Mortgage Recasting: What It Is & How It Works

KEY TAKEAWAYS

- Mortgage recasting lowers your monthly payment by applying a lump sum to your principal and recalculating your payment schedule.

- Unlike refinancing, recasting keeps your interest rate and loan terms the same, with minimal fees and no credit check required.

- You’ll typically need at least $5,000 and a conventional loan to qualify for mortgage recasting, and not all lenders offer this option.

- Recasting works best when you want lower payments but are happy with your current rate and don’t need to shorten your loan term.

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformIf you’ve come into some extra cash and want to lower your monthly mortgage costs without the hassle of refinancing, recasting your mortgage might be worth considering.

So, what is a mortgage recast? This lesser-known strategy lets you keep your current interest rate while reducing what you pay each month. Mortgage recasting is a simple option that works well for homeowners who want to free up some monthly budget without starting the loan process over from scratch.

Keep reading to learn everything you need to know about recasting a mortgage:

A mortgage loan recast makes sense when you have a significant amount of cash available to put toward your principal and you’re satisfied with your current interest rate. It’s ideal for homeowners who’ve received a windfall and want to lower the amount of their income spent on mortgage payments without the complexity and cost of refinancing.

Recasting also works well if you’re planning to stay in your home long-term and simply want to free up monthly cash flow for other expenses or investments.

Mortgage recasting, also known as a mortgage loan recast, is when you put a substantial lump sum toward what you owe on your home, and your lender adjusts your monthly payment based on the new, reduced balance. The payment goes down because you’re spreading a smaller balance over the remaining years of your loan. Your interest rate stays exactly the same, and so does your payoff date.

The main difference between recasting a mortgage and refinancing is pretty simple: When you refinance, you’re taking out a completely new loan with new terms, which usually means a new interest rate, closing costs, and a fresh credit check.

With a mortgage recast, you keep your existing loan, but the lender adjusts the payment schedule. That makes recasting faster, cheaper, and easier if your main goal is reducing your monthly payment.

Homeowners often consider recasting a mortgage when they receive a financial windfall like a bonus, inheritance, or proceeds from selling another property. It’s a way to put that money to work immediately while maintaining the flexibility of lower ongoing payments. You get the benefit of paying down debt and reducing your monthly obligations without locking into a new mortgage term or dealing with the paperwork that comes with refinancing.

