Cash on Cash Return in Real Estate: Definition, Formula, & Examples

KEY TAKEAWAYS

- Cash on cash return measures the annual cash flow you receive compared to the actual cash you invested upfront in a property.

- A cash on cash return of 8-12% is generally considered good, though the ideal percentage varies based on location, property type, and your investment goals.

- You can improve your cash on cash return by increasing rental income or reducing your initial cash investment.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformYour rental property might look great on paper, but how much cash does it actually put in your pocket? Cash on cash return shows you how your annual income stacks up against every dollar you invested upfront.

What Is Cash on Cash Return?

Cash on cash return (CoC) is a metric that measures the annual income you generate from a rental property relative to the amount of cash you actually invested. It tells you how much money your property puts back into your pocket each year compared to what you paid upfront.

The cash on cash return formula is: Cash on Cash Return = Annual Cash Income ÷ Cash Invested. This simple calculation highlights the profitability of the actual dollars you put into a deal.

Cash on cash return differs from other metrics. For example, ROI considers your total return over time. The cap rate on rental property focuses on the property’s net operating income relative to its purchase price.

Real estate investors use CoC to compare different investment opportunities, especially when evaluating properties with different down payment requirements or financing structures. If you’re deciding between two properties with similar prices but different financing options, CoC will help you determine which deal generates immediate returns on your actual cash investment.

Cash on Cash Return Formula

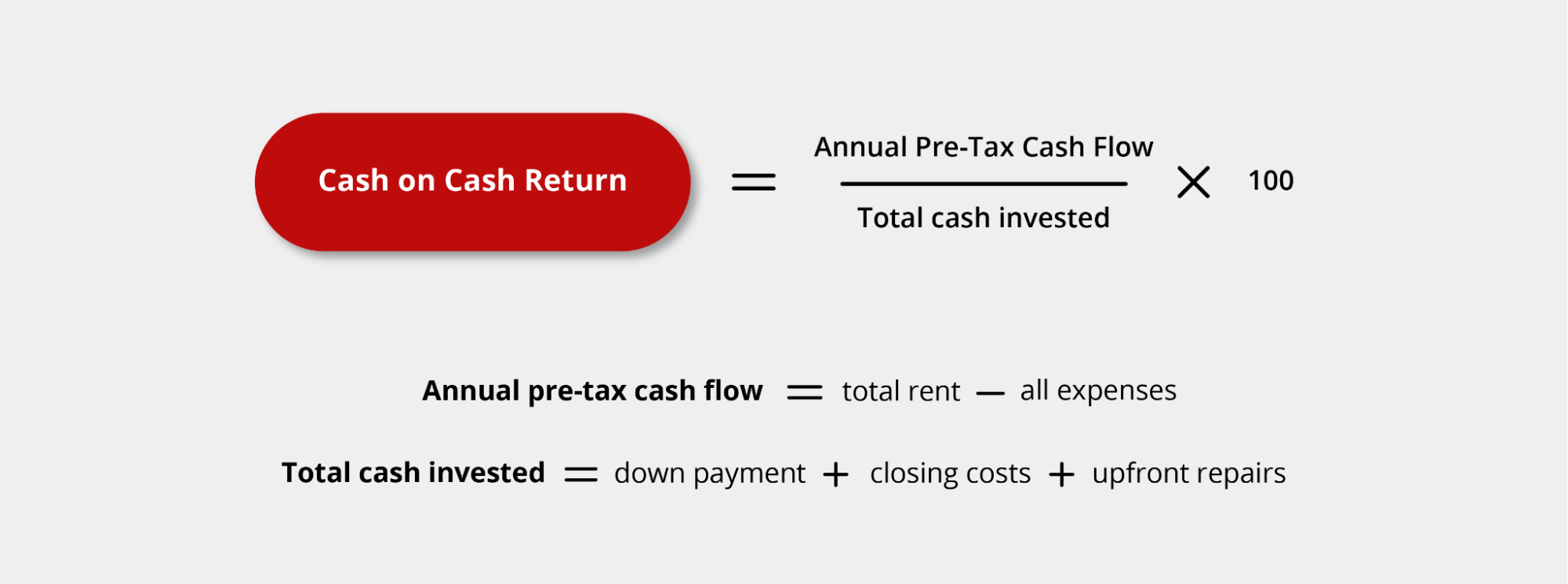

The cash on cash return formula real estate investors rely on is:

Cash on Cash Return = (Annual Pre-Tax Cash Flow ÷ Total Cash Invested) × 100

Now, let’s break down the terms:

- Annual pre-tax cash flow: This is your net cash income after you pay all your expenses but before you pay taxes. To calculate, take your total rental income for the year and subtract operating expenses.

