Documents Needed for Mortgage Pre-Approval

KEY TAKEAWAYS

- When you get pre-approved for a mortgage, the lender provides you with a document stating how much they’re willing to lend you.

- Mortgage pre-approval can help borrowers determine how much home they can afford.

- Having a pre-approval letter when making an offer can make a buyer more competitive.

- Borrowers will typically have to provide information regarding their identity, credit, income, and assets in order to get pre-approved for a mortgage.

Getting pre-approved for a mortgage makes it easier for you to buy a home because the seller knows that they can close more quickly. In order to get pre-approved, you need a set of documents to show a lender that you’re capable of fulfilling the terms of a mortgage. This gives you an advantage against other home buyers who haven’t gotten pre-approved and often makes it more likely you’ll get chosen in the event of a bidding war. It’s something that should be on your home buyer checklist. So, what do you need for pre-approval?

The exact set of documents needed for mortgage pre-approval differs depending on the lender and loan type you’re applying for. However, you can expect to supply a core set of personal documents for filling out the loan documents. This information is used to verify your ability to repay the loan along with meeting other mortgage loan criteria. A mortgage pre-approval may also go through the underwriting process even though you haven’t tendered an offer on a home. There are various ways in which to get pre-approved for buying a home, and a mortgage expert can help you learn more about your options.

Getting pre-approved for a mortgage is similar to going through the mortgage process, but with fewer steps. The main purpose of getting pre-approved is to learn how much you can spend on a house and speed up the processing of the actual mortgage once you’ve had your offer accepted. It’s worth taking the time to get pre-approval because of the advantage you get when you’re looking for a home to buy. The following is a look at what documents are needed for a mortgage pre-approval.

KEY TAKEAWAYS

- When you get pre-approved for a mortgage, the lender provides you with a document stating how much they’re willing to lend you.

- Mortgage pre-approval can help borrowers determine how much home they can afford.

- Having a pre-approval letter when making an offer can make a buyer more competitive.

- Borrowers will typically have to provide information regarding their identity, credit, income, and assets in order to get pre-approved for a mortgage.

What Is Mortgage Pre-Approval?

A mortgage pre-approval is when a lender looks into your financial situation to determine how much money they may be willing to lend you for a home. It also tells you how much home you can buy, and eliminates an unwanted surprise in the form of being told you can’t borrow as much as you need when you apply for a mortgage.

The pre-approval process is similar to that of applying for a mortgage in that you show proof of your income, assets, and debts. Even though you’re not getting funding to buy a home, the lender needs to determine how much money they can safely pre-approve you for. After the lender has determined the maximum amount you can borrow, they’ll issue you a letter you can show to a seller and improve your chances of going under contract on a home.

It’s worth noting that a pre-approval letter is not necessarily a guarantee that you’ll be able to get a mortgage. You may get your pre-approval withdrawn in the event you experience a significant change in your income. However, if there are no changes in your income between the time you get pre-approved and go under contract, then the amount you get pre-approved for should hold up when you apply for a mortgage.

How long does it take to get pre-approved for a mortgage?

In general, it takes about 10 business days to get pre-approved, but the type and complexity of the loan can extend or shorten this time frame. The time it takes to get pre-approved has the potential to shorten the length of time required to fund a mortgage after an offer has been accepted.