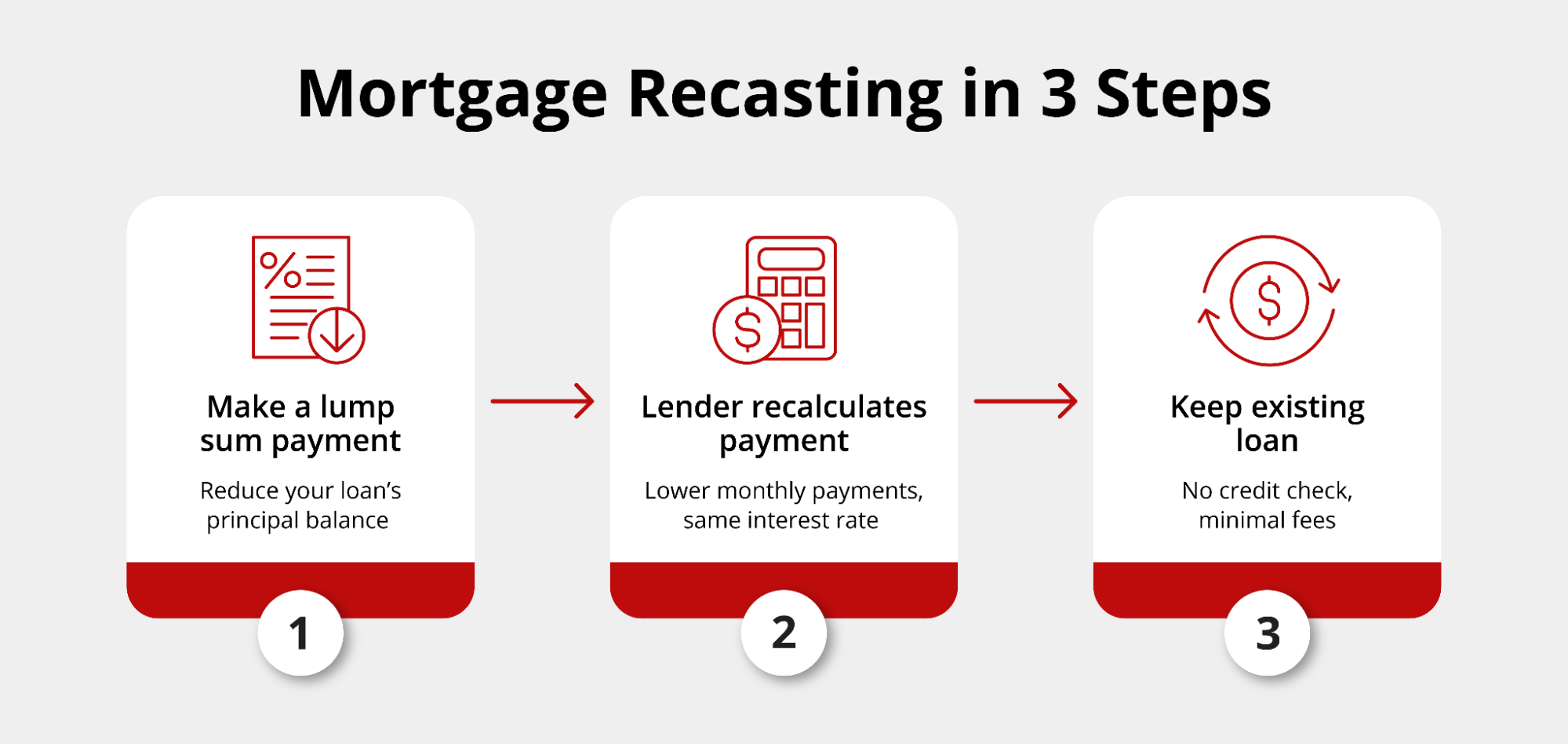

How Mortgage Recasting Works

The mortgage recasting process is straightforward, but it’s often helpful to understand the steps involved. Here’s how you can recast your mortgage:

- Make a large lump-sum payment toward your principal balance: This isn’t your regular monthly payment — it’s an extra payment on top of what you normally pay. The amount varies by lender, but most require at least $5,000 or around 10% of your remaining balance.

- Request a loan recast from your lender: Not every lender offers this service, so you’ll want to confirm availability before making your lump-sum payment. Some lenders charge a processing fee for recasting, but this fee is often much less than refinancing costs.

- Lender recalculates your monthly payment based on the lower balance: Once your lender processes the request, they recalculate your monthly payment based on your new, lower principal balance. The calculation spreads your remaining balance over the same number of months left on your existing mortgage, and your interest rate remains the same.

It’s important to note that because your interest rate is unchanged, you’re still on track to pay off your mortgage on the original schedule. The main benefit of mortgage recasting is the immediate reduction in your monthly payment, which can free up cash flow for other goals or expenses.

Pros and Cons of Mortgage Recasting

Like any financial decision, mortgage recasting has its advantages and drawbacks. Understanding both sides helps you decide if it’s the right move for your situation.

Pros of recasting a mortgage include:

- Lower monthly payments: The most obvious benefit is a reduced monthly payment. By paying down a chunk of principal, you immediately decrease what you owe each month without extending your loan or changing your rate.

- No new credit check: Unlike refinancing, lenders won’t check your credit when you recast a mortgage. Your lender isn’t issuing a new loan, so there’s no need to verify your credit score again.

- Lower costs than refinancing: Recasting fees are minimal compared to refinancing. You might pay a few hundred dollars for a recast, while refinancing can cost thousands in closing costs, appraisal fees, and other charges.

Keep in mind that mortgage recasting isn’t the best idea for everyone, and there are some important limitations to keep in mind.

Potential cons of mortgage recasting are:

- Requires large lump sum: You need a significant amount of cash available to make recasting worthwhile. Coming up with $5,000 to $10,000 or more isn’t feasible for every homeowner, especially if you’re already working to build emergency savings.

- Doesn’t shorten loan term automatically: While your monthly payment decreases, you’re still paying off the loan over the original timeline. If your goal is to pay off your mortgage faster, you’d need to make additional principal payments separately.

- Not available for all loan types: Most lenders only allow recasting for conventional loans. Government-backed loans like FHA loans, VA loans, and USDA loans typically don’t qualify, which limits who can take advantage of this option.