- Total cash invested: Includes every dollar that comes out of your pocket at the start. This means your down payment, closing costs, and any upfront repairs.

It’s important to understand that “total purchase price” and “cash invested” are not the same thing. If you buy a $300,000 property with a 20% down payment, your cash invested isn’t $300,000. Your cash invested is the $60,000 down payment plus any additional upfront costs.

Cash on Cash Return Examples

Let’s look at some examples of how to calculate cash on cash return.

Example 1: You purchase a single-family home for $250,000. You put down 20% ($50,000), pay $4,000 in closing costs, and spend $6,000 on repairs before your first tenant moves in. Your total cash invested is $60,000.

The property generates $2,000 per month in rent, giving you $24,000 in annual rental income. Your annual expenses include:

- Mortgage payment: $10,800

- Property taxes: $2,400

- Insurance: $1,200

- Maintenance: $1,800

- Property management: $2,400

- Vacancy allowance: $1,200

Your total annual expenses are $19,800. Your annual pre-tax cash flow is $24,000 – $19,800 = $4,200.

Using the cash on cash return formula: ($4,200 ÷ $60,000) × 100 = 7%

Your cash on cash return is 7%.

Example 2: You’re considering the same property with two different financing options. In Scenario A, you put down 25% ($62,500) plus $4,000 in closing costs, for a total cash investment of $66,500. Your annual pre-tax cash flow is $5,000.

In Scenario B, you put down 20% ($50,000) plus $4,000 in closing costs, for a total cash investment of $54,000. Your annual pre-tax cash flow is $4,200.

Scenario A CoC: ($5,000 ÷ $66,500) × 100 = 7.5%

Scenario B CoC: ($4,200 ÷ $54,000) × 100 = 7.8%

Even though Scenario A generates more annual cash flow, Scenario B has a higher CoC because you invested less cash upfront.

What Is a Good Cash on Cash Return?

Industry benchmarks suggest that a CoC of 8-12% is generally considered good for rental properties. Several factors influence what you should consider an acceptable CoC:

- Location: Properties in high-demand urban areas might deliver lower CoC (5-7%) but offer greater appreciation potential and lower risk. Properties in less-established markets might offer higher returns (10-15%) but come with increased risk and uncertainty.

- Property type: Single-family homes, multi-family properties, and commercial real estate have different typical return ranges. If you’re working to build a real estate portfolio, you’ll likely encounter varying CoC benchmarks across different property types.

- Risk tolerance: Conservative investors might accept a 6% CoC in exchange for a low-maintenance property in a prime location. Aggressive investors might target 12% or higher returns and accept the additional risk that comes with less proven markets.

- Financing terms: Properties purchased with investment property loans that have lower down payments can show higher CoC because you’re investing less cash upfront.

