How to Choose the Best VA Mortgage Lender for You (2026)

KEY TAKEAWAYS

- The best VA lenders in 2026 offer strong VA loan expertise, fast underwriting, competitive pricing, and clear communication, not just recognizable brand names.

- Comparing lenders requires evaluating rates, fees, VA specialization, technology, and customer service to find the best fit for your needs.

- Veterans should avoid common mistakes like choosing based on rate alone or failing to verify VA approval and should ask targeted questions to assess lender experience.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformFinding the right VA mortgage lender matters more than ever in 2026, especially with shifting interest rates, evolving underwriting standards, and new digital lending tools. The best VA lenders combine competitive pricing, deep program knowledge, and smooth loan processing tailored specifically for military borrowers.

Since VA loans have unique requirements, choosing a lender with proven expertise can save you time, money, and stress. This guide breaks down what to look for and how to match yourself with the right lender, whether you’re buying, refinancing, or using your benefit for the first time.

What Makes a VA Mortgage Lender the “Best” in 2026?

The best VA lenders in 2026 are those that combine competitive pricing, fast processing, and deep expertise with VA loans, which have unique rules compared to conventional mortgages. While any VA-approved lender can originate these loans, companies that specialize in VA lending typically offer smoother underwriting, fewer delays, and better guidance for military borrowers.

Experience with VA underwriting and dealing with COEs, funding fees, and VA appraisal requirements is critical to avoiding surprises during the loan process. With an experienced VA lender like Griffin Funding, you can get the personalized support and efficiency veterans value most.

Types of VA Loan Mortgage Companies

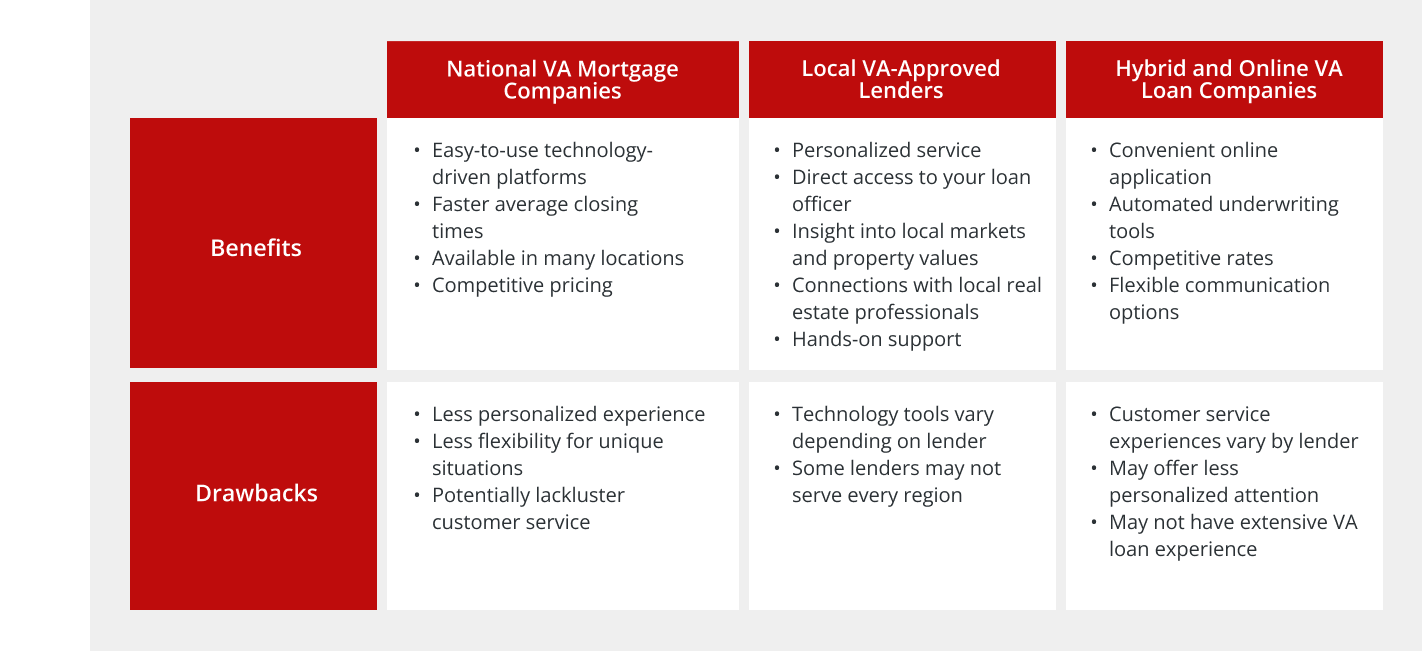

There are several types of VA mortgage providers, each with different strengths. Understanding these categories can help you decide which structure best fits your needs, whether you’re purchasing or using programs like a VA streamline refinance or VA cash-out refinance.

