Best DSCR Lenders: Griffin Funding vs Angel Oak vs Kiavi vs Visio vs Lima One vs Easy Street

KEY TAKEAWAYS

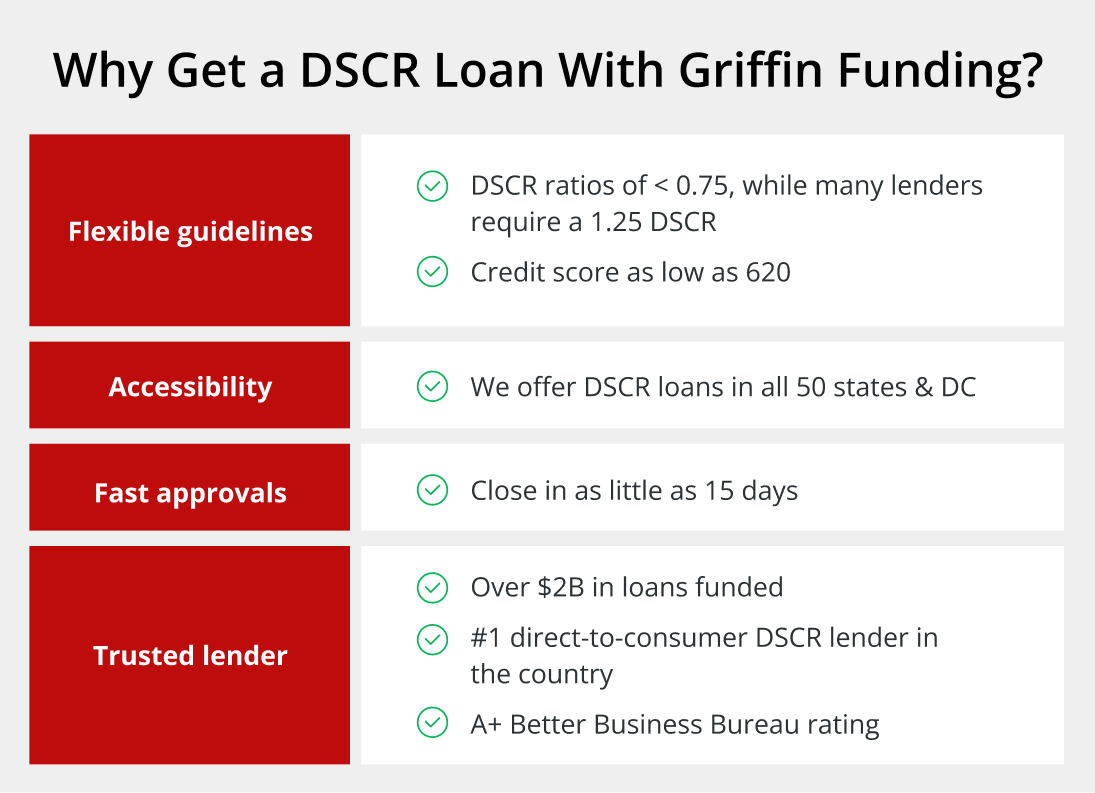

- Griffin Funding leads in speed and flexibility with fast approvals, nationwide coverage, and flexible underwriting guidelines that make us a top choice for most investors.

- DSCR loans focus on property cash flow rather than personal income, making them more accessible for investors with complex financial situations or multiple income streams.

- Minimum DSCR requirements typically range from 1.0 to 1.25, but the best lenders offer flexible underwriting that considers the complete borrower profile beyond just the ratio.

- Rate shopping is essential since each DSCR mortgage company offers different rate structures, and comparing multiple lenders can save thousands over the loan term.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformFinding the best DSCR lender is crucial for your real estate investment success. With rental property financing becoming increasingly competitive, investors need lenders who understand their unique needs and can deliver both competitive rates and reliable service. We’ve analyzed the top DSCR loan lenders in the market to help you make an informed decision for your investment property financing.

What to Look for in a DSCR Lender

Choosing the best DSCR lender for your unique situation means evaluating several critical factors that directly impact your investment returns and borrowing experience. Here’s what to look for in a DSCR loan lender:

- Interest rates and loan terms: Compare both fixed and adjustable rate options across different loan terms. Many lenders offer 30-year fixed rates, but some provide interest-only payment periods that can improve cash flow during the early years of ownership.

