DSCR Mortgage Document Checklist (2025): Exactly What You Need

KEY TAKEAWAYS

- DSCR loans focus on rental income potential rather than your personal W-2 earnings, making DSCR loan documentation requirements different from traditional mortgages.

- Having all the documents needed for a DSCR loan ready before applying can cut weeks off your approval timeline and prevent frustrating back-and-forth requests.

- Long-term rentals, short-term rentals, and new purchases each require different types of income documentation.

- Purchasing through an LLC requires additional formation documents and ownership verification beyond individual borrower requirements.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformKnowing exactly what documents are needed for a DSCR loan before you apply can streamline the approval process. Unlike traditional mortgages that focus heavily on your personal income, DSCR loans evaluate the property’s ability to generate rental income that covers the mortgage payments.

This comprehensive DSCR mortgage document checklist breaks down everything you’ll need for a smoother DSCR loan application, helping you avoid delays and get your investment property financing approved faster.

What Is a DSCR Mortgage Loan?

A debt service coverage ratio (DSCR) loan evaluates whether a property’s rental income can cover its mortgage payments, rather than focusing on the borrower’s personal income. The ratio is determined by dividing the property’s monthly rental income by its monthly debt obligations (principal, interest, taxes, and insurance).

Most lenders look for a minimum DSCR of 1.0 to 1.25, meaning the property should generate enough income to cover 100% to 125% of its monthly obligations. This loan type has become increasingly popular among real estate investors because it allows them to qualify based on the property performance rather than personal income limitations.