How to Improve Cash on Cash Return

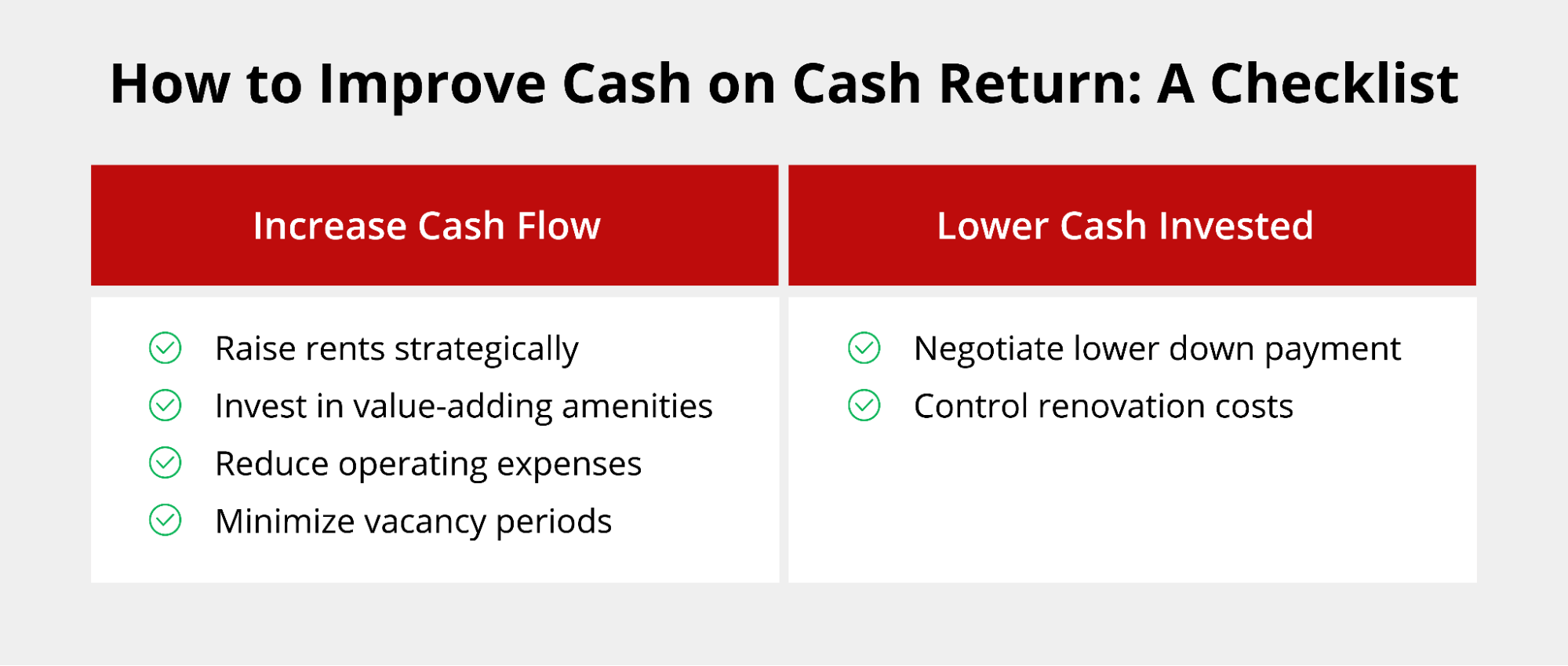

You can boost your CoC by increasing your cash flow or reducing your initial cash investment.

To increase your cash flow:

- Raise rents strategically: Research comparable properties in your area and adjust your rental rates to match market value.

- Add revenue-generating amenities: Consider charging for parking spaces, offering laundry facilities, or allowing pets for an additional monthly rent or deposit.

- Reduce operating expenses: Shop for better insurance rates, implement preventive maintenance, use energy-efficient appliances, and screen tenants carefully.

- Minimize vacancy periods: Market your property before your tenant moves out, price it competitively, and consider lease renewal incentives.

To lower your total cash investment:

- Negotiate a lower down payment: While this increases your mortgage payment, it can significantly boost your CoC by reducing your upfront cash outlay.

- Reduce renovation costs: Focus on repairs that directly impact rent prices rather than over-improving the property.

Cash on Cash Return vs Other Real Estate Metrics

Real estate investors have several metrics to evaluate property performance.

- CoC vs ROI: ROI measures your total return on the property, including cash flow, appreciation, mortgage paydown, and tax benefits. Cash on cash return focuses solely on annual cash flow relative to your initial cash investment. Learn how to calculate ROI on a rental property to complement your CoC analysis.

- CoC vs Cap rate: Cap rate compares a property’s net operating income to its purchase price, without considering your financing structure. Two investors buying the same property at the same price could have identical cap rates but different CoC depending on down payments and loan terms.

- CoC vs Internal Rate of Return: IRR is a calculation that factors in the time value of money and projects your total return over the entire holding period. IRR is better for investors evaluating long-term holds and comparing real estate to other investment types.

To sum it up:

- Use cash on cash return when you’re comparing multiple properties with different financing options.

- Use ROI when assessing overall investment performance including appreciation, calculating total wealth building over time.

- Use cap rate when comparing properties across different markets or evaluating a property’s income-generating potential independent of financing.

It’s important to note that CoC doesn’t account for property appreciation, tax benefits, or equity buildup from mortgage principal payments. A property with a 6% CoC that appreciates 5% annually builds wealth differently than a property with a 10% CoC in a flat market.

Begin or Expand Your Real Estate Investment Portfolio

Griffin Funding specializes in helping investors acquire and grow real estate portfolios. Whether you’re looking for DSCR loans or alternative mortgage loans, our team understands the unique needs of real estate investors.

Plus, you can track your investment performance and manage your finances more effectively with the Griffin Gold app.

Get started with an investment property loan online or contact us today to discuss your financing options.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Does cash on cash return include mortgage payments?

How do taxes affect cash on cash return?

Can cash on cash return be negative?

Why is cash on cash return useful for investors?

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...