National VA Mortgage Companies

National VA Mortgage Companies

National VA mortgage companies operate across most or all U.S. states, offering broad access and streamlined digital tools for military borrowers. These lenders often close a high volume of VA loans, which gives them deep familiarity with VA underwriting, COE processing, and appraisal requirements.

Pros:

- Strong technology platforms with online applications, automated updates, and fast preapproval tools

- Faster average closing times due to dedicated VA underwriting teams

- Broad availability, making them a good match for military families who relocate frequently

- Competitive pricing because of high loan volume

Cons:

- Service may feel less personal than working with a small or local lender

- Borrowers may be routed to large call centers rather than a single dedicated loan officer

Companies like Veterans United are well-known national VA lenders with strong reputations for delivering consistent VA-focused service.

Local VA Loan Approved Lenders

Local VA-approved lenders operate within a specific city, region, or state and offer a more relationship-driven experience. These companies often know the area’s housing trends, property types, and local appraisal challenges.

Pros:

- Personalized service with direct access to your loan officer

- Strong understanding of local market dynamics and property values

- Better communication with regional appraisers, inspectors, and real estate agents

- Helpful for VA borrowers who prefer in-person conversations or small-team support

Cons:

- Technology tools may vary from lender to lender

- Limited availability if you’re relocating or buying out of state

Local lenders are often a great choice for buyers who want a hands-on process and guidance tailored to their specific market.

Hybrid and Online VA Loan Companies

Hybrid and online VA lenders combine digital convenience with the guidance of real loan officers, making them a popular choice for veterans who want a streamlined experience. These companies usually offer quick online applications, easy document uploads, and transparent loan tracking through online portals.

Pros:

- Convenient online application process with fast digital preapproval

- Automated underwriting tools that can shorten turn times

- Competitive rates due to tech-driven operations

- Flexible communication options (phone, video, email, or messaging)

Cons:

- Personal service can vary depending on the lender’s structure

- Some operate at high volume, which may lower the level of customer service

- Not all hybrid lenders have deep VA experience, so it’s important to check how often they handle VA purchase loans, VA streamline refinances, or VA cash-out refinances

Hybrid VA lenders are ideal for borrowers who want speed and digital convenience but still value access to a knowledgeable loan officer when needed.

Key Factors to Compare When Choosing a VA Home Lender

When selecting a VA lender, it’s important to look beyond rates and compare how well each company supports military borrowers throughout the full loan process.

VA Loan Rates and Fees

- VA loan rates are influenced by market conditions, lender pricing structures, and your credit profile.

- Compare APR, discount points, lender fees, and credits, not just the advertised rate.

- Always request rate quotes on the same day to make an accurate comparison.

VA Loan Experience and Specialization

- Look for lenders who regularly close on VA loans and have VA-trained loan officers on staff.

- Specialists know how to navigate eligibility rules, COEs, residual income requirements, and VA appraisal guidelines.

- A lender deeply experienced with VA loans can prevent underwriting delays and help secure a smoother approval.

Customer Service and Responsiveness

- Great VA lenders communicate clearly, respond quickly, and guide you through COE verification, documentation, and appraisal steps.

- This is especially valuable for first-time VA buyers, who benefit from personalized support and easy access to their loan officer.

Turnaround Times and Closing Speed

- Closing speed varies widely among VA mortgage companies, with stronger VA lenders often delivering shorter underwriting and closing timelines.

- Quick processing is essential in competitive markets where sellers expect reliable timelines.

Technology and Digital Tools

- Look for lenders offering quick digital pre-approvals, secure document upload portals, and transparent loan tracking.

- Automated underwriting systems can speed up decision-making.

- Easy-to-use digital tools create a smoother and more predictable lending experience for VA borrowers.

Common Mistakes to Avoid When Choosing a VA Loan Company

Watch out for these common mistakes when searching for the best VA home mortgage lender:

- Choosing based on rate alone: The lowest advertised rate doesn’t always mean the lowest overall cost. APR, discount points, and fees can dramatically change what you actually pay over time.

- Not verifying a lender’s VA approval status: Some lenders advertise VA expertise but aren’t truly VA-focused or experienced. Always confirm they are officially VA-approved and regularly originate VA loans, not just conventional mortgages.

