FHA Appraisal Checklist & Guidelines

KEY TAKEAWAYS

- Unlike conventional appraisals that focus mainly on market value, FHA appraisals ensure homes meet strict safety and livability standards.

- Only certified HUD-approved appraisers can perform FHA appraisals, and they must check every item on HUD’s minimum property standards list.

- Any problems identified during the FHA appraisal typically need to be repaired and re-inspected before your loan can be approved.

- Both buyers and sellers benefit from understanding FHA appraisal standards and addressing potential issues early in the process.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformGetting ready for an FHA appraisal? Knowing what to expect after having your offer on a home accepted will make the process smoother. This FHA appraisal checklist walks you through everything appraisers look for, common red flags to avoid, and how to prepare your home for success. Understanding FHA appraisal requirements can help you navigate one of the most important steps in the mortgage process.

KEY TAKEAWAYS

- Unlike conventional appraisals that focus mainly on market value, FHA appraisals ensure homes meet strict safety and livability standards.

- Only certified HUD-approved appraisers can perform FHA appraisals, and they must check every item on HUD’s minimum property standards list.

- Any problems identified during the FHA appraisal typically need to be repaired and re-inspected before your loan can be approved.

- Both buyers and sellers benefit from understanding FHA appraisal standards and addressing potential issues early in the process.

What Is an FHA Appraisal?

An FHA appraisal is a required evaluation for anyone seeking an FHA loan that determines both the home’s market value and whether it meets government safety standards. This assessment protects both the borrower and the Federal Housing Administration by ensuring the property serves as adequate collateral.

Unlike conventional appraisals that focus mainly on market value, FHA appraisals examine the property’s condition, safety features, and structural integrity according to HUD’s minimum property standards. Only HUD-approved appraisers can perform these evaluations, and they must follow specific FHA appraisal guidelines during their inspection.

These same standards apply whether you’re purchasing a home or refinancing your existing loan, though some loan programs, like an FHA streamline refinance, may not require you to have another professional appraisal.

FHA Appraisal Requirements: What Lenders Look for

HUD’s minimum property standards are the foundation of every FHA home appraisal. These requirements focus on three core principles: The home must be safe for occupants, secure from intrusion, and structurally sound.

Safety is a major priority in FHA appraisal standards. Appraisers check for hazards, including lead-based paint, exposed electrical wiring, and missing safety features like handrails. The property must also have proper ventilation and adequate lighting in all living areas to ensure habitability.

Security requirements ensure proper locks and functioning windows, while structural soundness protects the FHA’s investment through stable foundations and roofs with at least two years of remaining life. The electrical system needs proper grounding and adequate capacity, while plumbing must provide hot and cold water with proper drainage.

When issues are identified, they typically must be corrected before loan approval.

FHA Appraisal Guidelines for Different Property Features

Understanding FHA appraisal guidelines helps both buyers and sellers prepare for what appraisers will examine during their visit. Let’s take a look at what these are:

- Roof, Foundation, and Structure: The roof, foundation, and structure must be in good repair with no active leaks or major structural issues. Foundation problems like significant cracks, settling, or water intrusion can immediately disqualify a property. The appraiser also checks for structural issues like sagging floors or doors that don’t close properly due to settling.

- Systems: All major systems need to function properly, including electrical systems with proper grounding, plumbing with adequate water pressure, and heating systems capable of maintaining comfortable temperatures. Air conditioning systems, if present, should also work correctly and be properly maintained.

- Access and Egress: Access and egress requirements ensure safe entry and exit. This includes properly functioning exterior doors with working locks, windows that open for emergency egress from bedrooms, and safe stairways with appropriate handrails. Walkways must be in good condition with adequate lighting for safe navigation around the property.

