5 Benefits of Homeownership

KEY TAKEAWAYS

- Property values historically appreciate over time, allowing homeowners to build wealth through their primary residence

- Homeowners can deduct mortgage interest and state/local taxes, reducing their annual tax burden

- You can currently exclude up to $250,000 (or $500,000 for married couples) in capital gains when selling your primary residence

- Real estate serves as a natural inflation hedge since home values typically rise alongside consumer prices

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage PlatformHomeownership remains one of the most effective ways to build long-term wealth in America. Beyond just having a place to call your own, owning a home provides financial advantages, stability, and opportunities that renting simply cannot match.

As Bill Lyons, CEO of Griffin Funding, shares: “I believe the saying ‘Homeownership is the first step on the stairway to wealth’ to be true.” That belief reflects Griffin Funding’s mission to help everyday Americans use homeownership as a foundation for long-term financial freedom.

This conviction is echoed by housing-market data. As Lawrence Yun, Chief Economist at the National Association of Realtors, explains, “A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than that of a renter.”

That striking wealth gap underscores why buying a home isn’t just about having a place to live—it’s a proven strategy for building long-term financial security.

If you’re weighing whether to buy or continue renting, understanding the concrete benefits of homeownership can help you make an informed decision. Read on to learn more about what the benefits of homeownership are.

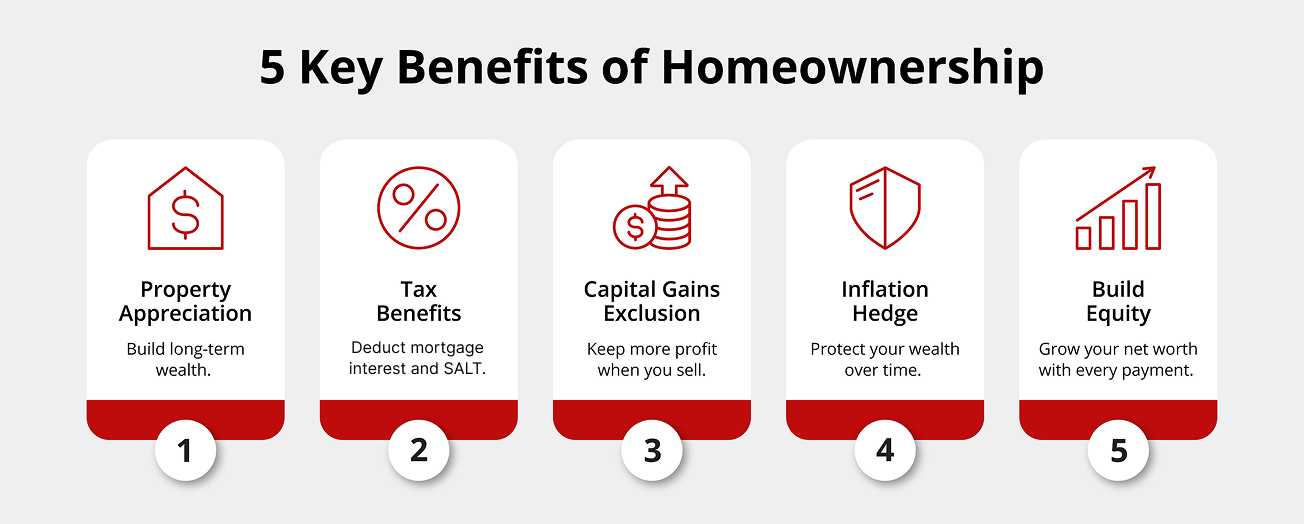

1. Property Appreciation Builds Long-Term Wealth

One of the most compelling benefits of homeownership is property appreciation. Unlike rent payments that provide no return on investment, your home has the potential to increase in value over time.

Property appreciation works silently in the background, building your net worth without requiring additional investment beyond your regular mortgage payments. For example, a home purchased for $300,000 today could be worth $390,000 in just ten years at a modest 3% annual appreciation rate.