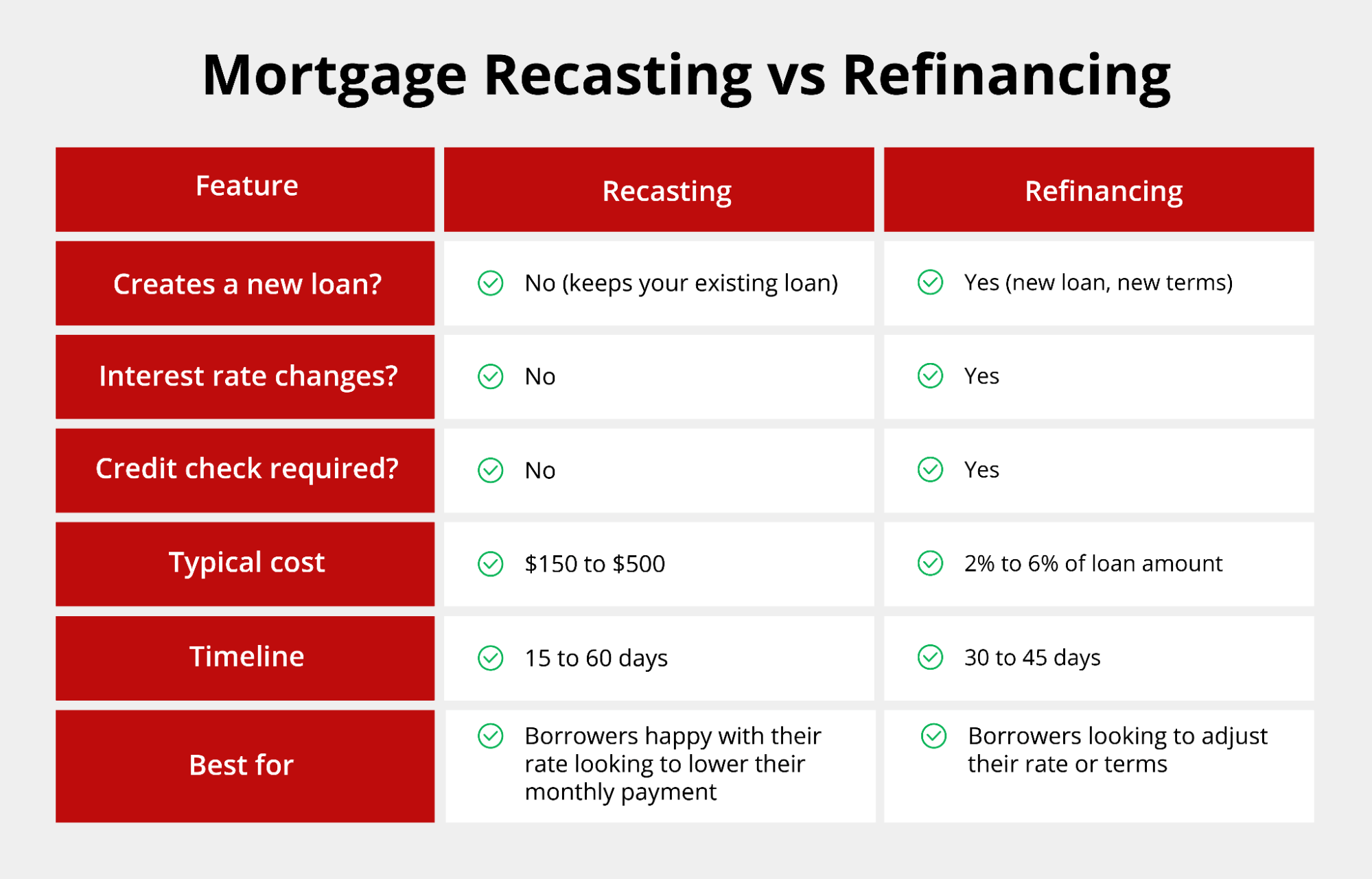

Mortgage Recasting vs Refinancing

Deciding between a mortgage recast and refinancing depends on your financial goals and current situation. Both strategies can lower your monthly payment, but they work in very different ways. Let’s take a look at the differences between mortgage recasting and refinancing:

- Process complexity: Refinancing involves applying for a completely new loan, which means paperwork, income verification, employment checks, and sometimes an appraisal. Recasting is much simpler — you make a payment and submit a request. There’s no underwriting process or lengthy approval wait.