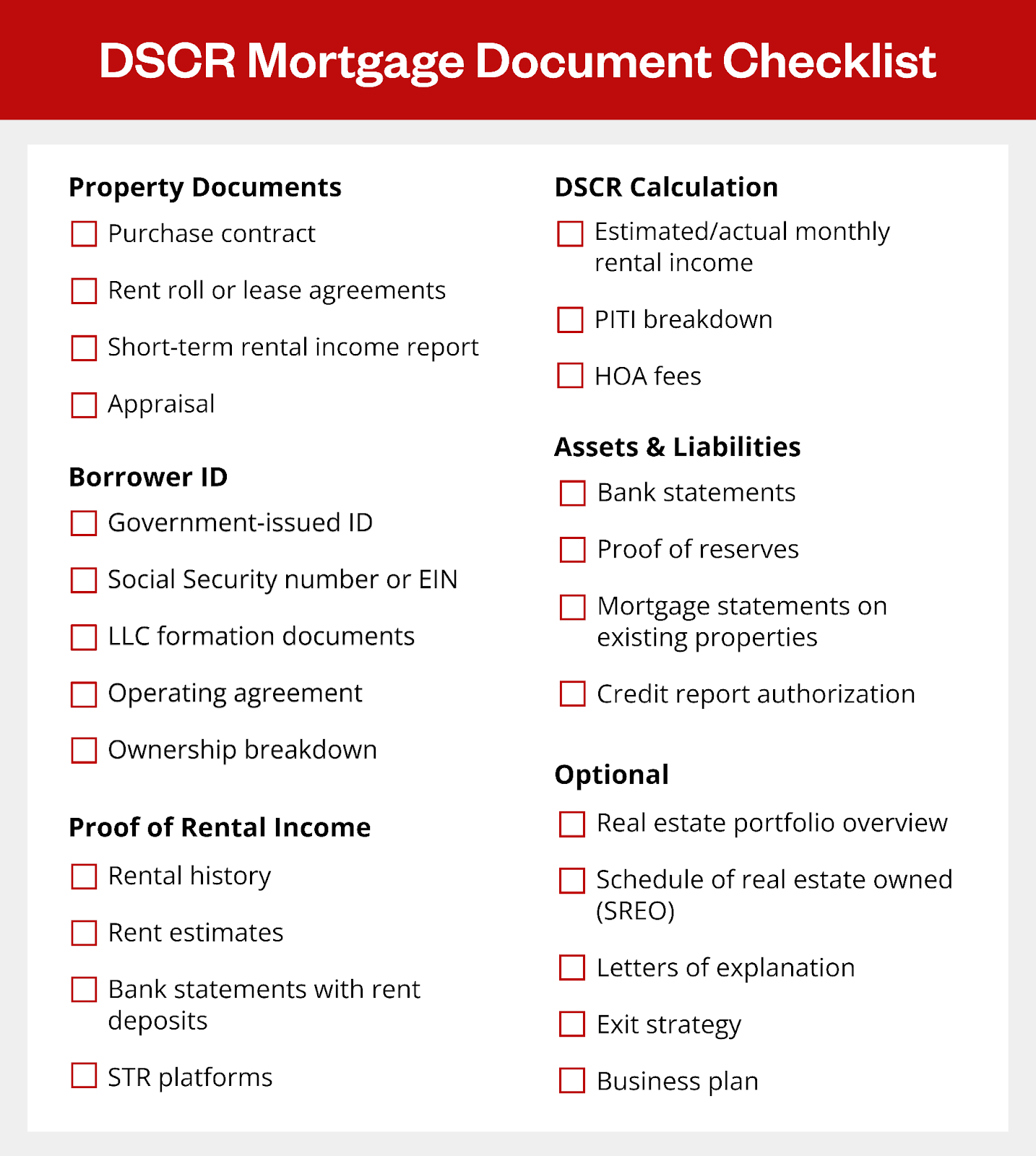

The DSCR Mortgage Document Checklist (2025)

Here’s everything you need to gather for your DSCR loan application. Start collecting these documents early to avoid delays during underwriting. Please note that depending on what type of DSCR loan program you choose, not all items on the checklist are required.

Property Documents

Property documentation proves the investment’s legitimacy and establishes its income-generating potential. These documents help lenders understand exactly what you’re purchasing and how it will perform financially:

- Purchase contract or sales agreement: This document shows the agreed-upon purchase price, closing date, and any contingencies that could affect the loan timeline.

- Rent roll or lease agreements: These documents demonstrate existing rental income for occupied properties and establish current market rates for comparable units.

- Short-term rental income reports: Airbnb or VRBO earnings statements prove income potential for properties used as vacation rentals rather than long-term leases.

- Appraisal: While typically ordered by the lender, you should understand when this will be required and budget for the cost in your closing expenses.

Borrower Identification

Identity verification ensures you’re legally able to enter into the mortgage contract and establishes whether you’re buying as an individual or business entity.

- Government-issued photo ID: Your driver’s license or passport must match the name on your loan application exactly.

- Social Security Number or EIN: Individual borrowers provide their SSN, while LLC purchases require the entity’s Employer Identification Number from the IRS.

- LLC formation documents: If purchasing through a business entity, you’ll need the articles of incorporation, operating agreement, and any amendments.

- Operating agreement and ownership breakdown: These documents detail who owns what percentage of the LLC and who has the authority to sign loan documents on behalf of the entity.

Proof of Rental Income (Real or Projected)

Income documentation plays the most critical role in DSCR loan underwriting since the property’s rental potential determines your qualification.

- 12-24 months of rental history: Bank statements or rent rolls from the property you intend to purchase show its proven income track record and rental stability.

- Rent estimates: Professional market rent analysis from platforms like Rentometer, Stessa, or formal appraisals establishes income potential for new purchases or vacant properties.

- Bank statements showing rent deposits: These provide direct evidence of rental income flowing into your accounts, typically required for the most recent 2-3 months.

- STR platforms: Airbnb or VRBO 1099 forms and earnings reports document short-term rental income that may fluctuate seasonally.

DSCR Calculation Documents

These documents allow lenders to calculate your exact debt service coverage ratio and determine loan approval.

- Estimated or actual monthly rental income: Market rent analysis or existing lease agreements establish the property’s monthly income potential.

- PITI breakdown: This detailed calculation includes Principal, Interest, Taxes, and Insurance payments that the rental income must cover.

- HOA fees (if applicable): Homeowners association dues add to monthly obligations and reduce the effective debt service coverage ratio.

Use our DSCR loan calculator to determine if your property meets minimum ratio requirements before submitting your application.

Asset and Liability Documents

Financial statements prove you have sufficient reserves and manageable debt levels to handle investment property ownership successfully.

- Bank statements: The last few months of statements from all accounts show liquid assets and cash flow patterns.

- Proof of reserves (if required by lender): While not required by all lenders, this documentation includes savings, investments, or other assets that could cover mortgage payments during vacancy periods.