- Minimum DSCR requirements: Most lenders require a debt service coverage ratio between 1.0 and 1.25, but some flexible lenders will go to 0.75 or less for strong borrowers. Understanding these thresholds helps you target the right lender for your property’s income potential.

- Loan-to-value ratios: LTV ratios typically range from 70% to 80% for investment properties, but the best mortgage lenders for investors may offer higher ratios for exceptional borrowers or prime properties.

- Prepayment penalties: Some DSCR lenders charge penalties for early payoff, which can limit your exit strategies. Look for lenders with minimal or no prepayment restrictions.

- States serviced: Not all lenders operate nationwide, so verify coverage in your target investment markets before starting the application process.

- Customer support and loan speed: Investment opportunities often require quick action, making responsive customer service and fast closing times crucial factors in lender selection.

- Portfolio loan options vs traditional underwriting: Portfolio lenders keep loans in-house rather than selling them, often allowing more flexible underwriting standards compared to traditional mortgage companies.

Griffin Funding Overview

Griffin Funding has established itself as a leading DSCR lender by combining competitive rates with investor-friendly policies. Our approach focuses on making DSCR loans accessible to a range of real estate investors.

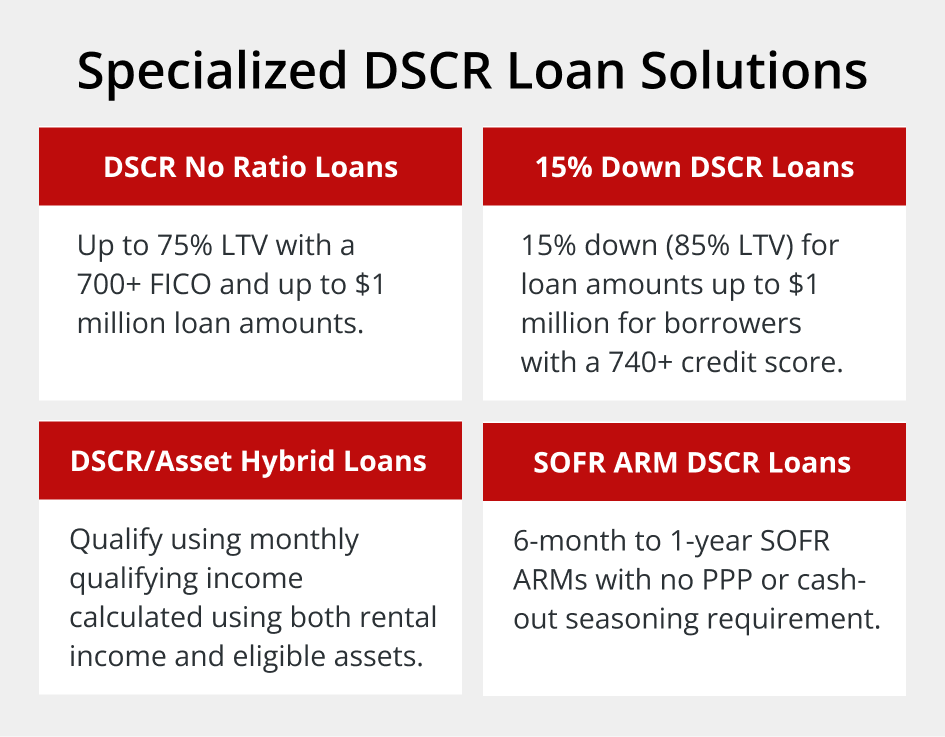

We offer both 30-year fixed and interest-only payment options with loan amounts up to $20,000,000. Our non-QM loans include specialized products like DSCR home equity loan options and DSCR cash-out refinance products.

Griffin requires a minimum 620 credit score and accepts DSCR ratios that are less than 0.75, making our loans accessible to newer investors and properties with modest cash flow.

Unlike many competitors, Griffin Funding operates in all 50 states, providing consistent service regardless of your investment location.

Pros:

Pros:

- Fast approvals: Most applications receive approval decisions within 24-48 hours.

