What Is PACE Financing?

KEY TAKEAWAYS

- PACE financing allows homeowners and businesses to fund energy-efficient, renewable, and resiliency upgrades through a property tax assessment instead of a traditional loan.

- It offers major advantages such as no upfront cost, long repayment terms, and the potential for increased property value and lower utility bills.

- Eligibility, availability, and transferability vary by state and jurisdiction, making it important to understand local program rules before applying.

- PACE = Property Assessed Clean Energy. C-PACE = Commercial Property Assessed Clean Energy.

- Alternatives like HELOCs, cash-out refinancing, and alternative mortgage loans may be better options for borrowers who prefer traditional repayment structures or plan to refinance soon.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage Platform

Property Assessed Clean Energy (PACE) financing has become an increasingly popular option for homeowners looking to upgrade their properties without taking on traditional debt.

Designed to support energy-efficient and resiliency-focused home improvements, PACE financing programs offer a unique alternative to standard financing by tying repayment to the property itself. With longer terms, flexible qualification, and the ability to fund large projects upfront, PACE financing can make renovations more accessible for homeowners who want to improve comfort, efficiency, or safety.

What Is PACE Financing?

Property Assessed Clean Energy (PACE) financing is a government-enabled, privately funded program that allows homeowners to finance certain upgrades and repay the cost through their property tax bill rather than through a traditional home renovation loan. It works as a special property tax assessment attached to the home, not the homeowner, meaning repayment stays with the property if it’s sold.

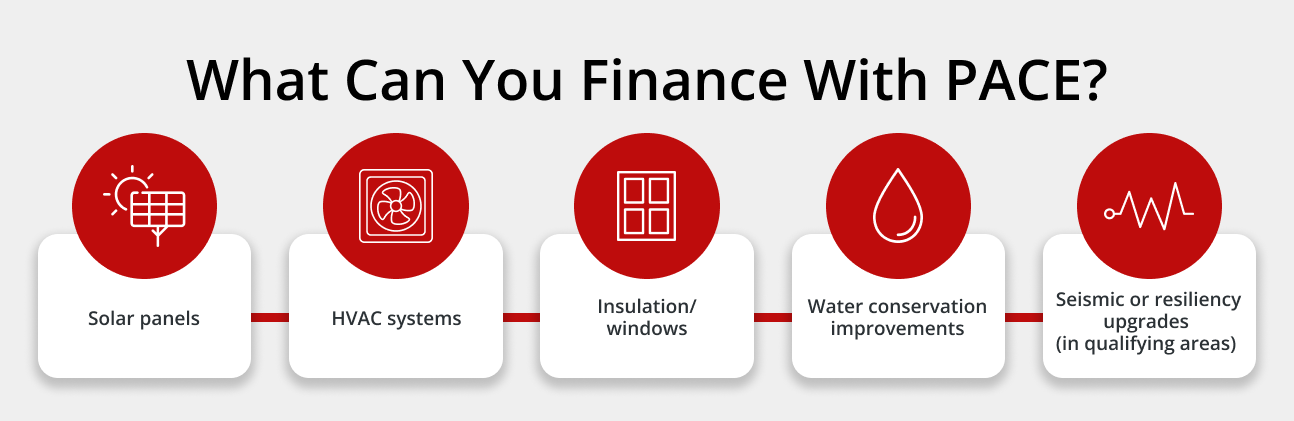

Eligible improvements typically include:

- Energy efficiency upgrades (HVAC systems, insulation, windows)

- Renewable energy installations (solar panels, battery storage)

- Water conservation improvements (low-flow fixtures, irrigation upgrades)

- Seismic or resiliency retrofits (in select jurisdictions)

PACE financing is designed to make major home improvements more accessible by offering longer terms, easier qualification, and the ability to fund projects that reduce environmental impact or improve property safety.

How Does PACE Financing Work?

PACE financing operates differently from traditional loans, using a property-based repayment structure that allows homeowners to fund major upgrades with long-term, predictable payments.

The Basic Structure

PACE financing adds a special assessment to your property tax bill, allowing you to pay for upgrades over an extended period, which typically ranges from 10 to 30 years. The financing is secured by the property itself, not the individual borrower, which is why eligibility focuses more on property criteria than personal credit. In many jurisdictions, the assessment can even transfer to the next owner if the home is sold, depending on local regulations.

This model offers an alternative to traditional home equity solutions by spreading repayment across tax cycles with fixed interest rates.

Step-By-Step Process

The general PACE financing process is as follows:

- Property evaluation: The PACE provider verifies eligibility, local program availability, and property conditions.

- Approval through a PACE financing program: The homeowner applies and receives approval based on property criteria and available equity.

- Scope of work established: Eligible upgrades are reviewed, cost estimates are finalized, and contractors are selected.

- Contractors complete improvements: Work is performed by approved or certified contractors within the PACE program.

- Repayment via property tax assessments: The financed amount appears as a line item on future property tax bills until the balance is repaid.

Who Is Eligible?

PACE eligibility varies by state and local program, but typically applies to:

- Residential properties

- Commercial, industrial, and multifamily properties, which have even broader access in many regions

- Homes with sufficient equity, a solid property tax payment history, and a mortgage in good standing

- Properties located in areas where PACE programs are authorized by state and local law

Eligibility depends far more on property factors than the homeowner’s personal credit score, making PACE an attractive option for many who might not qualify for traditional financing.

Understanding C-PACE Financing (Commercial PACE Financing)

C-PACE financing extends the PACE model to commercial properties, giving businesses and developers a powerful tool to fund large-scale energy and resiliency improvements with long-term, property-based repayment.

What Is C-PACE Financing?

What Is C-PACE Financing?

