A Guide to Investing in Real Estate After Retirement

KEY TAKEAWAYS

- Real estate provides retirees with predictable monthly income that can supplement Social Security and pension payments.

- Property investments offer tangible assets that typically appreciate over time and hedge against inflation.

- Financing options for retirees include traditional mortgages, home equity products, and income-based loans that don’t require W-2 verification.

- You can start investing in real estate for retirement through various strategies, from rental properties to REITs.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformRetirement doesn’t mean the end of financial growth. Explore how you can invest in real estate for retirement and create lasting financial security through property investments.

Why Retirees Are Turning to Real Estate Investing

The stock market’s volatility can keep you up at night, but real estate offers a tangible asset. Many retirees discover that investing in real estate after retirement provides stability their portfolios previously lacked.

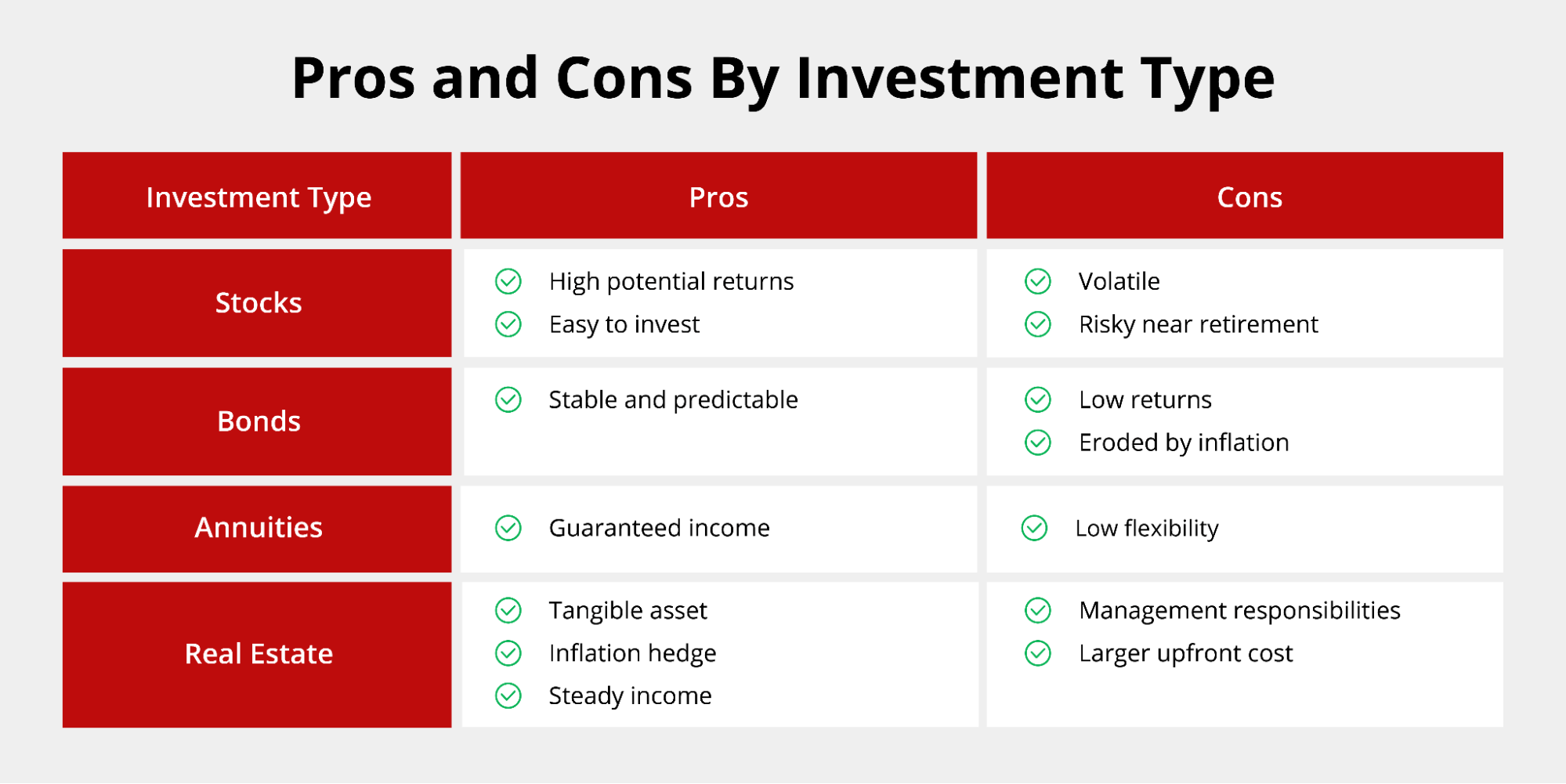

Traditional retirement investments remain popular, but they come with significant downsides:

- Stocks: Market crashes can devastate your portfolio overnight, and volatility increases as you age without time to recover from losses.