As Yun’s analysis highlights, homeowners benefit twice — first through property appreciation, and again through the equity they accumulate simply by paying down their mortgage.

You can leverage this accumulated wealth in several ways. Many homeowners tap into their home equity through cash-out refinancing to fund renovations, consolidate debt, or invest in other opportunities. Explore first-time buyer programs to start building this wealth sooner, even with limited savings for a down payment.

Remember that market conditions do fluctuate, and not all periods see consistent appreciation. However, real estate has proven remarkably resilient over extended time periods.

2. Tax Benefits: Mortgage Interest and SALT Deductions

Multiple tax benefits are available to homeowners through deductions. The most substantial is the mortgage interest deduction (MID), which allows you to deduct interest paid on mortgage debt up to $750,000 for loans incurred after December 15, 2017. For earlier loans, the limit is $1 million.

This deduction can result in substantial tax savings, especially in the early years of your mortgage when interest comprises the majority of your monthly payment. For example, if you’re in the 24% tax bracket and pay $15,000 in mortgage interest annually, you could save $3,600 on your federal taxes.

According to the nonpartisan Tax Policy Center, “The mortgage interest deduction helps lower the cost of homeownership for millions of families in the U.S., allowing taxpayers to subtract interest paid on up to $750,000 of mortgage debt from taxable income.”

This reinforces that the true cost of owning a home is often lower than it appears—especially for borrowers who itemize deductions.

Another valuable deduction comes through state and local taxes, known as the SALT deduction. You can deduct up to $40,000 in combined state and local property taxes and either income or sales taxes. Both MID and the SALT deductions are only available when you itemize.

Budgeting for first-time buyers can seem overwhelming, but understanding these key tax benefits helps you see the true cost of homeownership is often lower than it initially appears.

3. Capital Gains Exclusion on Home Sale

If you sell your primary residence, the IRS offers one of the most generous tax breaks available, referred to as the capital gains exclusion. Single homeowners can exclude up to $250,000 in profit from their taxable income, while married couples filing jointly can exclude up to $500,000.

This exclusion applies when you’ve owned and lived in the home as your primary residence for at least two of the five years before the sale. You don’t need to purchase another home to qualify, and you can use this benefit repeatedly throughout your life (though generally not more than once every two years).

Imagine you purchased a home for $350,000 and sold it ten years later for $600,000. That’s $250,000 in profit. As a single filer, you’d owe zero federal capital gains tax on that entire amount. A married couple could profit up to $500,000 tax-free.

Personal finance expert Suze Orman calls this one of the most overlooked advantages of homeownership: “Your home can be one of the most tax-advantaged investments you ever make – when you sell, up to $500,000 in profit can be completely tax-free for a married couple.”

Her insight highlights how the capital-gains exclusion transforms a home from a living space into a long-term wealth-building asset. Use our capital gains tax calculator to get a free capital gains tax estimate that helps you better plan your home sale.

4. Real Estate as a Hedge Against Inflation

As Keeping Current Matters explains, “In short, a fixed-rate mortgage protects your budget, and home-price appreciation grows your net worth. That’s why homeownership is a strong hedge against inflation.”

In periods when consumer prices are climbing, this fixed-payment stability allows homeowners to stay ahead of rising costs while renters face annual increases.

Inflation erodes purchasing power over time, making your dollars worth less each year. Real estate can serve as a hedge against this economic reality. As the general price level rises, home values and rents typically increase alongside them, protecting homeowners’ wealth.

Your fixed-rate mortgage provides strong inflation protection compared to rent payments. The principal and interest portion of your payment remains constant throughout the loan term, even as inflation drives up the cost of everything else. A $2,000 monthly payment represents a much smaller burden ten years from now when wages and prices have increased, but your housing cost hasn’t.

Property values themselves tend to track with inflation over long periods. When the Federal Reserve expands the money supply and consumer prices rise, real estate typically appreciates alongside other hard assets. This relationship isn’t perfect year-to-year, but the long-term trend is clear.

