50-Year Mortgage Pros & Cons

KEY TAKEAWAYS

- A 50-year mortgage can improve monthly affordability but comes with significantly higher lifetime interest costs and slower equity buildup.

- While 50-year mortgages exist in non-QM or loan modification scenarios, qualified mortgage (QM) loan terms currently cannot be longer than 30 years.

- Borrowers considering a 50-year mortgage loan should carefully weigh long-term risks, including higher interest rates, limited flexibility, and potential refinancing challenges.

- Alternatives like 40-year loans, interest-only products, ARMs, and other non-QM options often provide similar affordability benefits with more availability and flexibility.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage Platform

As rising home prices continue to challenge buyers, the topic of introducing a 50-year mortgage has come up as an unconventional way to improve home affordability. This extended loan term can reduce monthly payments, but it also comes with important trade-offs that borrowers should understand.

This guide breaks down the key advantages and drawbacks so you can decide whether a 50-year mortgage fits your financial goals.

What Is a 50-Year Mortgage?

A 50-year mortgage is a home loan where the repayment term is extended to five decades instead of the traditional 30 years, reducing monthly payments but delaying full ownership of the home. The idea has surfaced in recent policy discussions — reporting in November 2025 noted the Trump administration was considering a 50-year government-backed mortgage concept, though experts questioned whether it solves the underlying supply issue.

Amid persistently high interest rates and housing costs, there’s growing interest in extended-term loans as a tool to make homeownership more accessible, though critics warn of slower equity buildup and higher total interest costs.

Are There 50-Year Mortgages?

While 50-year mortgages have generated attention, they are not available as qualified mortgages (QM) because federal rules cap QM loan terms at 30 years. This means traditional lenders generally do not offer true 50-year home purchase loans.

When 50-year loan terms do appear, it’s usually through loan modification programs designed to help distressed borrowers reduce their monthly payments. Most lenders avoid 50-year terms because the extended payoff timeline significantly increases total interest costs, slows equity growth, and can introduce long-term risk for both the borrower and the lender.

In today’s U.S. market, most “50-year” conversations are about policy proposals or loan modifications, not common purchase mortgages. If you’re shopping for affordability, compare 40-year, interest-only, and ARM options side-by-side using the full Loan Estimate.

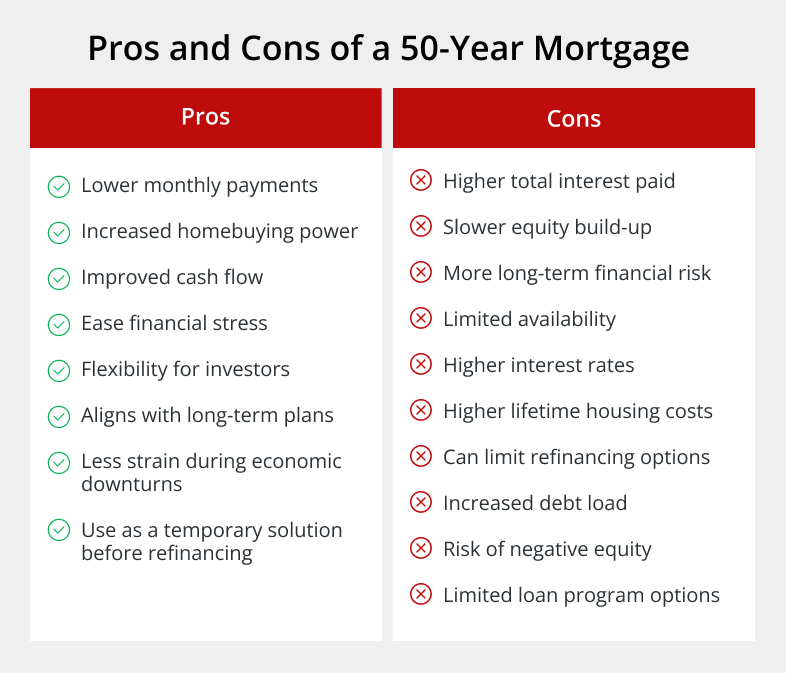

Pros of a 50-Year Mortgage

Some of the benefits of a 50-year mortgage include:

1. Lower Monthly Payments

Extending the mortgage term to 50 years spreads the loan balance across more payments, significantly lowering the monthly cost. This can make homeownership more accessible for borrowers struggling with affordability or living in high cost-of-living areas.

2. Increased Homebuying Power

Because lower payments improve a borrower’s debt-to-income ratio, some buyers may qualify for a larger loan amount. This can be especially useful for those deciding whether to rent or buy in highly competitive or expensive markets.

3. Improved Cash Flow

Lower monthly housing expenses free up money for savings, emergency funds, or investment opportunities. This is often attractive to self-employed borrowers or people with seasonal or fluctuating income.

4. Potentially Lower Financial Stress

Smaller, easier-to-manage mortgage payments can provide more emotional and financial breathing room. This helps buyers avoid overextending themselves or becoming “house poor.”

5. Flexibility for Investors

Real estate investors may favor lower payments because it increases monthly cash flow and improves a property’s debt service coverage ratio (DSCR). This can make rental properties more profitable from day one.

6. Option for Long-Term or Multi-Generational Planning

For families planning to keep a property long term or pass it down to future generations, a longer mortgage term isn’t as much of a downside. The focus is on ownership stability rather than rapid payoff.

7. Payments More Manageable During Economic Downturns

Lower monthly obligations can act as a financial cushion during periods of inflation, economic recession, or job instability. This reduces the risk of delinquency during tough economic cycles.

8. Allows More Time Before Refinancing

Buyers may use a 50-year loan as a temporary affordability solution until interest rates fall. The extended term provides breathing room while waiting for a more favorable refinancing opportunity.