- Failing to compare multiple quotes: VA pricing can vary widely between lenders, so getting at least 2–3 same-day quotes is essential.

- Overlooking lender fees and hidden costs: Origination fees, discount points, credit report charges, and rate-lock fees can add up quickly. Make sure you get a full fee worksheet so you can compare lenders fairly and avoid surprises at closing.

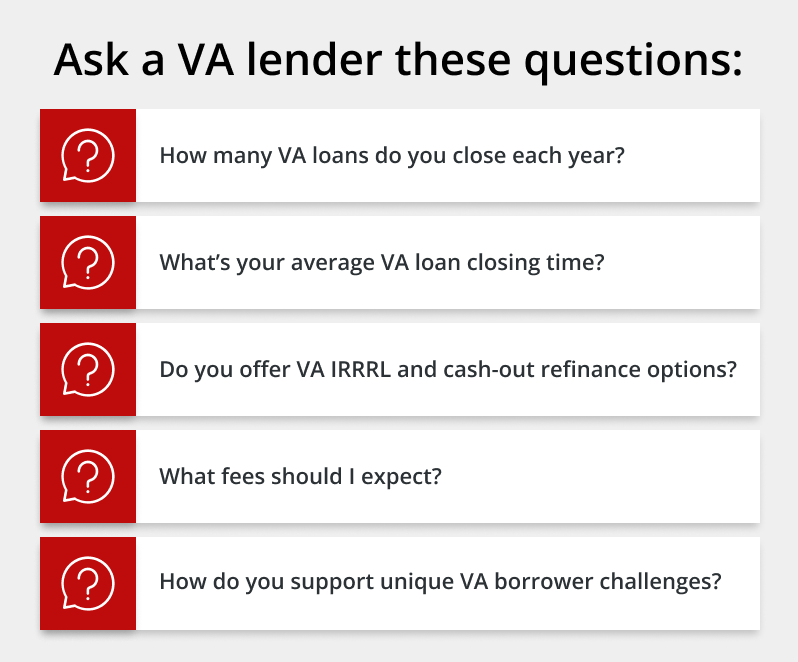

Questions to Ask VA-Approved Lenders Before You Choose

When seeking out the best VA home loan lender, it’s important to know the right questions to ask so you can properly compare your options.

- “How many VA loans do you close each year?” This helps you measure the lender’s true VA expertise beyond simply being VA-approved.

- “What’s your average VA loan closing time?” Faster lenders are better equipped to handle VA appraisals, underwriting steps, and competitive purchase timelines. Griffin Funding aims to close all VA loans in 30 days or less.

- “Do you offer VA IRRRL and cash-out refinance options?” A strong VA lender should support both the VA streamline refinance (IRRRL) and VA cash-out refinance programs.

- “What fees should I expect?” Ask about lender fees, credits, discount points, and any charges unique to VA loans so you can compare lenders accurately.

- “How do you support credit challenges unique to VA borrowers?” The best VA mortgage companies should be able to help with COE issues, credit updates, and documentation challenges.

Best Lenders for VA Mortgages in 2026

The top VA mortgage lenders in 2026 aren’t defined by brand names but by consistent service quality, VA expertise, and borrower-focused support. The best lenders for VA mortgages offer not just competitive pricing, but a smooth experience from start to finish.

What top VA mortgage companies do well:

- Provide fast, reliable preapprovals

- Maintain strong VA underwriting teams

- Offer competitive VA pricing with transparent fee structures

- Communicate proactively, especially around appraisals and conditions

- Support programs like VA IRRRL and VA cash-out refinances

Examples of excellent service traits:

- A loan officer who explains residual income rules in plain language

- A lender who requests documents upfront to avoid last-minute conditions

- Digital tools like the Griffin Gold app that keep borrowers updated in real time

Why “fit” matters more than picking a big-name lender:

Different veterans have different needs. Some want speed, others want personal service, and others prioritize technology or low fees. Choosing a lender based on your goals is far more effective than selecting one solely because they’re well-known.

Get Pre-Approved for a VA Loan Today

Getting pre-approved is the first step toward a smooth VA homebuying experience, and working with the right lender ensures your benefits are maximized from day one. Griffin Funding offers specialized VA support, competitive rates, and modern digital tools like our free VA loan calculator and VA loan affordability calculator.

Whether you’re purchasing, refinancing, or exploring your eligibility, starting with a trusted VA-focused lender can make your entire journey easier and more confident. Get started online today and take full advantage of your VA loan benefits.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Why should I get a VA loan with Griffin Funding?

How do I know if a lender is VA-approved?

Do VA loans have lender fees?

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...