FHA Loan Waiting Periods for Bankruptcy, Foreclosure, & Short Sale

KEY TAKEAWAYS

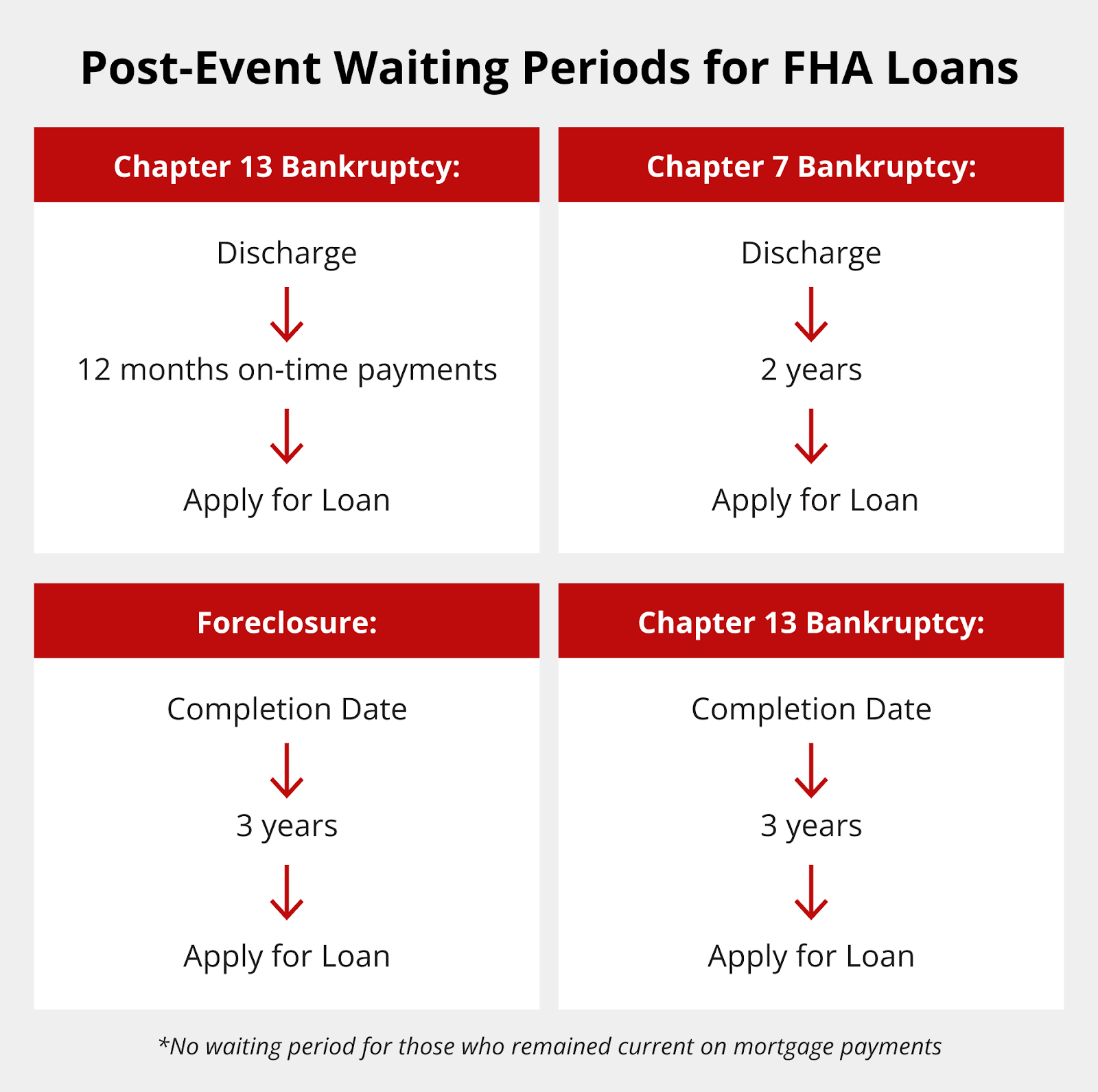

- The FHA bankruptcy waiting period ranges from 12 months for Chapter 13 to 2 years for Chapter 7

- Both foreclosure and short sale events require a standard 3-year FHA waiting period