- Mortgage statements on existing properties: Current balances and payment history on other investment properties demonstrate your track record managing real estate debt.

- Credit report consent: Some lenders might check your credit. This authorization allows lenders to pull your credit score, though DSCR loans typically have more flexible credit requirements than conventional mortgages.

Optional (But Recommended) Documents

While not always required, these additional documents can strengthen your application and speed up approval by providing lenders with a complete picture of your investment strategy.

- Real estate portfolio overview: A summary of all properties you own, including purchase dates, current values, and rental income, helps lenders understand your experience level.

- Schedule of real estate owned (SREO): A detailed list of investment properties with addresses, loan balances, and monthly cash flow demonstrates your ability to manage multiple properties.

- Letters of explanation: Written explanations for any gaps in rental history, recent property sales, or unusual financial circumstances can prevent underwriter questions that delay closing.

- Exit strategy or business plan (for BRRRR or flip strategies): Documentation of your plans for BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategies or fix-and-flip projects shows lenders you have a clear investment thesis.

Tips for Streamlining DSCR Loan Approval

Following these tips can help reduce your loan processing time and improve your chances of smooth approval:

- Organize documentation in advance: Create digital folders for each document category before you start shopping for properties to avoid scrambling when you find the perfect deal.

- Label files clearly: Use descriptive filenames like “2024_Bank_Statements_Checking” instead of generic names that confuse underwriters and cause delays.

- Respond promptly to requests: Answer loan officer questions and provide additional documentation within 24-48 hours to keep your file moving through underwriting.

- Work with experienced DSCR lenders: Choose lenders who specialize in investment property loans rather than traditional mortgage companies that may not understand DSCR requirements.

- Maintain organized financial records: Keep rental income separate from personal accounts and maintain detailed records of property expenses to demonstrate professional property management.

Get a DSCR Loan With Griffin Funding

Griffin Funding specializes in DSCR loans for real estate investors who want to build their rental portfolios. Our experienced loan officers understand the unique documentation requirements for investment properties and work with you to ensure a smooth approval process.

Ready to get started? Download the Griffin Gold app to begin your application today and connect with a loan specialist who can guide you through the documentation process from start to finish.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What are common mistakes that delay DSCR loan approval?

Nobody wants to wait extra weeks for a loan approval because of avoidable mistakes. Here are the most common issues that slow down the underwriting process:

- Mixed personal and rental income: Borrowers often deposit rental income into personal accounts alongside other funds, making it difficult for underwriters to track consistent rental deposits and verify income streams.

- Incomplete LLC documentation: Entity purchases frequently get delayed when borrowers forget essential items like operating agreements, good standing certificates, or fail to provide current ownership breakdowns.

- Unrealistic rent estimates: Providing rent projections without proper market analysis backing triggers additional review requirements that can add weeks to your timeline.

- Missing reserve documentation: Failing to provide adequate proof of liquid assets or cash reserves can stall approval, especially for properties with lower DSCR ratios.

- Not getting pre-approved: Understanding your borrowing capacity and having all your documents for mortgage pre-approval ready gives you an advantage when making offers and speeds up the closing process once you find the right property.

What's a good DSCR in 2025?

A good DSCR is typically 1.25 or higher, though many lenders will approve loans with ratios as low as 1.0. Properties with DSCR ratios of 1.25 or higher generally qualify for better interest rates and more favorable loan terms because they demonstrate stronger rental income potential.

Ratios below 1.0 indicate the property doesn't generate enough income to fully cover its debt obligations, which may require compensating factors like larger down payments, stronger credit scores, or additional reserves.

Griffin Funding accepts DSCR ratios less than 0.75, making it possible to finance properties even when rental income doesn't fully cover mortgage payments.

Do DSCR loans require tax returns?

No, DSCR loans do not require personal tax returns. This is one of the main benefits that makes DSCR loans attractive to real estate investors — you qualify based on the property's rental income, not your personal income.

However, there are some exceptions. Lenders may ask for tax returns if you're purchasing through an LLC that's been operating for more than one year, or if you're claiming rental income from existing properties on your application. Self-employed borrowers might also need to provide tax documentation depending on the lender's specific requirements.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...