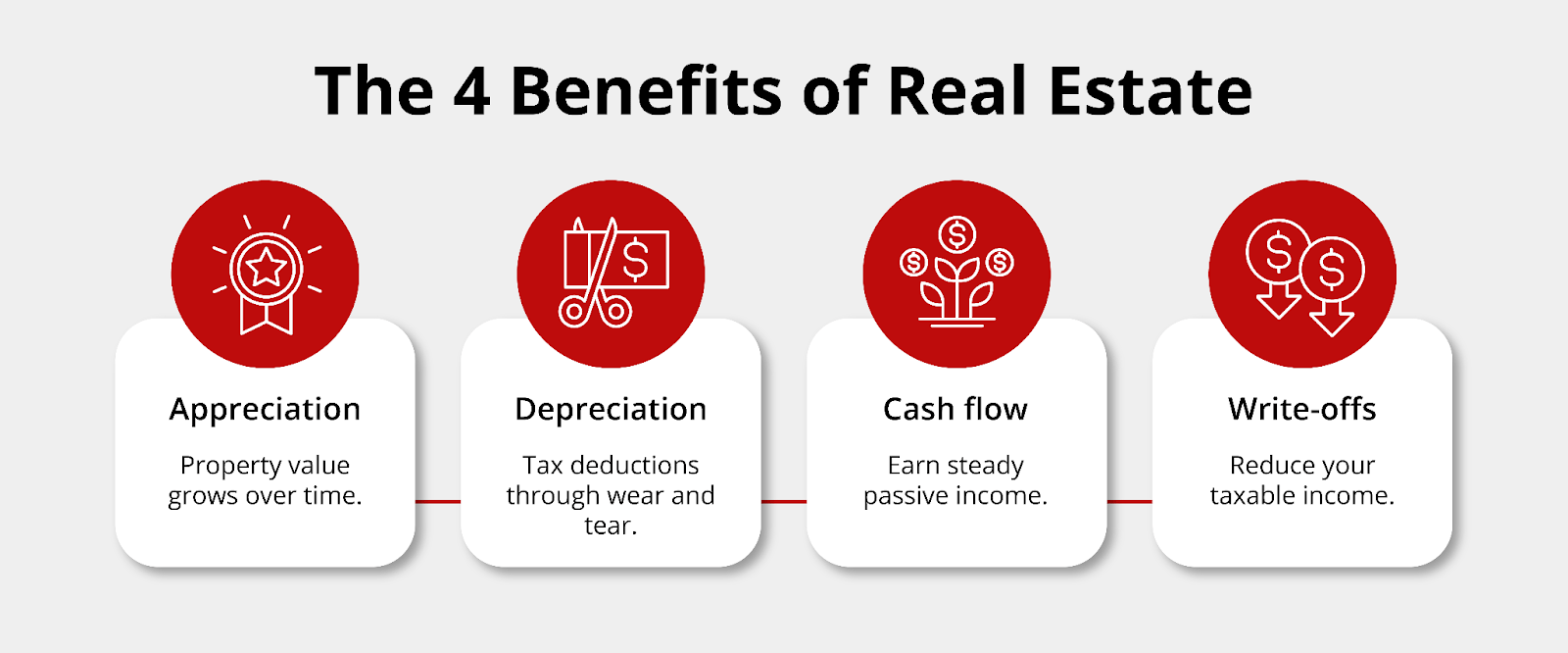

4 Benefits of Investing in Real Estate

KEY TAKEAWAYS

- Real estate offers multiple ways to build wealth and strengthen financial security.

- Appreciation increases your property value and builds equity over time.

- Depreciation and write-offs reduce your taxable income and improve cash flow.

- Positive cash flow provides ongoing passive income.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformReal estate remains one of the most reliable ways to grow wealth over time. It offers both immediate and long-term rewards, from steady income to valuable tax advantages. Explore how each benefit works so you can make smarter decisions as you build financial stability and plan for future growth.

According to the Federal Reserve Bank of San Francisco, “Real estate remains one of the most stable long-term investments, consistently delivering returns through appreciation, income, and tax advantages.”

Whether you’re focused on rental income or long-term appreciation, property investing offers a balance of growth and stability few other assets can match.

1. Appreciation: Grow Your Property Value Over Time

Appreciation refers to the increase in your property’s value over time. It’s one of the most significant benefits of real estate investing because it naturally builds wealth as your asset becomes more valuable.

Over the decades, U.S. home values have shown a long-term upward trend. Even though markets experience temporary declines, real estate generally appreciates as populations grow, demand rises, and construction costs increase.