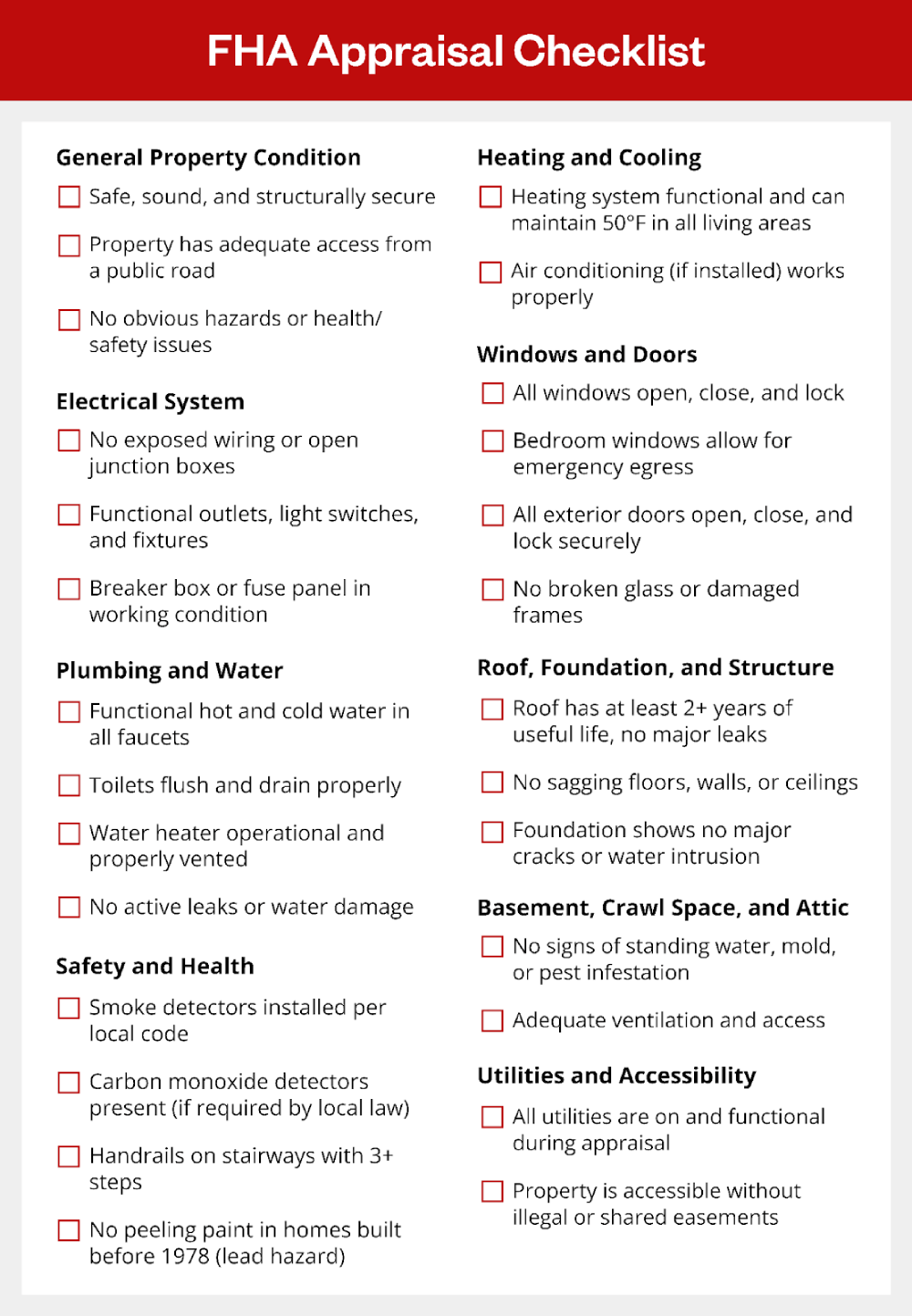

The Complete FHA Appraisal Checklist

Here’s a comprehensive checklist covering the main items FHA appraisers examine during their inspection:

- Utilities working and accessibility: All utilities must be connected and functioning, including electricity, water, sewer or septic systems, and heating. The property should have adequate access from public roads and proper addressing.

