent college graduates buying their first homes in certain upstate communities.

- Florida: The Florida Hometown Heroes Program provides low-interest mortgage loans and up to $35,000 in down payment and closing cost assistance in certain counties for first-time borrowers who meet income requirements.

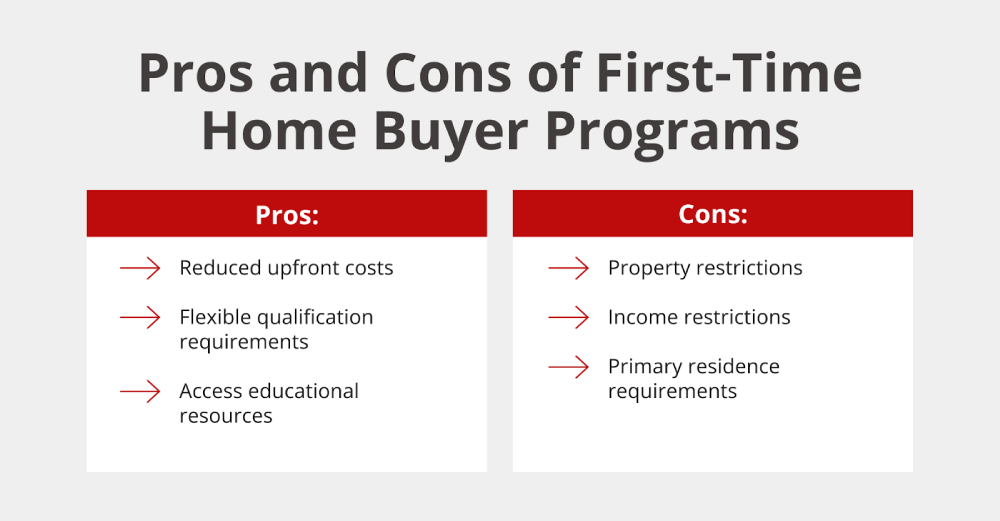

Pros and Cons of First-Time Home Buyer Programs

First-time home buyer programs offer significant advantages but also come with some limitations. Consider these factors when determining if these programs are right for your situation.

Pros of first-time home buyer programs include:

- Reduced upfront costs: First-time buyer programs typically require lower down payments, making it possible to buy a home sooner without years of saving.

- More accessible qualification: Many programs have more flexible credit requirements and debt-to-income ratios than conventional mortgages, helping buyers with limited credit history or moderate incomes qualify.

- Educational resources: Most programs include mandatory homebuyer education courses that prepare you for the responsibilities of homeownership and help prevent future financial difficulties.

Cons of first-time home buyer programs are:

- Limited property choices: Many programs restrict the types, locations, or price ranges of eligible properties, potentially limiting your options in competitive markets.

- Income restrictions: Most programs set maximum income limits that may disqualify moderate to high earners, even if they haven’t owned a home before.

- Occupancy requirements: These programs typically require that the property be your primary residence for a certain period, restricting your ability to rent it out or sell quickly.

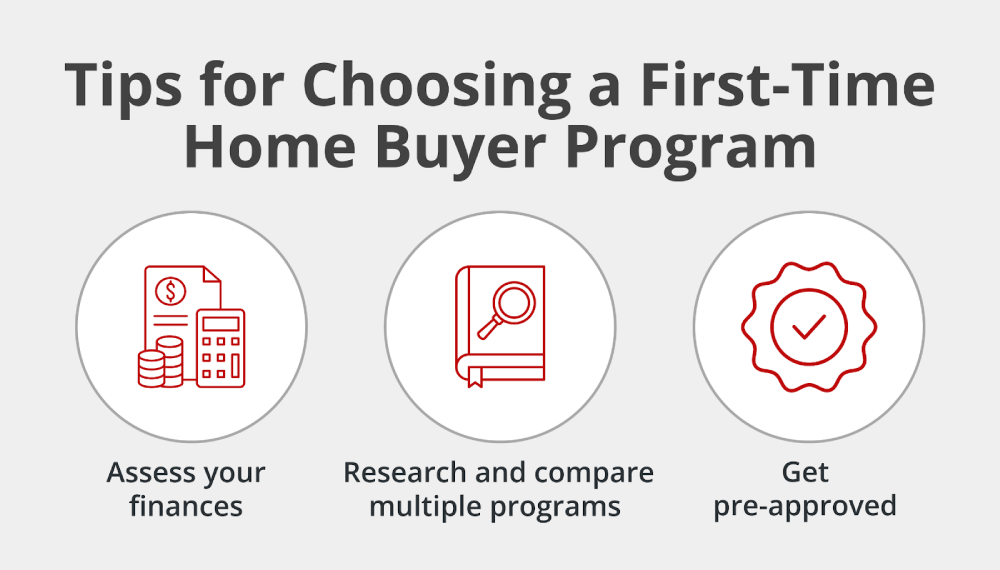

Tips for Choosing the Right Program

Finding the right first-time home buyer program can help reduce financial stress when purchasing a home. With numerous options available, evaluating which programs align with your specific circumstances is important. Here are a few tips to help you find the most beneficial program for your situation:

- Assess your financial situation: Take time to evaluate your current finances, including income stability, existing debt, and future plans. Consider how long you plan to stay in the home and what your housing needs might be in the coming years.

- Compare multiple programs: Don’t settle for the first program you find. Research several different first-time home buyer programs and compare their benefits, requirements, and limitations side by side to find the best fit for your unique situation.

- Get pre-approved to understand your budget: Working with lenders to get pre-approved will give you an idea of what you can afford and which programs you qualify for. This step helps identify potential obstacles before you start house hunting and strengthens your position with sellers.

Use the Griffin Gold app to track your progress toward homeownership goals and connect with financing options tailored to first-time buyers.

How a Mortgage Lender Can Help

A knowledgeable mortgage lender can be your most valuable resource when it comes to finding first-time home buyer programs. Unlike general financial advisors, mortgage lenders work with these programs daily and understand their nuances, eligibility requirements, and application processes.

When you work with an experienced lender, they can evaluate your financial situation and recommend specific programs that match your needs. They’ll consider your income, credit score, debt levels, and home-buying goals to identify the most advantageous option.

When you’re ready to move forward, a lender can give you pre-approval for a home loan. Pre-approval shows sellers you’re serious and gives you an idea of how much you can afford to spend on a house. A good lender will provide a detailed breakdown of what you can afford under different programs, including estimated monthly payments, required down payments, and closing costs.

Before making any decisions, review this first-time home buyer checklist to ensure you’ve considered all aspects of the home-buying process.

Explore First-Time Home Buyer Programs

First-time home buyer programs can reduce the financial barriers to homeownership. From down payment assistance and government-backed loans to grants and tax benefits, these programs have helped many people purchase a home sooner than they thought possible.

At Griffin Funding, we specialize in helping first-time buyers understand the complex landscape of home-buying assistance. Our mortgage professionals are experienced with all major first-time home buyer programs and can help you find the perfect combination of benefits for your unique situation. Get started online or contact us today to learn more about your options.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Net Operating Income: Definition, Formula, & Examples

What Is Net Operating Income (NOI)? Net operating income measures how much money your investment property gene...

Best DSCR Lenders: Griffin Funding vs Angel Oak vs Kiavi vs Visio vs Lima One vs Easy Street

What to Look for in a DSCR Lender Choosing the best DSCR lender for your unique situation means evaluating sev...

Cash on Cash Return in Real Estate: Definition, Formula, & Examples

What Is Cash on Cash Return? Cash on cash return (CoC) is a metric that measures the annual income you generat...