- Bonds: Minimal returns struggle to keep pace with inflation, eroding your purchasing power over time.

- Annuities: Lock up your money with limited flexibility and often come with high fees that reduce your returns.

Real estate allows you to control the asset directly. You decide when to buy, sell, or renovate. You set rental rates and choose tenants. This level of control appeals to retirees who’ve spent decades making their own financial decisions.

Property investments also act as a powerful hedge against inflation. As prices rise across the economy, rental rates typically increase too. Your property’s value grows while generating income that adjusts with economic conditions.

Benefits of Investing in Real Estate for Retirement

Rental properties offer advantages that are ideal for retirement income, including:

- Predictable income: Rental properties generate consistent monthly cash flow, supplementing Social Security and pension payments.

- Asset appreciation: Real estate typically increases in value over time, turning your initial investment into substantial equity.

- Tax advantages: You can defer capital gains through 1031 exchanges, rolling profits from one property into another without immediate tax consequences. Plus, bonus depreciation allows you to deduct 100% of qualified assets in their first year of service.

- Portfolio diversification: Real estate moves independently from stocks and bonds, protecting your retirement savings from market risk.

Real Estate Investment Options for Retirees

There are multiple pathways to invest in real estate for retirement. Before choosing a strategy, learn how to calculate ROI so you can compare different properties and investment approaches. Here are the most accessible strategies:

- Rental properties: Single-family homes work well for beginners because they’re easier to manage and sell with one tenant. Multifamily properties like duplexes, triplexes, and small apartment buildings generate multiple income streams, though you’ll deal with more tenants and maintenance issues.

- REITs (Real Estate Investment Trusts): You buy shares like stocks, earning dividends from commercial properties, apartments, or office buildings without managing any properties. REITs provide liquidity and professional management but offer less control and fewer tax benefits than direct ownership.

- Real estate crowdfunding: These platforms pool money from investors to fund projects like commercial developments or apartment complexes.

- Turnkey properties: Purchase fully renovated homes with tenants already in place and professional management companies handling operations. These properties cost more upfront but eliminate renovation headaches and vacant periods.

Risks to Consider Before You Invest

Real estate investing offers substantial rewards, but you need to understand the potential downsides before committing your retirement savings. Consider these key risks:

- Market cycles and interest rate risk: Real estate typically appreciates long-term, but short-term fluctuations can leave you underwater on your mortgage, and interest rate increases make financing more expensive while reducing property values.

- Property management burden: You’ll need to handle maintenance requests, screen applicants, collect rent, and manage conflicts (professional property managers solve these problems but eat into your profits).

- Liquidity issues: You can’t sell half your rental property when you need cash, and selling takes months with substantial costs.

- Unexpected repairs: Roofs fail, air conditioners break, and plumbing leaks cause water damage. A single major repair can be costly.

- Vacancies: Empty properties eliminate your income while expenses continue, including mortgage payments, property taxes, insurance, and maintenance.

How to Get Started With Real Estate After Retirement

Follow these steps to begin building your property portfolio:

- Assess your financial situation and retirement goals: Calculate how much you can invest without jeopardizing your essential living expenses. Review your retirement income sources and determine how much additional cash flow you need.

- Choose your investment strategy: Active investing means buying rental properties you manage yourself, while passive investing includes REITs, crowdfunding platforms, or turnkey properties. Your choice depends on how much time and effort you want to commit.

- Work with a financial advisor or lender: Financial advisors help you understand how real estate fits your overall retirement plan. Lenders familiar with mortgages for retirees can explain financing options that work with your income situation.

- Explore funding options: You can purchase properties with cash, tap home equity, or use various mortgage products. Some retirees invest through a self-directed IRA for tax advantages. Others consider a 401(k) withdrawal for home purchase, though tax implications require careful consideration.

- Begin with your first property or REIT investment: Start small to learn the process without overwhelming risk. Purchase a single rental property in a strong market or invest in established REITs with proven track records.

