SALT Deduction: What Is the State and Local Tax Deduction?

KEY TAKEAWAYS

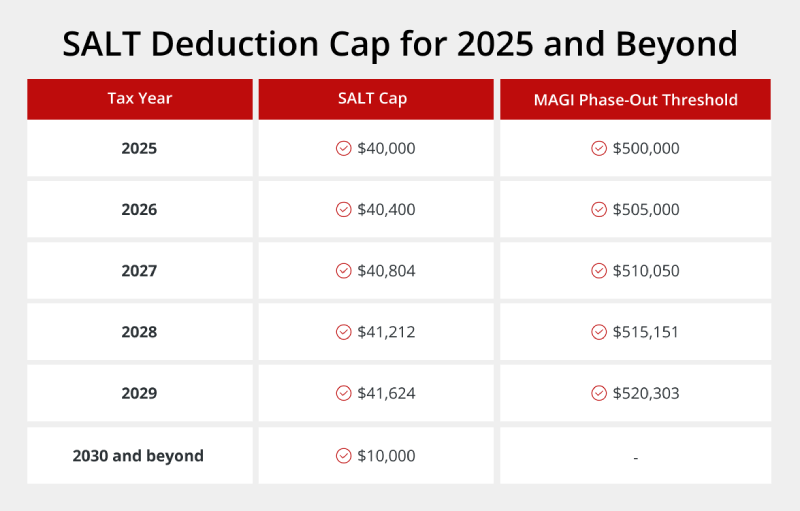

- The SALT deduction allows taxpayers to deduct the cost of their state and local taxes from their federally taxable income, up to $40,000 for the 2025–2029 tax years under the One Big Beautiful Bill Act.

- The SALT tax deduction is only available to taxpayers who itemize their deductions.

- The 2017 Tax Cuts and Jobs Act (TCJA) set the SALT deduction cap at $10,000 for every year until 2025.

- Donald Trump’s One Big Beautiful Bill (OBBB) Act has increased the SALT deduction cap to $40,000 beginning in 2025, with the cap being increased 1% each year through 2029, reverting to $10,000 in 2030

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformThe SALT tax deduction prevents taxpayers from paying taxes on the same income twice, both locally and federally. This deduction allows taxpayers who itemize their deductions to deduct the value of their state and local taxes from their federally taxable income, up to $40,000. For residents of high-tax states or property owners, this deduction can be quite advantageous.

KEY TAKEAWAYS

- The SALT deduction allows taxpayers to deduct the cost of their state and local taxes from their federally taxable income, up to $40,000 for the 2025–2029 tax years under the One Big Beautiful Bill Act.

- The SALT tax deduction is only available to taxpayers who itemize their deductions.

- The 2017 Tax Cuts and Jobs Act (TCJA) set the SALT deduction cap at $10,000 for every year until 2025.

- Donald Trump’s One Big Beautiful Bill (OBBB) Act has increased the SALT deduction cap to $40,000 beginning in 2025, with the cap being increased 1% each year through 2029, reverting to $10,000 in 2030

What Is the SALT Deduction?

The state and local taxes (SALT) deduction is a federal tax benefit for taxpayers who itemize their deductions. It allows these taxpayers to deduct the cost of their state and local taxes, including income tax or sales tax, as well as property taxes, from their federal income for tax calculation purposes. The SALT deduction is designed to ensure taxpayers don’t pay tax on the same income twice.

How the SALT Tax Deduction Works

The SALT tax deduction only applies to taxpayers who choose to itemize their tax deductions, rather than taking the standard deduction. If you’re eligible for tax deductions that exceed the amount of the standard deduction, itemizing your deductions can be an advantageous choice. To do so, you’ll need to list out every deductible cost item by item, hence the term “itemize.”

To claim the SALT tax deduction, you’ll first need to choose whether you’d like to deduct your state and local income tax or your sales tax. Generally, you should choose whichever amount is larger.

Deduct either your income or sales tax plus your property taxes — a total of up to $40,000 for the 2025-2029 tax years — from your taxable income before calculating your federal taxes.

The IRS’s Schedule A (Form 1040) can help you with this calculation:

- Line 5a: Check the box if you intend to deduct your state and local sales tax instead of your income tax. If you plan to deduct your income tax, leave this box unchecked. Then, input the amount on the line.

- Line 5b: Input your state and local personal property taxes.

- Line 5c: Input your state and local property taxes.

- Line 5d: Add the previous 3 lines together.

- Line 5e: Enter the amount on Line 5d or $40,000, whichever is less.

History of the SALT Deduction

State and local taxes first became deductible from federal taxable income in 1913. At this time, the government established a permanent federal income tax. Upon its introduction, many state and local taxes became deductible from federal taxable income.

Throughout the later half of the 20th century, a number of tax reforms were introduced that limited the range of state and local taxes that could be deducted from taxable income. In 2017, the Tax Cuts and Jobs Act added the $10,000 cap on the SALT deduction, which remained in place through the end of 2024. Beginning with the 2025 tax year, the One Big Beautiful Bill Act raised the cap to $40,000.

Who Qualifies for the SALT Deduction?

Only taxpayers who itemize their deductions are eligible for the SALT tax deduction; those who take the standard deduction cannot subtract SALT tax from their federal taxable income.