- Fast fundings: Fund in as little as 6 calendar days if you are organized.

- Flexible guidelines: Griffin’s underwriting team considers the complete investor profile rather than relying solely on rigid qualification boxes.

- 30-year fixed, ARM, and interest-only options: Multiple payment structures allow investors to optimize cash flow based on their investment strategy.

- Multiple prepayment penalty options: Griffin offers 6-month and 1-year ARMs with no prepayment penalties and 30 or 40-year fixed terms, ranging from zero to five-year prepayment penalties.

Cons:

- Limited commercial options: Griffin focuses primarily on residential investment properties, with fewer options for larger commercial deals.

The Griffin Gold app streamlines the application process, while our extensive testimonials demonstrate consistent customer satisfaction across different investor profiles.

Angel Oak Overview

Angel Oak has built a reputation as a specialized DSCR mortgage company with particular strength in non-qualified mortgage products and regional expertise.

This DSCR loan lender offers a comprehensive suite of investor loan products, including traditional investment property loans and specialized DSCR options. Their programs cater to both individual investors and those building larger portfolios.

Angel Oak offers DSCR loans up to $3 million with a $100,000 minimum, including purchase, cash-out refinance, rate-and-term refinance, and delayed financing options. They allow DSCR loans for short-term rentals with AirDNA reports and accept properties held in LLCs, corporations, or trusts.

Angel Oak requires a minimum 680 credit score with loan-to-value ratios up to 85%. They offer DSCR ratios below 1.0 and even no-DSCR options, making them accessible for properties with limited cash flow.

Pros:

- Strong presence in Southeast: Angel Oak’s regional focus allows it to provide specialized knowledge of local markets and faster processing in its primary service areas.

- Non-QM flexibility: Their extensive non-qualified mortgage experience translates to creative solutions for complex investment scenarios.

Cons:

- Slower funding process reported by users: Multiple borrowers report longer closing times compared to tech-forward competitors, potentially problematic in fast-moving markets.

Kiavi Overview

Kiavi differentiates itself through technology-driven lending processes designed for efficiency and speed in today’s competitive investment market. Its platform automates much of the underwriting process, allowing for faster decisions and reduced paperwork compared to traditional lenders.

Kiavi operates in 45 states (licensed in only 13), providing broad coverage while maintaining focus on its core markets with the strongest operational infrastructure.

Pros:

- Fast online applications: Their digital-first approach allows you to complete the application in just a few minutes and get approved quickly.

- Good for single-family rentals: Kiavi’s systems are optimized for the single-family rental market, making them ideal for investors focused on this property type.

Cons:

- Less flexible on DSCR ratios: Kiavi’s automated systems mean less flexibility for borderline deals that might benefit from human underwriter review.

- More geared toward experienced investors: Their streamlined process assumes familiarity with investment property financing, which can be challenging for newer investors.

Visio Overview

Visio Lending focuses exclusively on rental property financing, positioning itself as a specialist in the long-term rental investment space. This DSCR lender concentrates on long-term rental loans with programs designed specifically for buy-and-hold investors seeking stable, predictable financing.

Visio accepts properties with 1.0 DSCR ratios, making them competitive for properties with modest cash flow potential. Additionally, this lender operates across 41 states and is licensed in 1 state.

Pros:

- Transparent pricing: Visio provides clear, upfront pricing without hidden fees or last-minute surprises that can derail closing schedules.

- No personal income verification: Their focus on property cash flow rather than personal income makes them attractive to investors with complex personal financial situations.

Cons:

- Higher rates than competitors: Visio’s rates often run slightly higher than those of other top DSCR lenders, potentially impacting long-term investment returns.

Lima One Overview

Lima One targets serious real estate investors with a focus on scalability and portfolio growth support. The lender offers DSCR loans, fix-and-flip financing, and multifamily options, providing a complete suite of investment property financing solutions.

Operating in 46 states (licensed in only 13), Lima One sets minimum DSCR requirements at 1.0, though this can vary based on borrower qualifications and property characteristics. Properties with stronger cash flow potential often qualify for more competitive interest rates.

