DSCR vs. Conventional vs. Bank Statement Loans: Investor Mortgage Comparison (2025)

KEY TAKEAWAYS

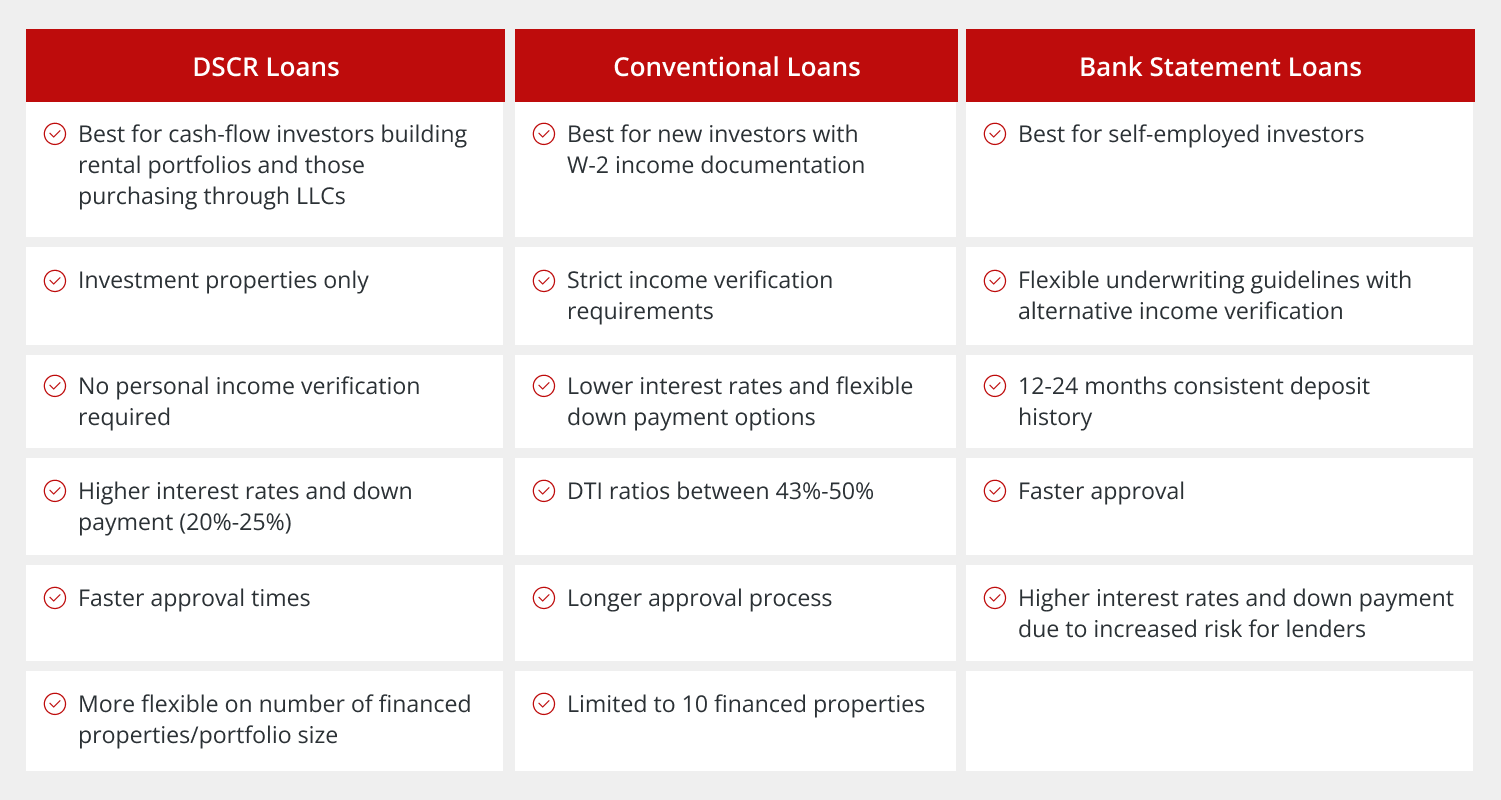

- DSCR loans qualify borrowers based on property cash flow rather than personal income, making them ideal for experienced investors

- Conventional loans generally offer the lowest rates but require traditional income verification and debt-to-income ratio requirements

- Bank statement loans provide flexibility for self-employed investors who cannot provide standard income documentation

- Your investor profile and financial situation determine which loan type offers the best fit for your investment goals

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformReal estate investors have multiple financing options, each designed for different situations and investor profiles. Compare DSCR loans, conventional loans, and bank statement loans to help you choose the right financing for your investment strategy and current financial situation.