Several factors influence how much your property appreciates:

- Location: Properties in high-demand areas with strong job markets and amenities tend to grow faster in value.

- Property improvements: Renovations and upgrades can enhance market appeal and boost resale value.

- Market timing: Buying in a stable or undervalued market can lead to higher returns when demand strengthens.

As the Fannie Mae Economic & Strategic Research Group notes, “Real estate has outperformed many other investments over multi-decade periods because investors can build wealth through both price appreciation and leverage.”

This combination of rising value and financial leverage is what makes real estate a cornerstone asset for long-term investors.

As your property value increases, you gain equity, which is the difference between what you owe and what your property is worth. Many investors use alternative mortgage loans or refinance strategies to access that equity, giving them flexibility to scale their portfolio without relying on traditional income documentation.

Ultimately, growing equity improves your net worth and can give you leverage to reinvest, refinance, or expand your holdings.

2. Depreciation: Unlock Tax Advantages

Depreciation allows you to deduct a portion of your property’s cost each year to reflect wear and tear. This IRS-approved deduction reduces taxable income while preserving your cash flow, making it one of the key benefits of real estate investing.

Residential investment properties can be depreciated over 27.5 years. For instance, if the building (excluding land) is valued at $275,000, you can typically deduct $10,000 annually. This deduction directly reduces your reported rental income and lowers your tax bill.

Savvy investors often order a cost segregation study to accelerate depreciation and maximize tax savings. This analysis breaks down a property into components like flooring, lighting, and appliances that qualify for shorter depreciation schedules.

By identifying these assets, investors can often apply 100% bonus depreciation, allowing them to deduct the full cost of qualifying items upfront instead of spreading deductions over decades. The result is stronger early-stage cash flow and improved overall return on investment.

Depreciation does include something called recapture. When you sell the property, the IRS may tax a portion of the profit that comes from previous depreciation claims. Even so, the tax benefits you receive during ownership usually outweigh what you pay later, especially if you reinvest the proceeds into new properties.

“For real-estate investors the real power isn’t just in monthly rental income – it’s in structuring your deals and taxes so you retain as much equity and upside as possible.” — Mark Wilson, CPA, CEO of Advisent, LLC

If you’re exploring how investors apply these strategies, reviewing DSCR loan examples can show how depreciation and smart financing combine to strengthen overall returns.

3. Cash Flow: Earn Passive Income

According to the Harvard Joint Center for Housing Studies, “The ability to generate stable rental income gives investors a predictable cash flow that can compound their returns over time, even in periods of market volatility.”

Cash flow refers to the income left after covering all expenses, including mortgage payments, taxes, insurance, and maintenance. Positive cash flow means your property generates consistent profit every month.

Cash flow isn’t just income – it’s stability and reinvestment potential for serious investors.

Many investors consider steady cash flow the most rewarding of all the benefits of real estate investing. It provides ongoing income, helps pay down debt, and builds a financial cushion for future opportunities.

To calculate cash flow, subtract your total monthly expenses from your total rental income. For example, if you earn $2,000 in rent and spend $1,500 on expenses, you have $500 in monthly cash flow.

You can increase positive cash flow by:

- Setting rents based on current market rates

- Reducing vacancies through strong tenant screening

- Managing maintenance efficiently

- Refinancing to lower your monthly payment

Different property types offer different cash flow potential:

- Single-family homes: Easier to manage and often appreciate steadily

- Multi-unit properties: Generate multiple income streams under one roof

- Short-term rentals: Can bring higher revenue but may require more hands-on management

Consistent cash flow gives you flexibility. It can supplement your income now and fund future investments that help you build long-term wealth.

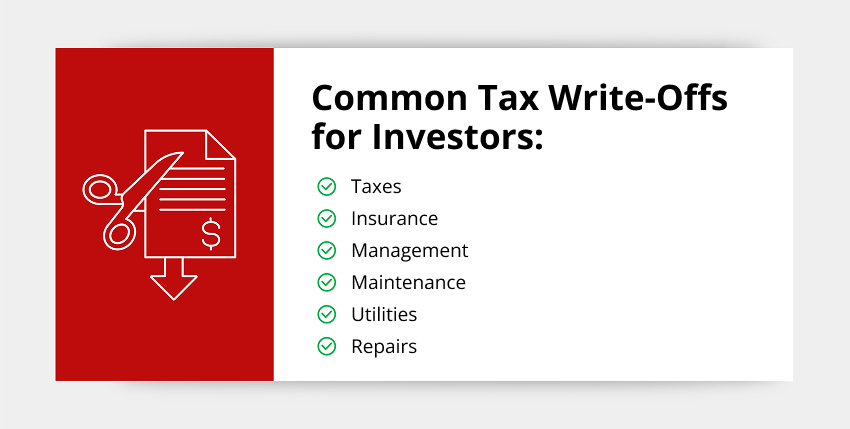

4. Write-Offs: Reduce Your Tax Bill

Real estate investors can deduct many operating expenses that directly reduce taxable income and increase overall returns. These deductions—often referred to as write-offs – help ensure you keep more of your rental income each year.

