FHA Refinance Guidelines & Requirements Checklist

KEY TAKEAWAYS

- Four distinct FHA refinance programs are available — rate-and-term, simple, cash-out, and streamline — each designed for different financial goals and situations.

- All FHA refinance programs require the property to be your owner-occupied primary residence, verified through utility bills or employment documentation.

- Most programs require a consistent mortgage payment history, with specific requirements ranging from six to twelve months of on-time payments.

- Loan-to-value ratios range from 80% for cash-out refinances to 97.75% for rate-and-term and simple refinances, directly impacting how much you can borrow.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformWhether you’re looking to lower your monthly payment, access your home’s equity, or switch to better loan terms, understanding FHA refinance requirements is crucial for a successful application. FHA-backed mortgages come with several refinance options, each with specific guidelines that borrowers must meet to qualify.

This FHA refinance checklist covers all four types of FHA refinancing programs available to homeowners. From streamlined options that require minimal documentation to cash-out refinances that unlock your home’s equity, we’ll break down the requirements, benefits, and processes for each option.

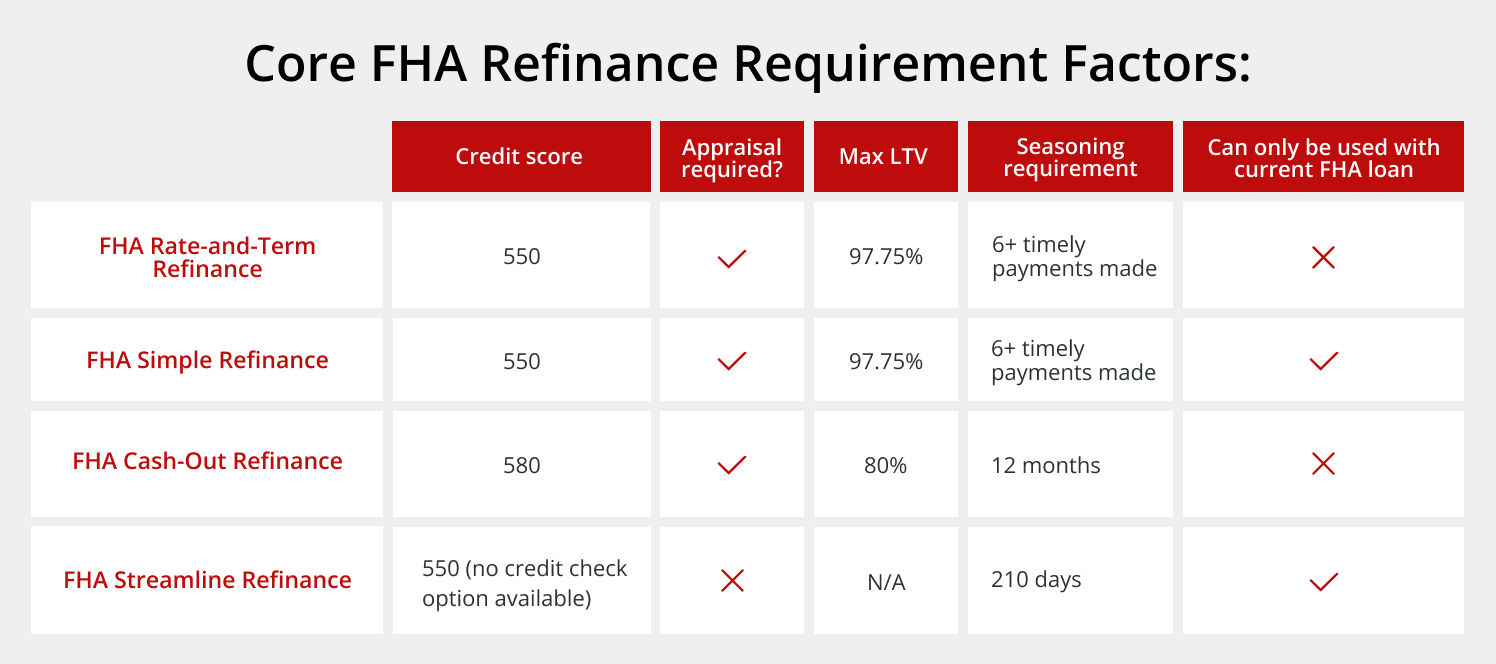

Core FHA Refinance Requirement Factors

Before we discuss the specific FHA refinance requirements for each program, let’s discuss the requirements that apply across all of them. Understanding these core requirements will help you determine which refinance option best fits your situation.