The SALT deduction is particularly beneficial to people who pay high amounts of state and local income and property taxes. Homeowners, particularly those in areas with high property taxes, can benefit greatly from this deduction, as can high earners and residents of high-tax states.

How Recent Legislation Impacts the SALT Deduction

Donald Trump’s One Big Beautiful Bill enacts tax policy changes in 2025. It raises the SALT deduction cap from $10,000 to $40,000 for 2025 through 2029. Senate changes modified the bill slightly, so that the deduction limit increases annually by 1% each year, until it reverts back to $10,000 in 2030.

These deductions only apply to taxpayers with an AGI of $500,000 or less. For every dollar of income over $500,000, the deduction cap is reduced by 30 cents.

Should You Claim the SALT Tax Deduction?

To determine whether you should claim the SALT deduction, it’s first important to decide whether it may be advantageous to you to itemize deductions.

For the 2025 tax year, the standard deduction is $15,000 for single filers and married couples filing separately, and $30,000 for married couples filing jointly. If your deductible expenses are greater than $15,000, it may make sense to itemize deductions. If they’re less than your corresponding standard deduction, it makes more sense to take the standard deduction.

If you think you may want to claim the SALT deduction, start by calculating your state and local taxes. If your total SALT tax is less than $40,000, you can deduct the total amount from your federal taxable income. If it’s greater, you can deduct up to $40,000, provided your AGI does not exceed $500,000. You can use your total SALT tax to estimate whether itemized deductions would be worthwhile. For instance:

- If your SALT tax amounts to $15,000, you’ll only need to find additional qualifying deductions to exceed the $15,000 standard deduction threshold — at which point itemizing becomes worthwhile.

- If your SALT tax only amounts to $5,000, you’ll need an additional $10,000 in qualifying deductions to save using itemized deductions. In this case, itemizing deductions may not be advantageous.

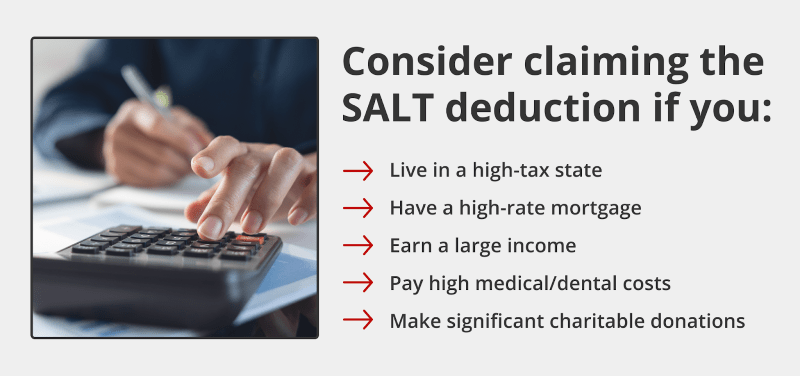

It may also be advantageous to itemize your deductions and claim the SALT tax deduction if you:

- Live in a state with high taxes or high property taxes (see property tax by state)

- Have a mortgage with a high interest rate

- Are a high earner

- Have high out-of-pocket medical and dental expenses

- Have made considerable charitable donations

Determine Whether the SALT Deduction Is Right for You

The SALT tax deduction is just one of many ways to save come tax season. For other money saving techniques to help you find your way to financial wellness, get the Griffin Gold app. It has smart features like budgeting, credit management, and more.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Who benefits most from the SALT deduction?

The more you pay in state and local income tax, the more you can benefit from the SALT tax deduction. You may find this deduction particularly beneficial if you:

- Live in a state with high income tax: Residents of California, Connecticut, Hawaii, Illinois, New Jersey, and New York in particular can benefit from this deduction.

- Are a high earner: High earners, especially those who are married filing jointly, may benefit from SALT deductions.

- Own property: Homeowners and other property owners can benefit from the SALT tax, particularly those who live in areas with high property taxes / values.

What’s happening to the SALT deduction in 2026?

Beginning in the 2025 tax year, the SALT deduction is increasing to $40,000 for taxpayers with an AGI of $500,000 or less. It will then increase by 1% each year until 2030, at which point it will revert to $10,000 yearly.

For taxpayers with an AGI over $500,000, the SALT deduction decreases by 30 cents for each dollar of AGI over $500,000.

What taxes and fees are not covered by the SALT deduction?

Taxes and fees not covered by the SALT deduction include:

- Any federal taxes, including income tax, Social Security tax, and Medicare tax

- Inheritance and estate taxes

- Excise taxes

- HOA fees

- Service charges

Only state and local income taxes, sales taxes, and property taxes are deductible via the SALT deduction.

Recent Posts

How to Get the Lowest Mortgage Rate: 7 Strategies

How Mortgage Rates Are Set Before we teach you how to get the lowest mortgage rate, it helps to understand wha...

What Is an Escalation Clause in Real Estate?

A real estate escalation clause is an addendum to a purchase offer that authorizes your bid to increase automa...

Mid-Term Rentals: Guide for Real Estate Investors

Mid-term rentals are furnished properties leased for 30 days to 12 months, targeting traveling professionals, ...