- Fees: Refinancing typically costs 2% to 6% of your loan amount in closing costs. On a $300,000 mortgage, that’s $6,000 to $15,000. Recasting usually costs just a few hundred dollars, making it far more affordable if you just want to adjust your payment.

- Interest rate change: This is where refinancing has a clear advantage. If mortgage rates have gone down since you took out your loan, refinancing lets you get a lower rate, which can save you tens of thousands over the life of your loan. Recasting keeps your existing rate, so you won’t benefit from market changes.

- Credit impact: Refinancing requires a hard credit inquiry and affects your credit score temporarily. Recasting has no impact on your credit since there’s no new loan application.

- Timeline: Refinancing can take 30 to 45 days or longer to close. Recasting can usually be completed within a few weeks once you make your lump-sum payment.

Refinancing makes more sense when:

- Interest rates have dropped significantly

- You want to switch from an adjustable-rate (ARM) to a fixed-rate mortgage

- You need to remove private mortgage insurance

- You want to change your loan term

However, if you’re happy with your current rate and loan structure but have cash to put toward your principal, recasting is the easier and cheaper choice.

Eligibility & Requirements for a Mortgage Recast

Not every homeowner will qualify for a mortgage recast, and specific requirements vary by lender. To qualify, you’ll typically need:

- Conventional mortgage: Government-backed loans like FHA, VA, and USDA mortgages aren’t eligible for recasting. Most lenders restrict this option to conventional loans, so if you have a government-insured mortgage, you’ll need to explore other ways to lower your payment.

- Good payment history: Lenders want to see that you’ve been making your mortgage payments on time. If you’ve had recent late payments or delinquencies, your lender may decline your recast request.

- Minimum lump-sum payment: Most lenders require a minimum payment of $5,000, though some set the bar at 10% of your remaining balance or even higher. Check with your lender about their specific threshold before planning your payment.

- Loan seasoning period: Some lenders require that your loan be at least a few months old before allowing a recast. This prevents borrowers from recasting immediately after closing, which could indicate financial instability.

How to Recast Your Mortgage

If you’ve decided that recasting is right for you, here’s how to move forward with the process:

- Contact your lender: Call or email your mortgage lender to confirm that they offer recasting and to understand their specific requirements. Ask about minimum payment amounts, fees, and how long the process typically takes.

- Make your lump-sum principal payment: Once you’ve confirmed the details, make your large payment toward the principal balance. Keep documentation of this transaction — you’ll need proof that the payment was applied to principal, not just regular payments or escrow.

- Submit a recast request: Your lender will have a formal process for requesting a recast, which might involve filling out a form or submitting a written request. Provide any documentation they require, such as proof of payment and account information.

- Pay the recast fee: Most lenders charge a processing fee for recasting. This fee covers the administrative work of recalculating your loan and updating your payment schedule. It’s typically due when you submit your request.

- Receive confirmation and new payment schedule: After processing your request, your lender will send you confirmation of the recast along with your new monthly payment amount. This documentation should clearly show your reduced payment and confirm that your interest rate and loan term haven’t changed.

- Notify your mortgage servicer or update auto-pay: If you have automatic payments set up, you’ll need to update the payment amount to reflect your new monthly obligation. Double-check your bank records after the first new payment to ensure everything is processed correctly.

Explore Ways to Lower Your Monthly Mortgage Payment

Recasting your mortgage is just one strategy for reducing your monthly housing costs. Depending on your situation, refinancing might still be the better option, especially if rates have dropped or if you want to eliminate mortgage insurance.

Griffin Funding offers personalized refinance solutions designed to help you make the most of your home loan. Whether you’re exploring recasting, refinancing, or simply want expert guidance on managing your loan, our team is here to help. Download the Griffin Gold app to track your finances and explore options that fit your needs.

Ready to explore your mortgage options? Get started online today or contact us to learn more.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

How much does it cost to recast a mortgage?

When does a mortgage recast make sense?

Recasting also works well if you're planning to stay in your home long-term and simply want to free up monthly cash flow for other expenses or investments.

Do all mortgage companies allow recasting?

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...