A simple way to remember the most common categories is the acronym TIMMUR:

T – Taxes (property and state/local)

I – Insurance (property and liability premiums)

M – Management (property management or professional fees)

M – Maintenance (repairs and upkeep that keep the property rentable)

U – Utilities (when paid by the owner)

R – Repairs (routine fixes and improvements that preserve value)

According to the IRS Publication 527 – Residential Rental Property, investors may deduct “ordinary and necessary expenses for managing, conserving, or maintaining rental property” and “depreciate the cost of income-producing property through yearly tax deductions.”

Together, these provisions give real-estate investors powerful opportunities to reduce taxable income and improve after-tax returns.

Write-offs differ from depreciation because they cover actual out-of-pocket expenses in the year they occur, while depreciation spreads deductions over time. Using both effectively can minimize your tax burden and preserve your earnings.

For example, you can combine depreciation with deductions like tax benefits for maintenance, insurance, or mortgage interest. Together, these strategies can offset rental income and help your portfolio remain profitable year after year.

How to Start Investing in Real Estate

Getting started in real estate doesn’t require massive capital or decades of experience. You can begin by following a few clear steps:

- Set clear goals: Decide whether your focus is monthly income, long-term appreciation, or both. Clear goals help shape your strategy and property selection.

- Create a budget: Factor in down payment, closing costs, reserves, and repair expenses. Staying within your means ensures sustainable growth.

- Choose an investment strategy: Options include single-family rentals, multi-unit properties, or short-term rentals, depending on your goals and risk tolerance.

- Choose a loan product and lender: Selecting the right financing partner matters as much as the property itself. Explore investor-focused options like investment property loans and DSCR loans to find the structure that fits your income and goals. Partnering with an experienced lender helps you navigate terms, rates, and requirements confidently.

- Get pre-approved: Pre-approval clarifies your buying power and gives you a competitive edge when making offers. It also helps you estimate monthly payments and cash flow projections.

Once your plan and financing are in place, you can begin searching for properties that align with your investment criteria and start building wealth through real estate.

Begin Building Your Real Estate Investment Portfolio

Real estate investing creates opportunities for financial growth through appreciation, cash flow, and valuable tax advantages. It can serve as a foundation for long-term wealth when approached with clear goals and the right funding strategy.

Griffin Funding helps investors secure the financing they need to build a real estate portfolio that aligns with their goals. You can manage your loan and access helpful tools directly through the Griffin Gold app, making it easy to stay organized throughout your investment journey.

Take the next step toward financial freedom. Connect with Griffin Funding to explore flexible loan options and competitive rates tailored to your investment strategy. Get started online today and begin turning your real estate goals into reality.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Is real estate still a good investment?

Yes. Real estate remains one of the most dependable long-term investments. It provides consistent cash flow, tax advantages, and appreciation potential. Even when the market fluctuates, property ownership offers tangible value and control that many other investments can’t match.

How much money do I need to start investing in real estate?

You can start with as little as 15% to 25% down, depending on the loan type and property. Many investors begin with a single-family home before expanding into multifamily or short-term rentals. Lenders also offer creative financing options that make entry more accessible for first-time investors.

What is the 7% rule in real estate investing?

The 7% rule suggests that annual rent should be at least 7% of the property’s purchase price. This guideline helps you quickly assess whether a property might produce positive cash flow. While useful for screening, always calculate full expenses and financing terms before making a decision.

Can I write off mortgage interest on investment properties?

Yes. Mortgage interest is one of the largest tax deductions available to property owners. It can significantly reduce your taxable rental income. Combining this with other deductions, such as repairs, property taxes, and insurance, can help you save thousands each year.

Is it better to invest in real estate or stocks?

Both offer opportunities to build wealth, but they serve different purposes. Stocks provide liquidity and diversification, while real estate delivers leverage, tax benefits, and tangible control. Many investors use a mix of both to balance short-term flexibility with long-term growth.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...