What Does the Fed Rate Cut Mean for Mortgages?

KEY TAKEAWAYS

- The Federal Reserve doesn’t directly control mortgage rates, but its decisions influence the broader interest rate environment that lenders use to set their rates.

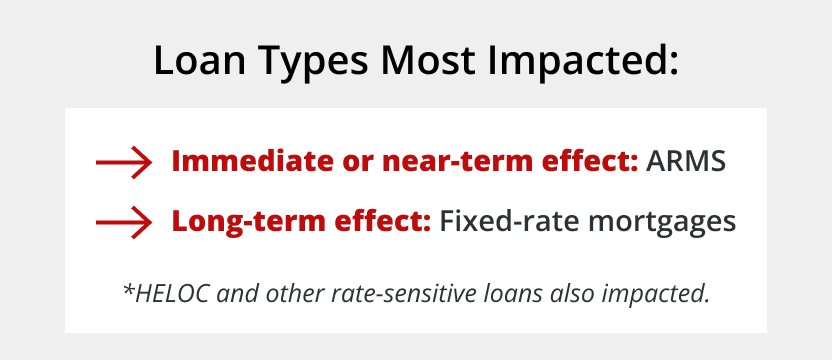

- Adjustable-rate mortgages and HELOCs typically respond more quickly to Fed rate cuts, while fixed-rate mortgages are more influenced by long-term bond market movements.

- Lower rates can increase your buying power and create refinancing opportunities, but they also tend to heat up competition in the housing market.

- While Fed rate cuts matter, inflation, unemployment, Treasury yields, and overall economic conditions also play major roles in determining mortgage rates.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

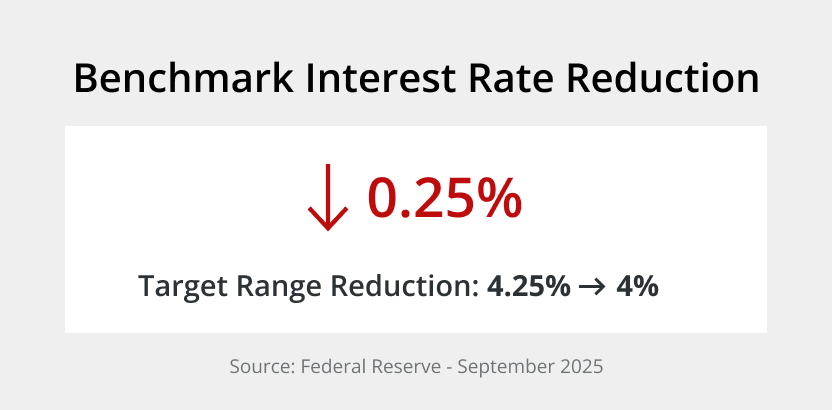

Effortless Digital Mortgage PlatformWhen the Federal Reserve announces a rate cut, it sends ripples through the economy. In September 2025, the Fed lowered its benchmark rate to a range of 4% to 4.25%, marking another significant shift in monetary policy. But what does this mean for your mortgage?

Whether you’re shopping for a home, considering refinancing, or just trying to understand how these decisions affect your wallet, the connection between Fed rate cuts and mortgages is more nuanced than you might think.

So, what does the Fed rate cut mean for mortgages? Keep reading to learn about how Fed rate cuts affect mortgage interest rates.

What the Federal Funds Rate Is and Why It Matters

When banks need short-term liquidity, they borrow from each other overnight, and the federal funds rate is the cost of those loans. It might sound like an obscure banking detail, but it’s actually one of the most powerful tools the Federal Reserve has to manage the economy.

When the Fed wants to encourage economic growth, it lowers this rate to make borrowing more affordable. When inflation goes up, it raises rates to cool the economy down. The goal is to balance maximum employment with stable prices, keeping inflation around 2% over the long run.

Here’s how the Fed uses the federal funds rate to influence the broader economy:

- When the Fed cuts rates, it becomes cheaper for banks to borrow money.

- Banks then typically pass these savings along to consumers and businesses through lower interest rates.

- This encourages more spending and investment, which can boost economic activity.

In September 2025, the Federal Reserve lowered the federal funds rate by a quarter percentage point to 4% to 4.25%. According to the Fed’s official statement, this decision came in response to slowing job growth and rising unemployment, even though inflation remains somewhat elevated.