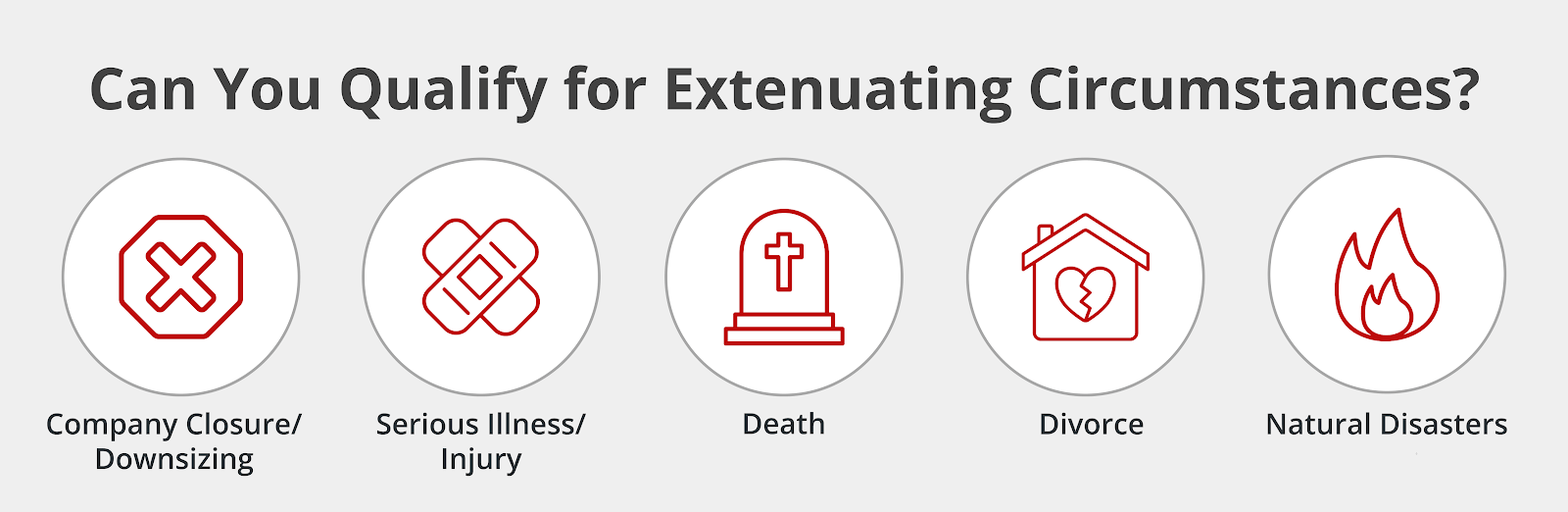

- Extenuating circumstances may reduce waiting periods with proper documentation

- Rebuilding credit and maintaining stable employment significantly improve approval odds after hardship

Outstanding Client Experience

Outstanding Client Experience Specialized Lending Solutions

Specialized Lending Solutions Direct-to-Consumer Advantage

Direct-to-Consumer Advantage We're Advisors, NOT Salespeople

We're Advisors, NOT Salespeople Effortless Digital Mortgage Platform

Effortless Digital Mortgage Platform

Financial hardships happen to many Americans, but they don’t have to end your homeownership dreams forever. The Federal Housing Administration (FHA) provides specific waiting periods after major credit events like bankruptcy, foreclosure, and short sales. These FHA waiting periods help you plan your path back to homeownership and prepare for a successful loan application.

KEY TAKEAWAYS

- The FHA bankruptcy waiting period ranges from 12 months for Chapter 13 to 2 years for Chapter 7

- Both foreclosure and short sale events require a standard 3-year FHA waiting period

- Extenuating circumstances may reduce waiting periods with proper documentation

- Rebuilding credit and maintaining stable employment significantly improve approval odds after hardship

What Is an FHA Loan?

The Federal Housing Administration backs FHA loans to help Americans achieve homeownership, especially first-time buyers and those with less-than-perfect credit. These government-backed mortgages require lower down payments (as little as 3.5%) and accept credit scores as low as 580 in many cases.

FHA loans offer several advantages over conventional mortgages:

- More flexible qualification requirements

- Lower closing costs and down payment requirements

- Ability to use gift funds for down payments

- Higher debt-to-income ratios are accepted

- Assumable loans that can make your home more attractive to future buyers

- Options for refinancing, including FHA cash-out refinance and FHA streamline refinance programs

The FHA waiting period after credit events protects both lenders and borrowers by ensuring financial stability before taking on new mortgage debt.

FHA Loan Waiting Period After Bankruptcy

The FHA loan waiting period varies depending on which type of bankruptcy you filed. Each Chapter of bankruptcy has different requirements and timelines that affect your eligibility for FHA financing.

Chapter 7 Bankruptcy

The standard FHA Chapter 7 waiting period requires 2 years from the discharge date, not the filing date. This timeline allows sufficient time to rebuild credit and demonstrate financial responsibility. However, borrowers may qualify for an exception with extenuating circumstances that caused the bankruptcy.

Extenuating circumstances include:

- Job loss due to company downsizing

- Serious illness requiring extensive medical bills

- Death of a primary wage earner

These situations must be beyond the borrower’s control and well-documented. Borrowers must provide court documents, medical records, termination letters, or death certificates as supporting evidence.

