DSCR HELOANs: Home Equity Loans for Investment Properties

Access equity from your rental properties without refinancing your first mortgage. A DSCR home equity loan lets you qualify using the property’s rental income instead of tax returns or W-2s.

Featured In

Why Get a DSCR HELOAN?

No tax returns required:

No tax returns or traditional income verification required — qualification is based on rental income.

Keep your current rate:

Access equity from your investment property without refinancing your existing first mortgage.

Streamlined underwriting:

Streamlined approval process focused on property performance rather than personal finances.

Flexible terms:

Flexible lending terms based on your property’s debt service coverage ratio.

Use funds for any purpose:

Use funds for renovations, purchasing more properties, or any investment purpose.

How it Works

What Is a DSCR HELOAN?

A DSCR HELOAN is a second mortgage that lets you access equity from your investment property by qualifying based on rental income instead of personal income, combining elements of DSCR loans and home equity loans.

The debt service coverage ratio (DSCR) determines a rental property’s ability to cover its debt obligations using rental income. Lenders calculate DSCR by dividing annual gross rental income by total annual debt payments (principal, interest, taxes, insurance, and HOA fees). This approach provides flexibility for investors who may not qualify for traditional home equity loans.

A DSCR of 1.0 means rental income exactly covers debt payments. Above 1.0 indicates positive cash flow, while below 1.0 signals the property doesn’t generate enough income to cover its obligations. Use our DSCR loan calculator to estimate your property’s ratio before applying.

DSCR HELOAN: Key Features

- No income or employment verification

- Cash-flow based approval (DSCR)

- Access equity without altering current rate

- Flexible use of funds

- Investment properties only

DSCR HELOAN Requirements

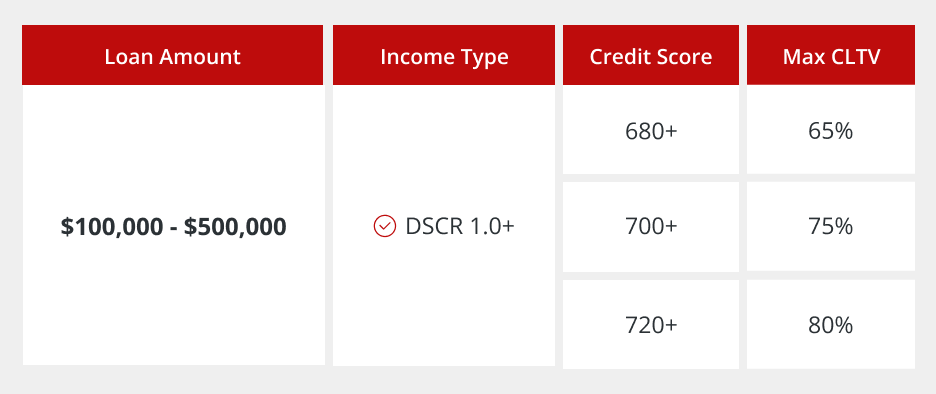

Loan Amount:

Minimum loan amount of $100,000; maximum of $500,000 for investment property home equity loans.

Credit Score:

680+ credit score is required to qualify for a DSCR equity loan.

LTV Ratio:

Max combined LTV ratio of 80%, meaning you need at least 20% equity in the property.

DSCR:

DSCR as low as 1.0 accepted.

Property Type:

Must be an investment property: single-family, PUD, townhome, or 2-4 units.

Appraisal:

Appraisal with comparable rent schedule (form 1007) required to verify rental income potential.

Prepayment Penalty:

Prepayment penalty options available: 5-year, 4-year, 3-year, 2-year, 1-year, or none.

Today’s DSCR Loan Rates

Review today’s DSCR loan rates to help plan your next investment purchase or refinance.

Calculators

DSCR Loan Calculators

Use these tools to estimate your DSCR for a new purchase or refinance.

Areas We Serve

Unlock your investment property’s equity with a DSCR HELOAN. Griffin Funding simplifies the process with competitive rates and expert guidance. Explore our full range of investment property loans or get started online today to get a home equity loan on an investment property.

FAQ

Frequently Asked Questions

DSCR HELOANs are specifically designed for investment properties. These investment property home equity loans qualify borrowers based on the property’s debt service coverage ratio rather than personal income. You don’t need to provide tax returns or traditional income verification. The loan allows you to leverage your property’s equity without refinancing your existing first mortgage, keeping your current rate intact while accessing additional capital.

Another option for real estate investors is a home equity line of credit (HELOC), which provides revolving credit you can draw funds from as needed rather than receiving a lump sum. Griffin Funding also offers fixed-rate HELOCs that combine the flexibility of a credit line with the stability of a fixed interest rate.

When deciding between a HELOC vs. a home equity loan for an investment property, consider that home equity loans provide a lump sum with predictable payments, while HELOCs offer ongoing access to funds.

If you’re considering a cash-out refinance instead of a HELOAN, use our DSCR refinance calculator to compare how much equity you can access with each option and see which better fits your investment strategy.

Griffin Funding specializes in DSCR HELOANs for investment properties. Unlike traditional banks that require W-2s and tax returns, we focus on your property’s rental income to determine qualification. Our streamlined process makes it easier for real estate investors to access equity without the strict income documentation requirements of conventional lenders.

Getting a DSCR HELOAN is straightforward if you meet the basic requirements. You’ll need a 680+ credit score, at least 20% equity in the property (80% maximum combined LTV), a DSCR of 1.0 or higher, and documented rental income through lease agreements. The process is often simpler than traditional loans because there’s no personal income verification required. Working with Griffin Funding ensures efficient processing and approval.

Yes, if the DSCR HELOAN is secured by the rental property itself, the interest qualifies as mortgage interest and is fully deductible as a rental expense on Schedule E. The funds must be used for business purposes such as property improvements, purchasing additional rental properties, or other investment-related expenses.

Note: Tax rules are complex and change frequently, so you should consult with a tax professional or CPA to understand how HELOAN interest applies to your specific situation and ensure proper documentation of how you use the funds.

Yes, you can obtain DSCR HELOANs on multiple investment properties. Each property must have sufficient equity (80% maximum combined LTV), generate adequate rental income (DSCR of 1.0 or higher), and you must maintain the required credit score and reserves.

There’s no limit on the number of properties you can leverage, making DSCR HELOANs an effective tool for investors building larger portfolios who need capital without selling assets.