The relationship between the Fed funds rate and general interest rates throughout the economy is pretty straightforward. While the Fed doesn’t control every interest rate out there, its benchmark rate influences everything from credit card APRs to auto loans. That said, when it comes to Fed rate cuts and mortgage interest rates, the connection is less direct than most people assume.

How Fed Rate Cuts Typically Impact Mortgage Rates

The Federal Reserve doesn’t set mortgage rates. While Fed rate cuts and mortgage rates are often discussed together, there are a variety of factors affecting mortgage rates, and the Fed’s actions are just one piece of the puzzle.

Mortgage rates, especially for fixed-rate loans, are more connected to the 10-year Treasury note yield than to the federal funds rate. When the Fed cuts rates, it can influence investor behavior in bond markets, which then affects Treasury yields. Lenders watch these Treasury yields closely when setting their mortgage rates.

There’s usually a correlation between Fed rate cuts and lower mortgage rates, but sometimes it’s not as automatic or immediate. Sometimes, mortgage rates actually drop before the Fed officially cuts rates because markets anticipate the move and adjust ahead of time. Other times, rates might not fall as much as expected if inflation concerns or other economic factors are at play.

Looking at historical patterns, mortgage rates tend to decline when the Fed goes on a rate-cutting cycle. However, the timing and magnitude can vary. During some periods, mortgage rates have dropped substantially with Fed cuts. In other cases, they’ve remained stubbornly high despite aggressive Fed action, especially when there are serious inflation concerns.

Which Types of Mortgages Are Most Affected

Not all mortgages respond to Fed rate cuts in the same way. Understanding which type of loan you have makes a big difference in how quickly you’ll see any benefits:

- Adjustable-rate mortgages (ARMs): These loans are directly tied to various index rates that move more closely with the federal funds rate. If you have an ARM, you could see your rate adjust downward within a few months, depending on your loan’s terms. The connection is much more immediate than with fixed-rate mortgages. If you’re considering whether to refinance an ARM, a Fed rate cut might present a good opportunity.

- Fixed-rate mortgages: These loans are influenced more by long-term bond market dynamics, particularly the 10-year Treasury yield, than by the Fed’s overnight lending rate. While Fed policy does affect bond markets, the relationship is indirect. If you’re shopping for a fixed-rate loan, you’ll want to watch Treasury yields as much as Fed announcements.

- HELOCs and other rate-sensitive products: Home equity lines of credit typically have rates tied to the prime rate, which moves in the same direction as the federal funds rate. When the Fed cuts rates, HELOC rates usually follow within a billing cycle or two. This makes them highly sensitive to Fed policy changes.

How the Fed Rate Cut Affects Homebuyers

For people looking to buy a home, Fed rate cuts can be a double-edged sword. Here’s what you need to know about how lower rates might impact your home search:

- More affordable monthly payments mean increased buying power: When rates drop, you can afford a more expensive home with the same monthly payment, or you can stick with your original budget and enjoy lower payments. Even a small drop in rates can save you hundreds of dollars each month.

- Timing considerations: Trying to time the market perfectly rarely works out. If you’re financially ready and find a home you love at a price you can afford, that might matter more than squeezing out another quarter point on your rate.

- Competitive market risks with lower rates: When rates drop, demand for homes typically increases as more buyers jump into the market. Unfortunately, increased competition can drive up home prices, potentially offsetting some of the savings from lower rates. You might find yourself in bidding wars more often or dealing with a faster-moving housing market.

What the Fed Rate Cut Means for Existing Homeowners

If you already own a home, Fed rate cuts open up some interesting possibilities depending on your current loan situation. Here’s how rate cuts might benefit you.

- Refinance opportunities: The general rule of thumb used to be that you need at least a 1% rate difference to make refinancing worthwhile, but that’s not always the case anymore. Even a half-point reduction could save you money if you plan to stay in your home for several years. Check refinance rates to see how current offers compare to your existing loan.

- Home equity loans and HELOCs: These products are more attractive financing options when rates fall. If you’ve been considering a renovation project or need to consolidate high-interest debt, a Fed rate cut could make these options more affordable.

- Impact on monthly mortgage payments: If you have a fixed-rate mortgage, your payment won’t change regardless of what the Fed does. But if you have an adjustable-rate mortgage, you could see your payment decrease when your rate adjusts, assuming the Fed’s cuts translate to lower index rates.

