How Tax Policy Changes Could Impact the Housing Market in 2025 and Beyond

KEY TAKEAWAYS

- Homeownership tax benefits drive demand and affordability. Deductions like the mortgage interest deduction and property tax write-offs reduce the cost of buying a home, fueling demand and impacting local housing prices.

- Changes to capital gains exclusions and bonus depreciation reshape investor behavior. Updates to 100% bonus depreciation and proposed capital gains reforms can influence when real estate investors buy, sell, or hold, which directly impacts housing inventory and pricing trends.

- Tax policy changes affect high-tax and low-tax states differently. States like California, New York, and New Jersey are hit hardest by SALT deduction caps, while low-tax states like Texas and Florida may see continued migration and stronger housing demand.

- Market timing often follows tax legislation. Savvy homebuyers, sellers, and investors frequently accelerate or delay transactions based on anticipated changes to real estate tax policy, creating temporary surges or slowdowns in local markets.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformTax policy and housing are deeply connected in ways that directly impact your wallet and home-buying decisions. When lawmakers adjust tax rules, the ripple effects flow straight through to real estate prices, buyer behavior, and market dynamics. Understanding these connections can help you make smarter decisions whether you’re buying your first home, selling property, or investing in real estate.

Keep reading to learn about the relationship between tax policy and housing.

How Tax Policy Directly Impacts the Housing Market

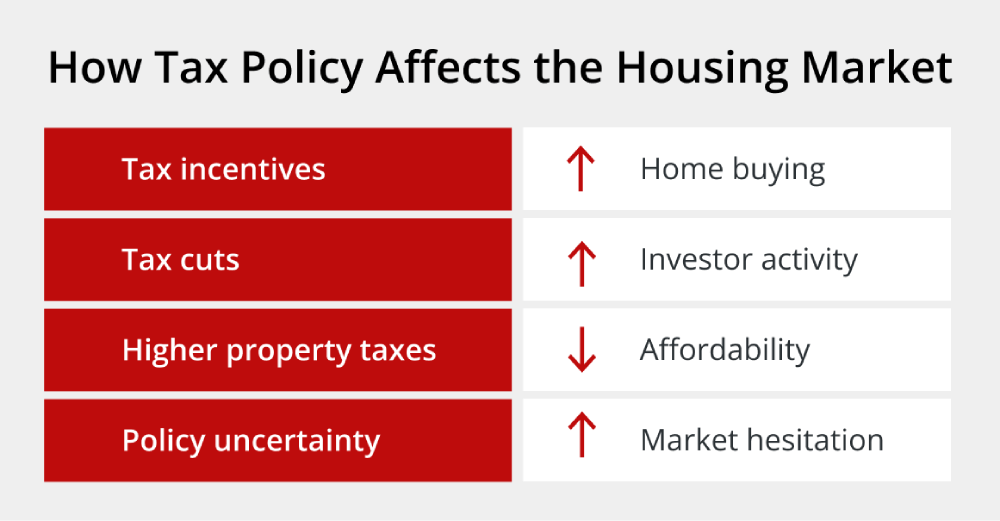

Tax incentives guide housing demand and affordability across the country. When the government offers tax breaks for homeownership, more people can afford to buy, which typically pushes prices higher. Remove those incentives, and demand often softens, sometimes leading to price corrections.

The mortgage interest deduction is a perfect example of this dynamic in action. For decades, this tax benefit made homeownership more attractive by allowing families to deduct mortgage interest payments from their taxable income. This policy subsidized homeownership, encouraging millions of Americans to buy rather than rent.

Similarly, the SALT (state and local tax) deduction cap, originally limited to $10,000 under the 2017 Tax Cuts and Jobs Act, has been expanded to $40,000 under the One Big Beautiful Bill Act (2025). This change is especially significant in high-tax states like California and New York, where many homeowners previously lost out on deductions for property taxes and state income taxes, resulting in reduced purchasing power and shifting migration patterns. The new, higher cap could restore substantial tax savings for upper-middle-class and affluent households, potentially improving home affordability and slowing outbound migration from these states.

Real estate tax law changes don’t just affect individual homeowners. Investors closely watch tax policy shifts because they directly impact investment returns. When depreciation rules become more generous or 1031 exchanges offer better deferral opportunities, investment capital flows into real estate markets. This increased investor activity can drive up property values and reduce inventory for regular home buyers, creating competitive pressure in rental markets as well.

Key Tax Provisions That Affect Real Estate

Major tax provisions shape how Americans interact with real estate markets, each creating different incentives and behaviors that collectively influence property values and the market as a whole. These include:

Mortgage Interest Deduction (Still in Effect in 2025)

The mortgage interest deduction remains one of the most valuable tax incentives for homeowners, and it was preserved under the One Big Beautiful Bill Act (OBBBA) of 2025.