- Electrical safety: No exposed wiring, properly grounded outlets, functional circuit breakers or fuse boxes, and adequate electrical capacity are necessary.

- Windows and doors: All windows should open and close properly with intact glass and screens. Exterior doors need working locks and proper weatherstripping to ensure security and energy efficiency.

- Roof with at least 2+ years of life: The roof must have at least two years of remaining life with no active leaks, missing or damaged shingles, or structural issues with gutters and downspouts that could cause water damage.

- No lead-based paint hazards (especially in homes built before 1978): Homes built before 1978 cannot have peeling, chipping, or chalking paint. Any lead hazards must be properly remediated by certified professionals before loan approval.

- Functioning water heater: The unit must work properly, be properly vented if gas-powered, and have appropriate temperature and pressure relief valves installed.

- Smoke and carbon monoxide detectors: Working detectors must be installed according to local building codes, typically on each level of the home and in sleeping areas for maximum safety.

- Basement and crawl space conditions: These areas must be free from standing water, excessive moisture, mold growth, and pest infestations that could affect the home’s habitability or structural integrity.

FHA Appraisal Red Flags

Several common issues can delay or derail FHA loan approval. Recognizing these red flags early can help buyers and sellers address problems before they become deal-breakers.

- Peeling or chipping paint (pre-1978 homes): Any deteriorating paint must be tested for lead content and properly remediated if positive, which can take weeks and cost thousands of dollars.

- Cracked or crumbling foundation: Structural issues require professional evaluation and often extensive repairs that can affect both home value and safety standards.

- Mold, pest infestations, or standing water in crawlspaces: Environmental hazards must be completely resolved before loan approval. They often indicate larger moisture or structural problems.

- Missing handrails or broken stairs: Safety features like proper railings and secure stairways are mandatory for FHA approval and must be installed to code.

- Non-functional heating system or exposed electrical wiring: Major system failures and safety hazards require immediate professional attention before the property can pass inspection.

Most red flags require correction before closing. The appraiser must re-inspect after repairs, adding time to the process. Sellers often benefit from completing obvious repairs before listing, while buyers should consider professional inspections early in the process to avoid surprises.

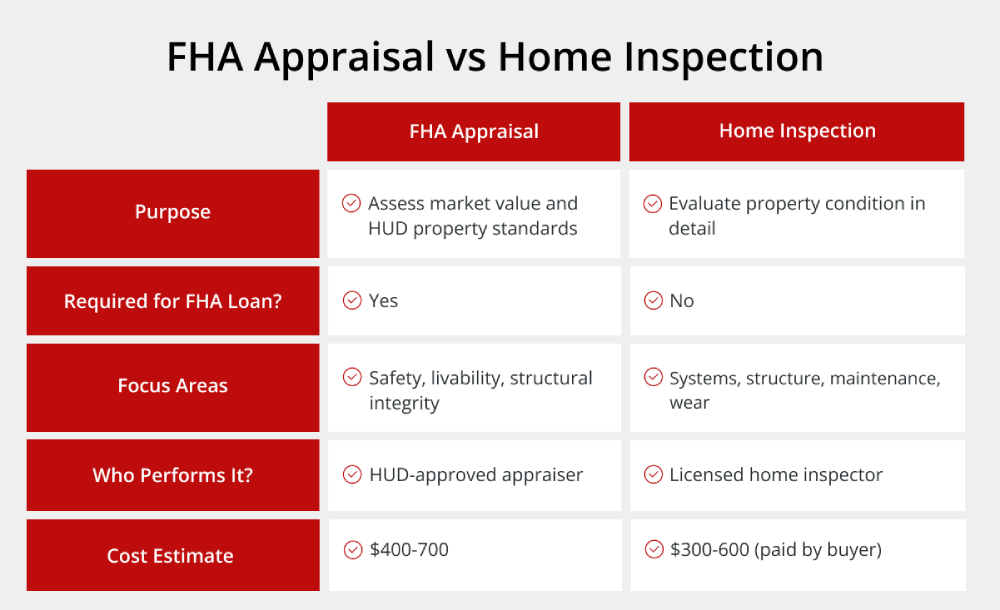

FHA Appraisal vs Home Inspection: What’s the Difference?