How Lenders React to Fed Rate Cuts

Mortgage lenders don’t all respond to Fed rate cuts in exactly the same way or at the same speed. Understanding how lenders operate during rate changes can help you make smarter decisions.

- Lender-specific rate strategies: Each lender has its own approach to pricing loans based on their cost of funds, risk tolerance, and competitive positioning. Some lenders move quickly to lower rates when they anticipate Fed cuts, trying to attract borrowers before their competitors do. Others take a more cautious approach, waiting to see how the market settles before adjusting their offerings. This means shopping around is even more important during periods of rate changes.

- Rate locks in a changing market: If rates are trending downward, you might be tempted to float your rate rather than locking it in, hoping for a better deal. But this strategy can backfire if rates unexpectedly jump back up or if market conditions change. Many lenders offer float-down options that let you lock in a rate but take advantage of further decreases before closing.

- Timing a mortgage application in a falling rate environment: If the Fed has signaled upcoming cuts, you might benefit from waiting a bit to apply. However, if rates have already dropped in anticipation of Fed action, waiting longer might not help. The key is understanding that current mortgage rates often move before the Fed officially acts.

Fed Rate Cut vs Market Conditions: Other Factors at Play

While Fed rate cuts grab headlines, they’re far from the only factor influencing mortgage rates. Several other economic conditions play equally important roles, including:

- Inflation: Even if the Fed cuts rates to stimulate the economy, mortgage rates might not fall much if inflation remains high. Lenders need to ensure they’re earning returns that outpace inflation, which means keeping rates elevated during inflationary periods. The September 2025 Fed decision acknowledged that inflation remains somewhat elevated, which could limit how much mortgage rates decline.

- Unemployment: Rising unemployment can actually lead to lower mortgage rates, even though it signals economic weakness. When unemployment increases, the Fed is more likely to cut rates aggressively, and investors tend to move money into safer assets like Treasury bonds, pushing their yields down. The Fed’s recent statement noted that job gains have slowed and unemployment has edged up, which factored into their decision to cut rates.

- Bond market dynamics: The 10-year Treasury note is the real driver of fixed mortgage rates. This yield moves based on investor expectations about inflation, economic growth, and Fed policy. Sometimes, Treasury yields drop before the Fed cuts rates because investors are forward-looking. Other times, yields might rise even as the Fed cuts rates if investors are worried about long-term inflation or government borrowing.

- Global economic uncertainty: Events happening overseas can push U.S. mortgage rates up or down regardless of Fed policy. When global markets experience volatility or turmoil, investors often flock to U.S. Treasury bonds as a safe haven, driving yields down and potentially lowering mortgage rates. Conversely, strong global growth can push rates higher as investors seek better returns elsewhere.

Lock In Your Rate With Griffin Funding

Understanding your potential mortgage rate after a Fed rate-cutting cycle can feel overwhelming, but you don’t have to go it alone. Whether you’re looking to purchase your first home or refinance your existing mortgage, having the right lending partner makes all the difference.

Griffin Funding offers competitive rates and personalized service to help you make the most of current market conditions. Our team stays on top of rate movements and can help you determine the best time to lock in your rate. Plus, with the Griffin Gold app, you can track rates and manage your mortgage application right from your phone.

Get started online today and lock in your rate.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Does the Fed rate cut lower mortgage rates?

Not directly. The Fed doesn't set mortgage rates, but its rate cuts influence the broader interest rate environment.

Fixed-rate mortgages are typically tied to the 10-year Treasury yield, while adjustable-rate mortgages and HELOCs respond more quickly to Fed rate changes. Mortgage rates often move in the same direction as Fed policy, but the connection isn't automatic.

Use our rent vs buy calculator to evaluate your options and see if buying a home makes sense for you.

How long does it take mortgage rates to respond to a Fed rate cut?

It varies by loan type and market conditions. Sometimes mortgage rates drop before the Fed officially cuts rates, as markets anticipate the move. Other times, it can take weeks or months for the full impact to show up in mortgage rates. ARMs and HELOCs typically adjust within a few months, while fixed-rate mortgages respond more to long-term bond market trends.

Is it a good time to refinance after a rate cut?

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...