- Credit score: While FHA loans typically allow lower credit scores than conventional loans, most refinance programs require full credit qualifying with standard FHA underwriting guidelines. In general, you should have a minimum credit score of 580.

- Appraisal: Most FHA refinance programs require a full property appraisal to determine current market value and ensure the property meets FHA’s Minimum Property Requirements, with the notable exception being the FHA Streamline Refinance.

- LTV requirement: Loan-to-value ratios vary by program type, ranging from 80% for cash-out refinances to 97.75% for rate-and-term and simple refinances.

- Seasoning requirement: Most programs require a minimum period of payment history on existing mortgages, ranging from six months to one year, depending on the specific refinance type.

- Property must be owner-occupied/primary residence: The property must be your primary residence, typically verified through current utility bills or employment documentation showing the subject property address.

FHA Rate-and-Term Refinance Checklist

The FHA rate-and-term refinance is designed to help borrowers modify their existing mortgage terms without accessing equity. This option allows you to refinance any type of existing loan, not just FHA mortgages.

Eligibility requirements are:

- Eligible for any existing loan type — your current mortgage doesn’t need to be FHA-insured

- Purpose must be to pay off the existing mortgage and associated refinancing costs only

- Full credit qualifying required using standard FHA underwriting guidelines

- Property appraisal required to meet the FHA’s Minimum Property Requirements

- Property must be an owner-occupied primary residence

Payment history requirements include:

- For mortgages with less than six months of payment history, all payments must be made within the month due

- For mortgages with six months or more payment history: All mortgage payments within the month due for the past six months, with no more than one 30-day late payment allowed

- If the mortgage isn’t reported on credit reports, provide 12 months of bank statements showing payment history

Loan-to-value limits are:

- 97.75% LTV for primary residences occupied for the previous 12 months

- 85% LTV for borrowers who occupied the property as their primary residence for fewer than 12 months

The maximum mortgage amount is the lesser of the nationwide FHA loan limits, the maximum LTV ratio, or the sum of existing debt plus transaction costs, which includes:

- Unpaid principal balance of existing mortgage

- Unpaid principal balance of junior liens over 12 months old

- Interest due, MIP, late charges, and escrow shortages

- All borrower-paid costs and required repairs

Additional requirements include:

- Maximum $500 excess cash back for estimating errors

- FHA Refinance Authorization Printout if paying off the existing FHA loan

- Payoff statement for existing mortgage

FHA Simple Refinance Checklist

The FHA Simple Refinance offers a streamlined approach for FHA borrowers looking to refinance their existing FHA-insured mortgage with minimal complications.

Basic FHA mortgage refinance requirements for an FHA Simple Refinance are:

- Current loan must be FHA-insured

- Purpose is to pay off the existing mortgage and associated refinancing costs

- Full credit qualifying required

- Property appraisal required, meeting the FHA’s Minimum Property Requirements

- Property must be owner-occupied

Payment history standards include:

- For mortgages under six months: The borrower must have made all payments within the month when they were due

- For mortgages over six months: All payments within the month due for the past six months, with a maximum of one 30-day late payment allowed

- Provide 12 months of bank statements if the mortgage isn’t reported on the credit report

Financial requirements are:

- 97.75% LTV for primary residences

- Maximum $500 excess cash back for estimating errors

- At least one borrower must hold title

Documentation required includes:

- FHA Refinance Authorization Printout from FHA Connection

- Case assignment reflecting Simple Refinance transaction type

- Payoff statement for existing mortgage

Property value considerations:

For properties acquired within 12 months of case number assignment, the adjusted value is the lesser of the borrower’s purchase price plus documented improvements or the current property value.

FHA Cash-Out Refinance Checklist

The FHA cash-out refinance allows borrowers to access their home’s equity while refinancing their mortgage. This program has the most stringent FHA cash-out refinance requirements due to the additional risk involved.

General eligibility requirements for this FHA refinance option include:

- Eligible for any existing loan type — current mortgage doesn’t need to be FHA-insured

- Full FHA appraisal required with property meeting Minimum Property Requirements

- Full credit qualifying required, meeting standard FHA underwriting guidelines

- Primary residence only — must be owner-occupied principal residence

- Properties owned free and clear are eligible

- Condominium units are allowed only if the project is currently FHA-approved

Owner and occupancy requirements are:

- Borrower must have owned and lived in the property as their primary residence for 1 year (12 full months) prior to case number assignment

- Exception for inheritance allowed if the property wasn’t used as an investment

- Verify occupancy through employment records or utility bills for the 12-month period