DSCR Loans

A DSCR loan is a powerful financing tool that evaluates investment properties based on their income potential rather than your personal financial profile.

What Is a DSCR Loan?

DSCR stands for Debt Service Coverage Ratio, which measures a property’s ability to cover its mortgage payments through rental income. This financing approach shifts the focus from borrower qualifications to property performance. Key features include:

- Qualification based on property cash flow, not personal income

- No employment verification or tax return requirements (lenders may still verify credit, property documentation, and reserve requirements)

- Available for single-family homes, condos, and multi-unit properties

- Loan amounts typically range from $100,000 to $5 million

- Terms available usually range from 15 to 40 years

- Interest-only payment options available on select programs

Who Are DSCR Loans for?

DSCR loans work best for specific investor types who prioritize cash flow and portfolio expansion:

- Experienced real estate investors building rental portfolios

- Self-employed borrowers with complex income structures or seasonal variations

- Investors purchasing properties through LLCs or trusts for asset protection

- Those seeking to expand quickly without personal income limitations or debt-to-income constraints

- Borrowers who want to separate investment properties from personal finances

- Investors focused on markets with strong rental demand and consistent cash flow potential

Pros & Cons of DSCR Loans

Advantages of DSCR loans include:

- No personal income verification required

- Faster approval process

- Can close in entity names (LLC, trust)

- More flexible on portfolio size and number of financed properties than conventional programs

- Ideal for cash flow-focused investment strategies

Disadvantages of DSCR loans include:

- May have higher interest rates than conventional loans

- Larger down payment requirements (typically 20-25%)

- Property must generate sufficient rental income

- Limited to investment properties only

Conventional Loans

A conventional loan follows traditional lending guidelines and offers the most affordable financing option for qualified borrowers.

What Is a Conventional Loan?

Conventional loans adhere to guidelines set by Fannie Mae and Freddie Mac, providing standardized lending criteria and the most widely available financing option. These loans represent the traditional mortgage market and offer predictable terms. Essential characteristics include:

- Fixed or adjustable interest rate options

- Loan terms from 15 to 30 years

- Down payment options starting at 3% (primary residence) or 20% (investment properties)

- Private mortgage insurance (PMI) for loans with less than 20% down

- Maximum loan limits vary by county and are adjusted annually

- Strict adherence to qualified mortgage (QM) rules and regulations

Who Are Conventional Loans for?

This DSCR vs. conventional loan comparison shows conventional loans suit these borrower profiles:

- First-time real estate investors with W-2 employment and traditional income sources

- Borrowers with strong credit scores (typically 620+ for investment properties)

- Those who can provide traditional income documentation, including tax returns

- Investors seeking the lowest possible interest rates and monthly payments

- Borrowers comfortable with debt-to-income ratio requirements and personal liability

- Those purchasing owner-occupied properties or traditional rental investments

Pros & Cons of Conventional Loans

Some advantages of conventional loans include:

- Low interest rates available

- Flexible down payment options for various borrower situations

- Well-established lending process with predictable timelines

- Available for primary residences and investment properties

- No prepayment penalties allow for early payoff strategies

- Extensive lender network provides competitive pricing

Disadvantages of conventional loans include:

- Strict income and employment verification requirements can exclude many investors

- Debt-to-income ratio limitations (typically 43-50%) can restrict borrowing capacity

- Limited to 10 financed properties per borrower under conventional guidelines

- Longer approval process with extensive documentation requirements

- Personal liability and recourse lending structure

Bank Statement Loans

A bank statement loan provides an alternative income verification method for borrowers who cannot provide traditional employment documentation.

What Is a Bank Statement Loan?