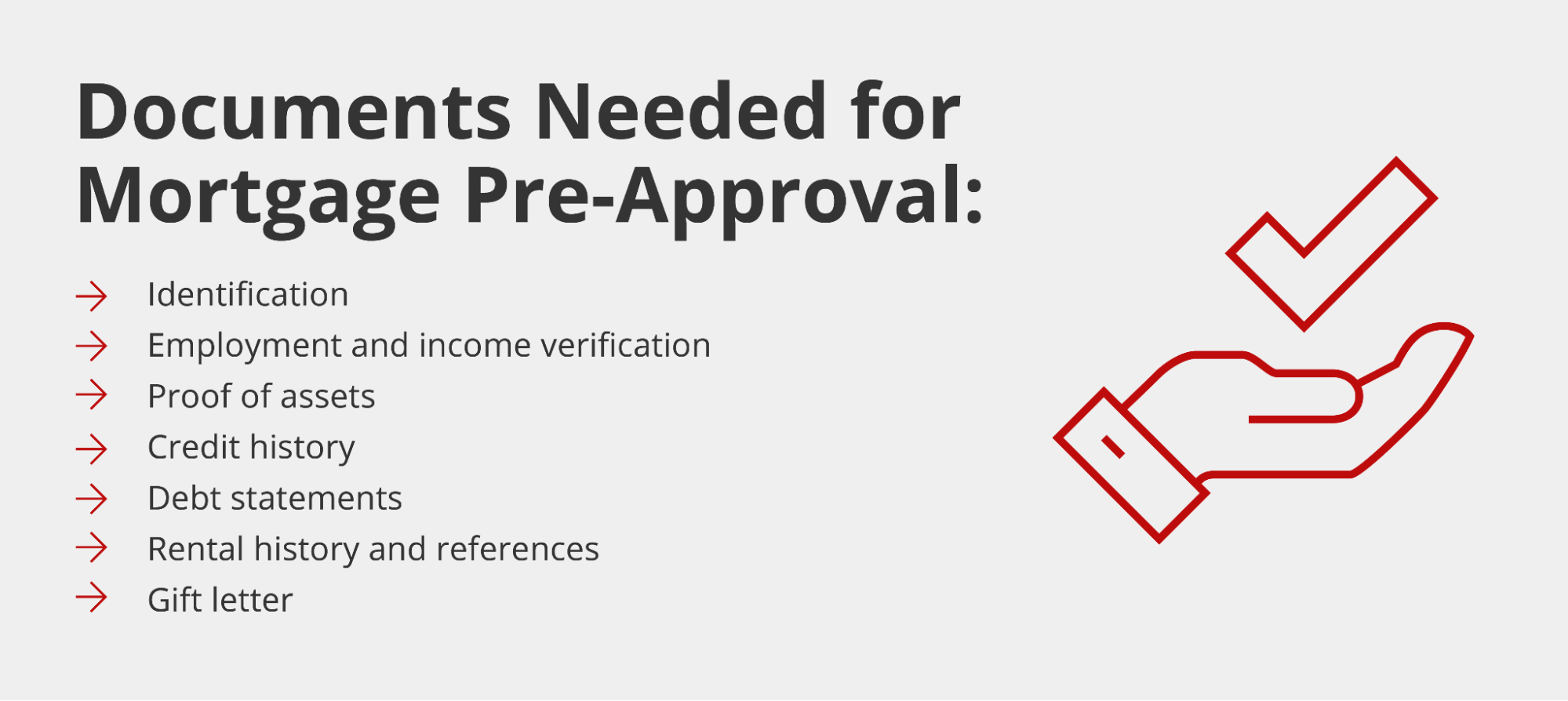

What Do I Need for Mortgage Pre-Approval?

You’ll need the following documents to properly prepare your mortgage documents for pre-approval and avoid making mistakes. The following list of documents can be used as a checklist to help you get everything in one place and ready to go.

Identification

Identification usually consists of your driver’s license or state ID, but you can also use the following:

- Social Security card

- Individual taxpayer identification number (ITIN)

- Passport

- Federal identification card

Make sure that the information on your ID is current and the ID itself hasn’t expired.

Proof of employment and income

Lenders need to be able to verify your ability to repay the mortgage, even for a pre-approval letter. Lenders may request the following documents in order to verify your income:

- W-2s from the last two years.

- Tax returns from the last two years.

- Bank statements from the past three months (including checking, money market, and savings accounts).

- Employment verification from your employer.

- Business documents if self-employed.

- Proof of alternative sources of income.

Proof of assets

In the event you own assets of value or currently own property, you may need to show proof of ownership or statements. Some assets that are considered for pre-approval include IRAs, CDs, stock market investments, 401(k)s, and mutual funds. Cash or cash equivalents that have statements to show their existence are also valid. Last but not least, any physical asset that can be sold to generate cash can be included, provided you have a title or something that proves ownership.

Credit history

You can get one free credit report per year from the credit rating agencies, but your lender may also pull your credit report with your permission. A credit report contains information including the loans you’ve taken out for various purposes, the current balances on your credit cards, and other miscellaneous debts you’ve incurred over the years.

Your credit report also states your credit score along with any late payments or defaults you have made. A high credit score helps you get better repayment terms in the form of a lower interest rate and other loan incentives. Late payments or defaults tend to stay on your report for seven years before falling off, and will affect your credit score if they’re not resolved. It may be a good idea to check your credit before filling out loan documents for mortgage pre-approval.

Debt statements

Debt statements include all of your outstanding debts. That includes student, personal, and auto loans, credit cards, and any other outstanding debts you’re currently paying down. This is to get an idea of your debt-to-income ratio and helps to determine how much you can borrow.

Rental history and references

In the event you’re looking to buy a home and move on from renting, you’ll need your rent payment history and references from your current landlord. If you’ve moved frequently, you may need to get references and payment history from multiple landlords.

You may or may not be required to show your rental history and get a reference from your landlord. The use of rental history as part of the pre-approval process is not an industry standard, but it’s a wise idea to have that information handy in case it’s requested.

Gift letter

Have you received a gift of money towards a down payment from a relative, friend, or acquaintance? In that case, you may need a gift letter from the person giving the gift. A gift letter states the money in your account is a result of their gift to you. This is to document the source of the money as a gift and not from another source such as a loan.

Other Documents Needed for Mortgage Pre-Approval

Not everyone can get approved for—or wants—a traditional mortgage to buy a home. Non-qualified mortgages can offer better terms or advantages over a traditional mortgage. However, it’s still possible to get pre-approved for Non-QM loans and non-conforming loans.

Pre-approval for non-conforming mortgages requires documents that aren’t needed for a traditional mortgage. As an example, if you’re a military veteran who wants to get a VA loan, you’ll need a Certificate of Eligibility (COE) from the branch of the military that you served in. Or, if you want to take out a bank statement loan, you may need to provide bank statements going back a period of time to show proof of income.

Prepare Your Mortgage Documents Before Applying

Getting your mortgage documents together and organized before you apply for a pre-approval with Griffin Funding makes the process less stressful. Taking the time to get all of your financial paperwork handy saves you time when you’re filling out the mortgage documents. The lender will then review your application and determine how much house you can afford. Preparation also reduces the potential for an error that can delay the processing of your pre-approval.

At Griffin Funding, we want to help you buy the house of your dreams. Get in touch with us today to speak to one of our loan specialists to learn more about our pre-approval process. We offer a range of mortgage products that include Non-QM loans, and we can help buyers apply for an FHA loan when they don’t have a large down payment towards a home.

Our loan experts can also help first-time buyers take advantage of first-time buyer programs that provide various forms of financial assistance and make it easier to afford a home. Get in touch with us to learn more about the different types of mortgage products that may be available to you.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

Rent Estimator: Get a Free Rent Estimate

Rent Estimator Use our free rent estimator to get an instant estimate for any property address and start maxim...

Home Value Estimator: How Much Is Your Home Worth?

How Much Is My House Worth? Curious about your home’s current value? Use the home value estimator below to g...

Bank Statement Loan Refinance Calculator

Whether you’re looking to reduce your monthly payment, pay off high-interest debt, or reinvest in your busin...