Cons of a 50-Year Mortgage

Some of the drawbacks of a 50-year mortgage include:

1. Much Higher Total Interest Paid

The largest drawback is the enormous amount of interest paid over the life of the loan. Extending amortization significantly increases total costs, especially when interest rates are high.

2. Slower Equity Build-Up

Because payments toward principal are minimal in the early years, equity grows very slowly. This creates more risk during a housing market downturn, when values may fall faster than the loan balance is reduced.

3. More Long-Term Financial Risk

Committing to a 50-year mortgage increases exposure to long-term changes in income, life circumstances, or economic conditions. Borrowers stay in debt far longer, which can add uncertainty to future financial planning.

4. Limited Availability

Very few U.S. lenders offer true 50-year terms. When they do appear, they’re usually tied to loan modifications rather than new mortgages.

5. Higher Interest Rates Compared to Standard Loans

Lenders typically charge higher interest rates for ultra-long terms due to increased risk. Even a small increase in a 50-year mortgage rate can become extremely costly when stretched across decades.

Shorter terms (like 15-year) often price lower than 30-year loans, but the spread varies by market conditions—so even a small rate difference becomes expensive when stretched over 50 years.

6. Higher Lifetime Housing Costs

Borrowers end up spending far more on housing over their lifetime. The money lost to interest could otherwise be saved or invested for retirement, emergencies, or growth.

7. Potential Difficulty Refinancing

Minimal early principal reduction can make refinancing challenging later, especially if home values stagnate or fall. A high balance relative to property value may limit refinance options.

8. Longer Debt Commitments Limit Financial Flexibility

A 50-year mortgage repayment timeline can impact major milestones like retirement planning or saving for education costs. Carrying debt for decades increases financial vulnerability and reduces long-term freedom.

9. Risk of Negative Equity (Especially Early On)

Because principal barely moves in the first several years, homeowners may fall into negative equity if property values dip. This makes selling or refinancing difficult without taking a loss.

10. Fewer Loan Program Options

50-year terms are not available through conventional, FHA, or VA programs. They tend to exist only in niche non-QM markets or loan modification scenarios, limiting access for most borrowers.

Who Could Benefit From a 50-Year Mortgage?

A 50-year mortgage isn’t right for everyone, but it can serve specific borrower profiles who value lower monthly payments and long-term flexibility over rapid equity growth. Here are the types of buyers who may find this ultra-long mortgage term most useful:

- Homeowners who plan to stay long-term: Buyers intending to hold a property for decades, or pass it down within the family, may value lower monthly payments more than rapid equity buildup.

- Buyers in mild appreciation markets: In areas where home values rise slowly, a 50-year term can help keep payments affordable without depending heavily on rapid price growth.

- Real estate investors needing cash-flow padding: Lower monthly payments can improve rental property cash flow and strengthen DSCR ratios, making long-term financing appealing for certain investment strategies.

- Borrowers with long-term income stability concerns: Those with fluctuating income or who want a financial cushion may appreciate the lower, more manageable payment structure.

- Homebuyers in high-priced metro areas: In expensive cities where affordability is a major barrier, a 50-year mortgage can help buyers qualify for a home that would otherwise be out of reach.

50-Year Mortgage Alternatives

While a 50-year mortgage can lower monthly payments, several alternative loan types offer similar benefits without requiring such an extreme term length. These options can provide flexibility, improved affordability, or easier qualification, especially for borrowers who don’t fit the profile required for traditional mortgages.

- 40-Year Mortgage: A 40-year mortgage is the closest substitute and is more widely available than a 50-year term, especially in the non-QM space. It often comes with interest-only options for the first 5–10 years, keeping payments lower while still offering a more manageable amortization timeline than 50 years.

- Interest-Only Mortgage: Interest-only mortgages allow borrowers to pay only interest for a set period (typically 5–10 years) before switching to full principal and interest payments. This structure works well for buyers who expect income growth or plan to refinance before the interest-only phase ends.

- Adjustable-Rate Mortgage: Adjustable-rate mortgages (ARMs) offer lower initial interest rates than fixed-rate loans, giving borrowers immediate monthly payment relief. They are especially useful for buyers who plan to sell, refinance, or relocate before the rate adjusts upward.

- Non-Qualified Mortgages: Non-QM loans provide flexible underwriting for self-employed borrowers, investors, and those with unique income situations. These loans often include interest-only or extended terms that mimic the affordability benefits of a 50-year mortgage.

Explore Your Mortgage Options

Choosing the right mortgage strategy is all about balancing affordability, long-term goals, and financial flexibility, especially in today’s challenging housing market. Whether you’re considering extended-term loans, interest-only options, or more flexible non-QM products, it’s important to work with a lender that understands your unique situation.

Choosing the right mortgage strategy is all about balancing affordability, long-term goals, and financial flexibility, especially in today’s challenging housing market. Whether you’re considering extended-term loans, interest-only options, or more flexible non-QM products, it’s important to work with a lender that understands your unique situation.

Griffin Funding offers a wide range of mortgage solutions tailored to buyers, investors, and self-employed borrowers, along with personalized guidance to help you make the best choice. Griffin Funding also offers the Griffin Gold app, where you can easily track your loan, manage documents, and stay informed throughout the entire mortgage process.

Get started online with Griffin Funding and find a home loan with a term and rate that works for you.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Is a 50-year mortgage a good idea?

Can you get a 50-year mortgage?

Will we see 50-year mortgages anytime soon?

Are mortgages with longer or shorter terms better?

Is a 50-year mortgage basically the same as a 40-year mortgage or interest-only loan?

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...