Bank statement loans use deposit history to verify income rather than traditional pay stubs or tax returns, making them ideal for borrowers with non-traditional income sources. These programs recognize that many successful investors and business owners have income that doesn’t fit conventional lending boxes. Program features include:

- Income calculated from 12 to 24 months of personal or business bank statements

- Available for self-employed borrowers, business owners, and investors

- Flexible underwriting guidelines that consider individual circumstances

- Interest rates are typically higher than conventional loans, but still competitive within the non-QM market

- Down payments usually start at 10% to 20% depending on program specifics

- Option to use multiple bank accounts to demonstrate income consistency

Who Are Bank Statement Loans for?

This bank statement loan vs. conventional loan analysis reveals these loans work well for:

- Self-employed real estate investors with variable income patterns

- Business owners with fluctuating income

- Contractors, freelancers, and commissioned sales professionals

- Borrowers who write off significant business expenses

- Those with strong assets but complex income documentation

- Investors who need faster approval than traditional stated income programs offer

Pros & Cons of Bank Statement Loans

Some pros of bank statement loans include:

- Alternative income verification method for non-traditional borrowers

- Faster approval than traditional stated income programs

- Suitable for self-employed borrowers and business owners

- Flexible underwriting approach considers individual circumstances

- Available for various property types, including investment properties

- Can accommodate seasonal or project-based income patterns

Cons of bank statement loans include:

- Higher interest rates than conventional loans due to increased risk

- Requires a consistent deposit history over a 12 to 24-month period

- Limited lender options compared to conventional programs

- May require larger down payments depending on risk factors

- Bank statements must show qualifying income patterns and stability

Which Loan Is Best for You in 2025?

Selecting the right financing depends on your investor profile and specific circumstances. This investor mortgage comparison reveals clear patterns that can guide your decision-making process:

- New investors with W-2 employment should consider conventional loans first. These offer the lowest mortgage rates and most affordable monthly payments. The traditional income verification process works well for employed borrowers with steady paychecks and predictable income streams.

- Self-employed investors benefit most from bank statement loans. These programs accommodate complex income structures and business write-offs that make conventional qualification challenging. The alternative documentation process recognizes the reality of entrepreneurial income and seasonal business variations.

- Cash flow-focused investors building rental portfolios find DSCR loans most advantageous. The ability to qualify based on property performance rather than personal income allows for faster portfolio expansion. This DSCR loan vs. conventional mortgage comparison shows DSCR programs excel for experienced investors.

- Investors purchasing through LLCs or trusts need DSCR financing since conventional loans require personal ownership. The entity-friendly structure supports advanced investment strategies and asset protection planning.

Consider your long-term investment goals, current financial situation, and growth timeline when making this decision. Many successful investors use different loan types for different properties as their portfolios evolve.

Explore Your Mortgage Options Today

Griffin Funding specializes in investment property loans tailored to your unique situation. Our experienced loan officers understand the nuances of real estate investment financing and can guide you toward the optimal solution.

Start your investment journey with confidence using our Griffin Gold app, which provides personalized loan recommendations and credit improvement strategies. Our technology-driven approach, combined with expert guidance, ensures you get the financing you need to achieve your investment goals.

Contact Griffin Funding today to explore your options and take the next step in building your real estate portfolio. Or, if you’re ready to begin your home buying journey, get started online right away.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What are current mortgage rates for investors?

Investment property mortgage rates vary by loan type, credit score, and market conditions. Conventional loans typically offer the lowest rates, followed by bank statement loans, then DSCR loans.

Rates change daily based on market factors, so checking current pricing is essential. Griffin Funding provides real-time rate quotes to help you make informed decisions about timing and loan selection.

Do I have to put 20% down on an investment property?

Down payment requirements vary by loan program. Conventional investment property loans typically require 20% to 25% down, while DSCR loans often need 20% to 30%. Bank statement loans may accept 10% to 20% down, depending on the specific program and borrower qualifications. Some portfolio lenders offer alternative down payment structures, so exploring multiple options can reveal more flexible terms for your situation.

Can I get a DSCR loan if I’ve never invested in real estate before?

Yes, DSCR loans are available to first-time real estate investors, though lenders prefer borrowers with some investment experience or strong financial backgrounds. The key qualification factor is the property's ability to generate sufficient rental income to cover mortgage payments.

New investors should research market rents thoroughly and consider properties with established rental history. Reading about real estate investing for beginners can provide valuable foundational knowledge before applying for any investment property financing.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...