Homeowners can continue to deduct interest paid on mortgage debt up to $750,000 for homes purchased after December 15, 2017. Those with older mortgages grandfathered in under the pre-2017 rules can still deduct interest on up to $1 million of mortgage debt.

This deduction reduces the real cost of borrowing for home purchases, making homeownership more affordable for millions of families. The benefit provides greater value to higher-income taxpayers in higher tax brackets, which sometimes creates criticism about whether it primarily helps those who need assistance the least.

However, for many middle-class families, this deduction can mean the difference between affording a home purchase or remaining renters.

With the passage of the OBBBA, the mortgage interest deduction remains untouched, providing stable, ongoing support for homeownership even as other parts of the tax code shift in 2025.

Property Tax Deductions (SALT Cap Raised to $40,000 in 2025)

The deductibility of property taxes through the SALT (State and Local Tax) deduction has been a major point of contention since the 2017 Tax Cuts and Jobs Act capped these deductions at $10,000 per year. That limit disproportionately impacted homeowners in high-tax states like California, New York, and New Jersey, where property taxes often exceed that cap.

As a result, many homeowners:

-

Faced higher effective federal tax burdens

-

Reconsidered homeownership in high-cost regions

-

Contributed to outbound migration to lower-tax states

Now, under the One Big Beautiful Bill Act (OBBBA), the SALT deduction cap has been raised to $40,000, restoring a substantial tax benefit to millions of homeowners in high-cost areas. By making homeownership more financially viable again, the higher SALT cap may boost affordability, stabilize property values, and slow migration out of high-tax states.

This update could shift real estate demand back toward expensive coastal markets, while also making luxury homes more attractive to high-income earners now eligible for larger deductions.

Capital Gains Exclusion on Home Sales (Proposals to Expand in 2025)

The capital gains exclusion remains one of the most powerful tax benefits for homeowners. Under current law, homeowners can exclude up to $250,000 in capital gains for single filers or $500,000 for married couples when selling a primary residence, provided they’ve lived in the home for at least two of the past five years.

This exclusion:

-

Encourages long-term homeownership

-

Reduces tax liability from equity appreciation

-

Helps homeowners reinvest into new properties or downsize more easily

Many sellers strategically time their home sales to maximize this exclusion, often holding onto appreciated properties until they qualify. Compared to renting, this tax break is a major wealth-building advantage tied to homeownership.

Proposals to Expand the Exclusion in 2025

Two high-profile bills in Congress aim to dramatically expand or eliminate the capital gains tax on home sales:

1. More Homes on the Market Act

Introduced by Reps. Jimmy Panetta (D-CA) and Mike Kelly (R-PA)

-

-

-

Would double the current exclusion limits to $500,000 for single filers and $1 million for married couples filing jointly

-

Would also index the exclusion for inflation, preventing erosion over time

-

Backed by the National Association of REALTORS®, who argue the current caps, set in 1997, no longer reflect today’s home values

-

-

“Raising the exclusion would bring more homes to market by freeing up equity-strapped sellers.” – NAR

2. No Tax on Home Sales Act

Introduced by Rep. Marjorie Taylor Greene (R-GA)

-

-

-

Would eliminate federal capital gains tax on the sale of a primary residence entirely

-

Gaining attention with support from former President Donald Trump, who has said he’s considering endorsing the measure as part of broader housing affordability reform.

-

-

What This Means for Homeowners

If either bill passes:

-

-

-

Long-time homeowners could see larger tax-free profits

-

Retirees and downsizers may be more willing to sell, unlocking inventory

-

The housing market could see an uptick in mobility and supply, especially in equity-rich areas

-

-

For now, the $250K / $500K exclusion remains in place under OBBBA with no changes, but policy shifts may be on the horizon.

Depreciation and Tax Deferral (1031 Exchanges)

Investment property owners benefit from powerful tax tools, depreciation deductions, and 1031 like-kind exchanges, making real estate one of the most attractive asset classes.

Depreciation allows investors to reduce taxable income while their properties appreciate in value, helping boost cash flow and long-term returns. Meanwhile, 1031 exchanges let investors defer capital gains taxes by reinvesting proceeds from a property sale into another qualifying property, allowing them to grow portfolios tax efficiently.

Good news for investors: Both of these key provisions, bonus depreciation and 1031 exchanges, remained fully intact following the passage of the One Big Beautiful Bill Act (2025). With 100% bonus depreciation officially restored for eligible real estate assets, investors can continue to accelerate deductions and defer taxes, amplifying the financial benefits of owning and scaling investment properties.

These tax strategies help explain why both institutional and individual investors continue allocating significant capital to residential and commercial real estate markets.

How Tax Policy Changes Could Influence Market Behavior

Tax policy modifications create ripple effects that touch every segment of the housing market, from first-time home buyers stretching to afford their initial purchase to sophisticated investors managing large portfolios.