- At least one borrower must be on title prior to FHA case number assignment

Payment history requirements include:

- All mortgage payments on all properties within the month due for the past 12 months

- Subject property mortgages must have a minimum of six months of payment history

- All mortgages must be current within the month prior to disbursement

- If the mortgage is not reported on credit, obtain a 12-month Verification of Mortgage (VOM)

- For borrowers with forbearance history: Must have completed the forbearance plan plus made 12 consecutive on-time payments

Financial limits are as follows:

- Maximum 80% LTV/CLTV ratio

- Non-occupying co-borrower income is not allowed for qualifying

- Manual underwriting allowed, but loans must be scored in TOTAL system

This loan also comes with a seasoning requirement. Additional investor overlay requirements include:

- At least six consecutive monthly payments on the existing loan

- First payment due date of the new loan is no earlier than 210 days after the first payment due date of the existing FHA loan

FHA Streamline Refinance Checklist

The FHA Streamline Refinance offers the most simplified path for existing FHA borrowers to refinance their mortgage with minimal documentation and faster processing.

Basic eligibility requirements include:

- Current loan must be FHA-insured

- No appraisal required — property value is based on the original FHA Case Assignment value

- Subject property must be a primary residence verified by a utility bill

- Two refinance types available: Credit Qualifying (requires full analysis) or Non-Credit Qualifying (no credit/capacity analysis required)

Payment history requirements are:

- Borrower must have made all mortgage payments for six months prior to case number assignment

- If funds to close exceed the new mortgage payment, the borrower must provide documentation supporting the funds to close

Mortgage seasoning requirements: On the FHA case assignment date:

- Borrower must have made at least six payments on the existing FHA mortgage

- At least six full months must have passed since the first mortgage payment due date

- At least 210 days must have passed from the original closing date

- If the mortgage was assumed, the borrower must have made six payments since assumption

Net tangible benefit requirement: The refinance must provide a genuine benefit through:

- Combined principal, interest, and MIP payment of the new mortgage cannot exceed the existing payment by more than $50

- Switch from ARM to a fixed-rate mortgage

- Reduction in the loan term, providing a meaningful financial advantage

Maximum mortgage amount is the lesser of the outstanding principal balance of the existing mortgage, plus interest due, late charges, escrow shortages, and MIP due, or the original principal balance of the existing mortgage, including financed upfront MIP..

Benefits of Refinancing an FHA Loan

Refinancing your FHA mortgage can provide numerous financial advantages depending on your current situation and chosen refinance type. These benefits include:

- Lower monthly payments: Rate-and-term and simple refinances can significantly reduce monthly payments when market rates drop below your current mortgage rate. Even a small reduction in interest rate can save hundreds of dollars monthly on typical loan amounts.

- Tap into home equity: Cash-out refinancing allows you to tap into your home’s equity for major expenses like home improvements, debt consolidation, or educational costs. With up to 80% LTV available, you can access substantial funds while maintaining reasonable loan terms.

- Improved loan terms: Refinancing offers opportunities to switch from adjustable-rate mortgages to fixed-rate loans, providing payment stability and protection against rising interest rates. You can also adjust loan terms to pay off your home loan faster or extend the term to get lower monthly payments.

- Streamlined processing: The FHA Streamline option provides expedited refinancing with minimal documentation for existing FHA borrowers, often closing faster than traditional refinances while maintaining competitive rates.

- Debt consolidation opportunities: Cash-out refinancing can help consolidate high-interest debt into your lower-rate mortgage payment, potentially saving thousands in interest costs over time while simplifying your monthly budget.

FHA loan pros and cons should be carefully weighed against your specific financial goals and current mortgage terms.

Explore Your FHA Refinance Options Today

Understanding FHA mortgage refinance requirements empowers you to make informed decisions about your home financing strategy. Whether you’re seeking lower payments through a rate-and-term refinance, accessing equity through a cash-out option, or taking advantage of streamlined processing for existing FHA loans, each program offers unique benefits tailored to different financial situations.

At Griffin Funding, our experienced mortgage professionals specialize in helping you understand FHA refinance guidelines so you achieve your homeownership goals. Contact Griffin Funding today to discuss your FHA refinance options and discover how we can help you optimize your mortgage terms.

You can also explore the convenient Griffin Gold app for streamlined mortgage management, or consider other options like reverse mortgage products for eligible homeowners or FHA 203(k) loan options if you’re planning home improvements alongside your refinance. Get started online today and begin the pre-approval process!

Find the best loan for you. Reach out today!

Get StartedRecent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...