Many people confuse FHA appraisals with home inspections, but these serve different purposes in the home buying process. An FHA appraisal focuses specifically on safety and structural soundness as defined by HUD’s standards, checking for issues that could affect the government’s investment or pose immediate safety risks.

Home inspections provide more comprehensive evaluations, examining systems in greater detail and identifying potential problems that might not violate FHA standards but could cost homeowners money later. Professional home inspectors look at appliance conditions, minor electrical issues, plumbing efficiency, and cosmetic problems that don’t affect basic safety.

The timing and requirements also differ significantly. FHA appraisals are mandatory for all government-backed loans and must be completed by HUD-approved appraisers. Home inspections are optional but highly recommended, especially for first-time buyers who need to understand their investment fully.

For existing homeowners considering an FHA cash-out refinance, both evaluations help ensure the property maintains its value and condition. Smart buyers often schedule both evaluations to get the most complete picture of the property’s condition.

What Happens If a Home Doesn’t Meet FHA Appraisal Standards?

When FHA appraisals reveal issues that don’t meet HUD’s standards, several outcomes are possible depending on the severity of the problems and the willingness of parties to address them.

Required repairs are the most common result. The appraiser notes specific problems that must be corrected by licensed professionals, and the property must be re-inspected before loan approval. This process can add several weeks to the closing timeline and requires coordination between all parties. For buyers interested in properties needing significant work, FHA 203(k) loans allow financing both the purchase and renovation costs in one loan.

Parties can negotiate who pays for necessary repairs. Sellers might complete the work, provide buyer credits, or reduce the purchase price to make up for needed improvements. Buyers might choose to pay for repairs themselves if they’re getting a good deal or if the seller won’t address issues. Sometimes problems are too extensive or expensive, leading buyers to walk away entirely using appraisal contingencies in their contracts.

Each repair cycle and re-inspection adds time to the process, potentially requiring rate-lock extensions or alternative financing. Working with experienced lenders who understand different loan types can help minimize delays and ensure smooth communication throughout the process.

Preparing for an FHA Appraisal: Tips for Buyers and Sellers

A successful FHA appraisal often comes down to preparation. Both buyers and sellers can work to ensure the process goes smoothly and avoid issues that can delay closing.

Tips for Sellers

- Address safety hazards like broken handrails or exposed wiring before listing.

- Fix plumbing and electrical issues to ensure systems are in working order.

- Clean up the exterior by trimming overgrown vegetation, repairing siding, and managing drainage.

- Inspect for water damage in basements, crawl spaces, and around windows.

- Schedule a pre-listing inspection to uncover and address potential issues early.

- Hire professionals familiar with FHA requirements to catch items homeowners may overlook.

Tips for Buyers

- Learn what FHA appraisers look for so you can spot potential red flags during property tours.

- Work with an agent experienced in FHA loans who’s familiar with the pros and cons of this financing option and can guide you through the process.

- Consider repair costs in your offer if issues are discovered during the appraisal.

- Negotiate seller concessions or price adjustments if repairs are needed.

- Get pre-approved by a reputable lender to strengthen your offer and show you’re a serious buyer.

- Use tools like the Griffin Gold app to stay on top of loan requirements and track progress.

Navigate the FHA Appraisal Process With Expert Help

Understanding FHA appraisal requirements requires expertise and experience that many buyers don’t possess on their own.

Griffin Funding’s mortgage professionals bring years of experience helping clients through the FHA appraisal process. Our loan officers prepare clients for what to expect during appraisals and provide guidance on addressing any issues that come up along the way.

Whether you’re comparing financing options like FHA loans vs USDA loans or need expert guidance through appraisal requirements, Griffin Funding has the experience and knowledge to help your transaction close smoothly and on time. Reach out to learn more or get started online today.

Find the best loan for you. Reach out today!

Get StartedRecent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...