-

-

- Home buyers: Changes in deductions and credits directly impact what families can afford to spend on housing. If mortgage interest deductions become less generous or property tax deductions shrink again in the future, the effective cost of homeownership rises, potentially pricing out some buyers or forcing them to consider less expensive properties or different locations.

- Sellers: Property owners often adjust their timing based on tax considerations, creating temporary supply fluctuations that affect market dynamics. If capital gains rules become less favorable, many accelerate sales to lock in current tax treatment, while announcements of more generous future rules can cause sellers to delay transactions.

- Investors: Real estate investment strategies, rental pricing, and portfolio choices all shift based on tax policy changes. Modifications to depreciation schedules, capital gains rates, or exchange rules can dramatically alter investment returns, with favorable changes increasing competition for properties and less favorable treatment potentially creating opportunities for regular home buyers.

-

You’ll also see market segment shifts. For example, luxury markets often show more sensitivity to tax changes since high-income buyers face higher marginal tax rates and benefit more from deductions. Meanwhile, affordable housing markets may experience increased demand if tax policy changes push some buyers toward less expensive properties, creating ripple effects throughout different price ranges.

How Trump’s Tax Policy Could Impact the Housing Market (2025 Update)

The Trump administration’s 2025 tax policy agenda builds on the foundation of the 2017 Tax Cuts and Jobs Act (TCJA), while proposing bold new reforms that could reshape housing affordability, real estate investing, and regional market dynamics.

Extending Key Housing Tax Benefits:

Proposals include permanently maintaining the mortgage interest deduction and addressing the state and local tax (SALT) cap, which has hit residents of high-tax states like California, New York, and New Jersey the hardest. With the SALT deduction cap now increased to $40,000 under the One Big Beautiful Bill Act (OBBBA), this shift may provide meaningful relief to homeowners in those regions and boost local housing demand.

Investor-Friendly Provisions:

Trump’s reinstatement of 100% bonus depreciation, now in effect for qualified property placed in service on or after January 20, 2025, is expected to supercharge investor activity, particularly in rental-heavy markets. Combined with the preservation of 1031 exchanges, this creates a powerful incentive for both small and institutional investors to deploy capital into residential and commercial real estate.

Capital Gains Tax Reforms Under Debate:

With multiple bills in Congress proposing either the doubling or elimination of the capital gains tax on primary residence sales (such as the More Homes on the Market Act and No Tax on Home Sales Act), the market could see increased inventory and more mobility among longtime homeowners.

Macroeconomic Ripple Effects:

While tax cuts and pro-investment policies typically spur economic growth, they may also lead to higher mortgage rates, as inflationary pressure builds and the Fed responds. This can create mixed effects: investors benefit from tax relief, but first-time buyers may face tighter affordability conditions due to rising mortgage rates.

Geographic Divergence in Impact:

The regional impact of Trump’s tax policies remains substantial. High-tax states may benefit from the SALT cap expansion, while low-tax, fast-growing states like Texas and Florida are likely to continue attracting both residents and capital due to their more favorable tax environments.

The housing market under Trump reflects these policy considerations alongside broader economic factors.

What Home Buyers and Sellers Should Know

Understanding how tax changes might affect your real estate decisions can help you time purchases, sales, and refinancing more strategically.

-

-

- Consult tax professionals: Work with tax advisors who understand current law and proposed changes to model different scenarios and optimize your timing for maximum benefits.

- Consider mortgage implications: Tax changes can affect your overall affordability and monthly payment calculations, so factor these into your financing decisions, especially when considering when to refinance.

- Focus on the fundamentals first: While tax benefits are valuable, they shouldn’t override important considerations like location, property condition, and your personal financial circumstances.

- Time transactions strategically: If tax law changes are coming, consider whether accelerating or delaying your purchase or sale could provide better tax treatment.

- Stay informed about regional impacts: Tax policy changes often affect different markets differently, particularly in high-tax versus low-tax states.

-

As a mortgage lender, Griffin Funding understands how tax policy changes affect financing decisions and can help you navigate these interactions. Our team stays current on regulatory changes and can explain how different scenarios might impact your specific situation.

Consider using the Griffin Gold app to track market conditions and stay informed about policy changes that could affect your real estate decisions.

Final Notes

Tax policy and housing are interconnected in ways that create both opportunities and challenges for property owners, buyers, and investors. Staying informed about real estate tax law developments helps you make better decisions whether you’re entering the market, optimizing your current holdings, or planning future transactions.

Griffin Funding provides the expertise you need when getting a mortgage. Our team combines deep knowledge of mortgage markets with an understanding of tax policy implications to help you achieve your homeownership goals.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What is the new SALT deduction cap in 2025?

Is 100% bonus depreciation still available in 2025?

How does tax policy affect the housing market?

Will I still get the mortgage interest deduction in 2025?

What are the new capital gains tax proposals for homeowners in 2025?

Do tax changes affect real estate investors differently than homeowners?

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...