5. Build Equity by Paying Down Your Mortgage Principal

Financial author Dave Ramsey puts it simply: “Every time you make a mortgage payment, you’re buying a little bit more of your house — that’s forced savings, and it’s one of the simplest paths to building wealth.”

This principle, known as equity building, is what separates homeowners from renters who see none of their monthly payment returned as value.

Every mortgage payment you make includes interest paid to the lender and principal that reduces your loan balance. As you pay down principal, you build equity in your home. This equity represents wealth you can access through borrowing or realize when you sell.

The benefits of homeownership become particularly clear when you compare mortgage payments to rent. Both require monthly cash outlays, but only mortgage payments build equity. A renter who pays $2,000 monthly for ten years has spent $240,000. A homeowner making the same payment has reduced their loan balance while also benefiting from any property appreciation.

Early in your mortgage, most of your payment goes toward interest. As time progresses, more goes toward principal through a process called amortization. On a 30-year fixed-rate mortgage, you’ll pay primarily interest in the first decade, but the ratio shifts in later years.

Bonus: Emotional and Lifestyle Benefits

While financial advantages drive many purchase decisions, the emotional and lifestyle benefits of homeownership deserve recognition. These intangible factors impact your quality of life and overall satisfaction.

- Stability and control over your space: Homeownership provides permanence that renting cannot match. You decide how long you stay, without worrying about lease renewals or landlords selling the property.

- Pride of ownership: Something profound happens when you own your home. You take greater care of the property, invest in improvements, and feel a deeper connection to your living space.

- Community engagement: Homeowners tend to put down deeper roots in their communities. You’re more likely to participate in local events, join neighborhood associations, and develop lasting friendships with neighbors.

- Customization freedom: Want to paint the walls deep purple? Install custom built-ins? Renovate the kitchen? Homeownership gives you complete freedom to modify your space without seeking approval.

These lifestyle benefits complement the financial advantages, making homeownership rewarding on multiple levels. The combination of wealth-building and personal satisfaction explains why buying a house continues to be a central goal for millions of Americans.

Together, these financial and emotional benefits explain why homeownership remains a cornerstone of the American dream — and why smart lending partners like Griffin Funding help make that dream attainable.

Explore Your Home Buying Options

Starting your homeownership journey doesn’t require 20% down or perfect credit. Programs exist to help you purchase with as little as 3.5% down, and some options allow you to buy a house with no money down.

Whether you need traditional mortgages or alternative mortgage loans for unique financial situations, Griffin Funding can help you find the right solution.

Ready to explore your options? Download the Griffin Gold app to track your financial progress and connect with mortgage programs tailored to your needs. Our experienced loan officers can guide you through the process, answer your questions, and help you take advantage of the many benefits homeownership offers.

Get started online or contact us today to begin your journey toward homeownership.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

Is buying a home still a good investment?

- Equity building through mortgage payments

- Tax deductions on interest and property taxes

- Inflation protection with fixed-rate mortgages

- Long-term wealth accumulation unavailable to renters

What are the main tax benefits of owning a home?

- Mortgage interest deduction: Deduct interest on loans up to $750,000

- SALT deduction: Deduct up to $40,000 in state and local property taxes

- Capital gains exclusion: Exclude up to $250,000 ($500,000 for couples) in profit when selling your primary residence

How does homeownership protect against inflation?

- Fixed-rate mortgages keep your payments constant while inflation drives up other costs, making housing progressively more affordable.

- Property values typically rise with inflation, preserving your wealth as the dollar's purchasing power declines.

- Renters face annual rent increases, while homeowners with fixed-rate mortgages enjoy stable housing expenses.

- Real estate historically maintains its value during inflationary periods.

What are some of the downsides of owning a home?

- High upfront costs (down payment, closing costs, fees)

- Responsibility for all maintenance and repairs

- Ongoing property taxes and insurance

- Reduced flexibility for relocation

- Potential property value decline during market downturns

- Need for emergency savings to cover unexpected repairs

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...