Financing Real Estate Investments in Retirement

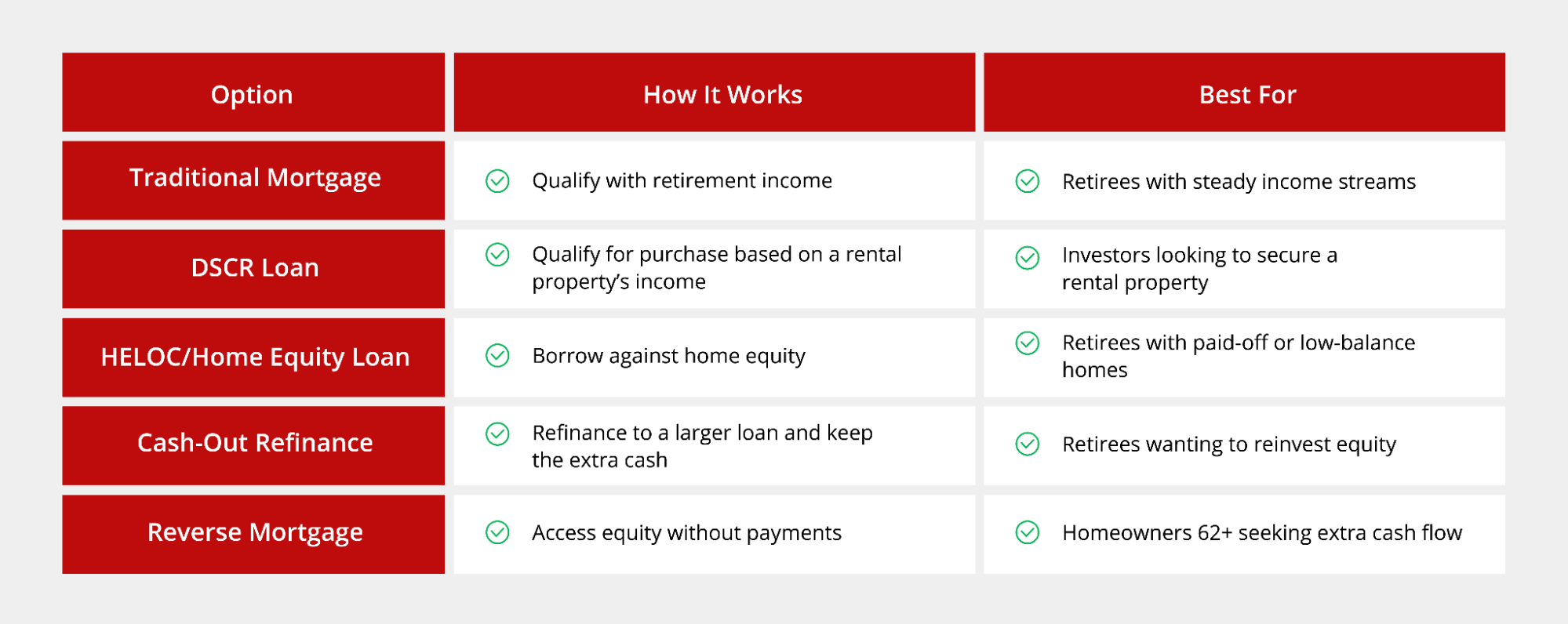

You have multiple financing options available to retire with real estate investing success. Investing in real estate in retirement requires understanding which funding methods work best for your situation. Here are the most common ways to finance property investments:

- Traditional mortgages: These remain available if you have steady retirement income from pensions, Social Security, or investment distributions. Explore investment property loans designed specifically for rental properties.

- HELOC or home equity loans: Tap your primary residence’s equity without refinancing, accessing cash at competitive rates using your home as collateral.

- Cash-out refinance: Replace your current mortgage with a larger loan, pulling equity out in cash. You’ll need sufficient equity and must qualify based on income and credit.

- Using IRAs or 401(k)s: Purchase real estate with retirement funds through self-directed accounts. You must follow strict IRS rules about property use and transactions.

- DSCR loans: Qualify based on the property’s rental income rather than your personal income. Lenders verify the property generates enough rent to cover the mortgage payment.

- Reverse mortgage loans: Access home equity without monthly payments if you’re at least 62 years old and own your home outright or have substantial equity.

Build Your Real Estate Portfolio in Retirement

You don’t need decades of investment experience to retire with real estate investing success. Start with one property or a REIT investment. Learn the process, refine your strategy, and expand at your own pace. The key is taking that first step toward financial independence.

Griffin Funding specializes in helping retirees build a real estate portfolio through flexible financing options designed for your unique situation. Our alternative mortgage loans qualify you based on rental income, assets, or bank statements rather than traditional W-2 income. You can also track your properties and manage your finances easily with the Griffin Gold app.

Get started online or contact Griffin Funding today to explore how real estate investing can strengthen your retirement finances.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Should retirees invest in real estate?

You need adequate liquidity for emergencies, time or funds for property management, and willingness to handle tenant issues.

Real estate works best as part of a diversified portfolio rather than your only investment, balancing stocks, bonds, and property for optimal retirement security.

What are common mistakes retirees make when investing in real estate?

- Overleveraging: Borrowing too much against properties leaves no cushion for vacancies or repairs, putting your retirement income at risk.

- Underestimating maintenance costs: Assuming properties need minimal upkeep when older buildings require constant attention and emergency repairs.

- Not screening tenants: Failing to properly vet renters leads to late payments, property damage, eviction costs, and extended vacancies.

- Ignoring location fundamentals: Buying in declining neighborhoods with poor rental demand, weak school systems, or limited job growth.

Can you buy real estate using retirement funds?

The property must serve investment purposes only — you cannot live in it or let family use it. All expenses and income flow through the retirement account. The IRS enforces strict rules about prohibited transactions, so work with a qualified custodian to avoid penalties and maintain compliance.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...