C-PACE (Commercial Property Assessed Clean Energy) financing is a program that allows commercial property owners to fund energy-efficient, renewable-energy, and resiliency upgrades through a special assessment added to their property tax bill.

Unlike residential PACE financing, which focuses on homeowners and is more limited in availability, C-PACE is widely used for commercial, industrial, multifamily, and mixed-use buildings. The structure is similar – repayment is tied to the property rather than the business or borrower – but C-PACE often supports much larger project sizes, longer financing terms, and more flexible underwriting tailored to commercial real estate.

Why Businesses Use C-PACE Financing

There are several reasons why businesses may use C-PACE financing, including:

- Lower upfront cost for major projects: C-PACE allows property owners to complete expensive upgrades—such as HVAC systems, solar installations, roofing, or seismic retrofits—without large cash expenditures.

- Positive cash flow potential: Energy savings from upgrades can exceed annual PACE assessments, helping to improve cash flow for the property owner.

- Non-recourse structure with transferability: Because C-PACE is tied to the property and not the business itself, it is typically non-recourse and can transfer to a new owner at sale, depending on local rules. This lowers risk for developers and investors.

- Capital stack advantages for developers: C-PACE can function as gap financing, replacing higher-cost equity or mezzanine debt in a project’s capital stack. This makes it attractive for new construction, adaptive reuse, and major redevelopment projects.

Key Benefits of PACE Financing

PACE financing offers a combination of financial, environmental, and market advantages that make it appealing for both homeowners and commercial property owners.

Financial Benefits

- No upfront cost for eligible improvements, making large projects accessible without out-of-pocket expenses.

- Long repayment terms—sometimes up to 30 years—allow for lower annual payments tied to the property tax bill.

- Potential increase in property value due to upgraded systems, improved efficiency, or resiliency improvements.

- Possible tax benefits, depending on local laws and whether certain assessments qualify as deductible.

Environmental and Energy Benefits

- Reduced energy use, which can significantly lower utility bills.

- Lower carbon footprint through renewable energy and energy-efficient upgrades.

- Upgraded building equipment and infrastructure, improving comfort, reliability, and sustainability.

Market and Compliance Benefits

- Supports compliance with local green building or energy-efficiency mandates, which are becoming more common in a lot of areas.

- Enhances property appeal for future buyers or tenants who value efficiency, sustainability, and upgraded systems.

Potential Drawbacks and Considerations

- Limited availability, as PACE programs depend on state and local legislation.

- Possible impact on refinancing, since the assessment appears on the property tax bill and may require special handling by mortgage lenders, which may delay or prevent the refinancing process.

- Higher property tax bill, reflecting PACE repayment added as an assessment.

- Lender consent requirements, which are mandatory in many jurisdictions before a homeowner can obtain PACE financing.

Types of Improvements Eligible for PACE Financing

PACE financing can be used for a wide range of upgrades that improve a property’s energy efficiency, sustainability, or resilience, offering an alternative to using cash or trying to refinance for home improvements.

Energy Efficient Projects

Energy Efficient Projects

- HVAC system upgrades (heating, cooling, ventilation)

- High-efficiency windows, insulation, and roofing improvements

- LED lighting and other electrical efficiency enhancements

Renewable Energy Projects

- Solar photovoltaic (PV) systems

- Solar thermal systems for water or space heating

- Geothermal heating and cooling systems

Water Efficiency Projects

- Low-flow faucets, toilets, and showerheads

- Irrigation system upgrades that reduce water waste

- Water recycling and graywater systems

Seismic and Resiliency (Where Allowed)

- Structural seismic strengthening

- Storm-hardening enhancements, such as impact-resistant windows, reinforced roofing, or flood mitigation

These resiliency upgrades improve safety and may help properties meet evolving local building requirements.

PACE Financing Alternatives

While PACE financing is useful for energy and resiliency upgrades, it’s important to compare it against more common alternative mortgage loans and funding options to find the best fit for your project.

- Traditional loans: Standard traditional mortgages or unsecured personal loans can fund home improvements without attaching an assessment to your property tax bill. These may offer simpler refinancing opportunities but often require borrowers to have stronger credit scores.

- Cash-out refinance: A cash-out refinance replaces your existing mortgage with a larger loan, allowing you to access equity for upgrades. It can offer competitive rates but increases your overall mortgage balance.

- Home equity loan: Home equity loans provide a lump sum with a fixed interest rate and predictable monthly payments. They are often used for major renovations and can be easier to manage than a property tax–based repayment structure.

- Home equity line of credit: A HELOC lets you access equity by providing a revolving line of credit, allowing you to borrow as needed during a draw period. It’s ideal for projects completed in stages or for homeowners who want more control over when they use funds.

Wrapping Up

PACE financing can be a powerful way to complete energy-efficient, renewable, or resiliency-focused upgrades without upfront costs—but it’s not the right fit for every homeowner. Exploring options like traditional loans, HELOCs, or cash-out refinancing can help ensure you choose the financing that aligns with your goals, budget, and long-term plans.

Griffin Funding offers a full suite of mortgage and home improvement financing solutions, supported by modern tools like the Griffin Gold app to help you compare options, track your loan, and stay organized throughout the process.

Whether you’re upgrading efficiency or investing in property resilience, Griffin Funding can guide you toward the best path forward. Get started online today and find a mortgage that’s right for you.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Is it hard to sell a house with PACE financing?

What’s the difference between PACE and C-PACE financing?

Is PACE financing available in every state?

Does PACE financing affect refinancing or getting a new mortgage?

In practice, you may need extra documentation, and some lenders may require the PACE assessment to be paid off or otherwise handled before closing—so it’s smart to confirm the rules before you start a refinance or purchase.

Do mortgage lenders have to approve C-PACE financing first?

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...