Lima One’s programs are designed to support investors as they scale from single properties to large portfolios, with systems built for volume lending.

Pros:

- Extensive lending network: Lima One’s broker network provides access to capital even in challenging markets or unique situations.

- Flexible terms: Their portfolio lending approach allows for creative structuring that traditional lenders cannot accommodate.

Cons:

- Can require more documentation: Lima One’s thorough underwriting process often demands additional documentation compared to streamlined competitors.

- Slower closing reported: Multiple investors report closing times extending beyond initial estimates, potentially problematic for time-sensitive acquisitions.

Easy Street Capital Overview

Easy Street Capital is a business-purpose investment property lender. They offer financing geared towards purchasing rentals, fix-and-flip properties, and building homes. They also allow borrowers to generate their own term sheets online. However, these term sheets can change after speaking with a loan officer or at a later point in the lending process.

Pros:

- Generate term sheets online: Borrowers can generate their own term sheets online, facilitating a quick and efficient experience.

- Business-purpose mortgage solutions: Easy Street Capital offers a variety of specialized loan programs aimed at those investing in real estate.

Cons:

- Term sheet changes: While borrowers can generate their own term sheets online, these terms can be changed after the borrower meets with a loan officer or moves further along in the process.

- Investment property loans only: Easy Street Capital only offers investment property loan products. They do not offer mortgages for those looking to finance a primary residence or a vacation home for personal use.

Which DSCR Lender Is Right for You?

Selecting the best mortgage company for investors depends on your specific situation, investment goals, and geographic focus. Consider these factors when making your decision:

Selecting the best mortgage company for investors depends on your specific situation, investment goals, and geographic focus. Consider these factors when making your decision:

- For speed-focused investors: Griffin Funding and Kiavi lead in approval speed, making them ideal for competitive markets where quick closes provide advantages.

- For Southeast investors: Angel Oak’s regional expertise and market knowledge can provide valuable advantages in their core markets.

- For portfolio investors: Lima One’s scalability focus and extensive network make it attractive for investors planning significant portfolio expansion.

- For transparent pricing: Visio’s upfront pricing approach appeals to investors who prioritize predictable costs over potentially lower rates.

- For flexible underwriting: Griffin Funding’s willingness to consider complete borrower profiles rather than rigid qualification metrics makes us suitable for complex situations.

Your choice should align with your investment timeline, geographic focus, and financing complexity. Consider checking Griffin Funding mortgage rates and using our DSCR loan calculator to compare options before making your final decision.

Why Choose Griffin Funding for Your DSCR Loan?

Griffin Funding is among the best DSCR mortgage companies thanks to our combination of competitive rates and rapid closing timelines. Our nationwide coverage ensures consistent service quality whether you’re investing in your local market or expanding into new states.

What sets Griffin apart is our personalized approach to investor support. Each borrower works with dedicated loan officers who understand their unique challenges. This personalized service, combined with a streamlined pre-qualification process, helps investors move quickly in competitive markets. Griffin also has multiple products and programs and is not limited to one set of guidelines.

Ready to explore your financing options? Get pre-qualified today to understand your purchasing power and take advantage of Griffin’s investor-focused DSCR loan programs.

Explore DSCR Mortgage Solutions

The best DSCR lender for your situation combines competitive rates, reliable service, and programs that match your investment strategy. Griffin Funding’s comprehensive approach to investment property financing, combined with our nationwide coverage and investor-focused service, makes us a top choice for serious real estate investors.

Whether you’re purchasing your first short-term rental property or expanding an existing portfolio, working with experienced mortgage lenders for investors ensures access to the capital and expertise needed for successful real estate investment outcomes.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What is the best DSCR lender in 2025?

For most investors seeking reliable service, competitive rates, and fast closings, Griffin Funding provides the best combination of advantages. Consider getting pre-qualified with Griffin to compare our offering against other options.

What DSCR ratio do most lenders require?

Are DSCR loans hard to get?

The main advantage of these loans is that borrowers don't need to provide tax returns, pay stubs, or other personal income documentation. However, lenders do require detailed rent rolls, lease agreements, and property appraisals to verify the property's income potential. Working with experienced DSCR lenders like Griffin Funding can streamline the process.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...