The FHA also requires borrowers to show they’ve reestablished good credit since the discharge. This means maintaining current accounts, avoiding new delinquencies, and demonstrating stable income for at least 12 months before applying.

Chapter 13 Bankruptcy

The FHA Chapter 13 waiting period allows qualification after just 12 months of on-time trustee payments. Court approval from a bankruptcy judge is mandatory before applying for any new credit, including FHA loans.

Borrowers must demonstrate financial responsibility during the payment period. Late trustee payments or violations of the court-ordered plan can disqualify applicants. The trustee’s recommendation carries significant weight in the approval process.

Documentation requirements include:

- Payment histories from the trustee

- Court approval letters for new credit

- Proof of stable income

- Records showing the reasons that led to bankruptcy have been resolved

FHA Loan Waiting Period After Foreclosure

The standard FHA foreclosure waiting period requires three years from the foreclosure completion date. The FHA defines this date as when the foreclosure deed transfers to the new owner, not when proceedings began.

The foreclosure definition includes both judicial and non-judicial foreclosures. Judicial foreclosures go through court proceedings, while non-judicial foreclosures follow state-specific procedures without court involvement. Both types trigger the same 3-year waiting period under FHA guidelines.

Extenuating circumstances may reduce this waiting period, but the requirements are strict. Borrowers must prove the foreclosure resulted from circumstances beyond their control.

Qualifying circumstances include:

- Job loss due to company closure or downsizing

- Medical emergencies requiring extensive treatment

- Death of a primary wage earner

Foreclosures significantly impact credit scores, often reducing them by 200 to 300 points initially. This credit damage affects more than just mortgage eligibility. Borrowers may face challenges securing rental housing, employment, or other credit products. The 3-year waiting period allows time for credit rehabilitation and demonstrates financial stability to future lenders.

FHA Loan Waiting Period After a Short Sale

The FHA short sale waiting period typically requires three years from the short sale completion date. However, borrowers who remained current on their mortgage payments throughout the short sale process face no waiting period.

Late mortgage payments during the 12 months preceding the short sale trigger the full 3-year waiting period. Even one late payment can disqualify borrowers from the no-waiting-period exception.

Lenders normally view short sales more favorably than foreclosures because they demonstrate the borrower’s proactive approach to resolving mortgage difficulties. Short sales typically cause less credit damage than foreclosures, which is a difference that can significantly impact the borrower’s ability to qualify for credit during the waiting period.

What Are Extenuating Circumstances?

The Department of Housing and Urban Development (HUD) defines extenuating circumstances as events beyond the borrower’s control that caused the credit event. These circumstances must represent a significant change in your financial situation that made mortgage payments impossible despite previous responsible payment behavior.

Qualifying extenuating circumstances include:

- Involuntary job loss due to company closure or downsizing

- Serious illness or injury requiring extended medical treatment

- Death of a primary wage earner or spouse

- Divorce that significantly impacts household income

- Natural disasters that damage property or disrupt income

Borrowers must demonstrate they maintained good credit before the event and have reestablished financial stability since recovery. Simple job changes or voluntary career moves typically don’t qualify as extenuating circumstances.

Proof requirements include:

- Employment termination letters

- Medical records

- Death certificates

- Divorce decrees

- Disaster declarations

The documentation must clearly establish the timeline and financial impact of the circumstances. Lenders may request additional evidence, such as tax returns or bank statements, to verify the claimed hardship’s severity and duration.

Tips to Improve FHA Loan Approval Chances Post-Hardship

Successfully obtaining FHA financing after a financial hardship requires strategic preparation and patience. Focus on these key areas to maximize your approval chances:

- Rebuild your credit by obtaining secured credit cards, making small purchases, and paying balances in full monthly

- Consider credit-builder loans or becoming an authorized user on a family member’s account

- Save for a larger down payment beyond the 3.5% minimum to demonstrate financial stability and reduce lender risk perception

- Document stable employment and income for at least two years, preferably in the same field or with the same employer, to show consistency

- Consider adding a qualified co-borrower with strong credit and income to strengthen your application and potentially qualify for better terms

- Partner with an FHA-experienced lender, like Griffin Funding, who understands the nuances of post-hardship lending and can guide you through the process

Discover FHA Mortgage Options Today

Griffin Funding specializes in helping borrowers navigate FHA loan requirements after financial hardships. Our experienced loan officers understand the complexities of post-bankruptcy, post-foreclosure, and post-short-sale lending. We’ll work with you to determine your eligibility, timeline, and the best strategy for your unique situation.

Don’t let past financial difficulties prevent you from achieving homeownership. Griffin Funding offers comprehensive mortgage solutions, including a recent credit event loan for borrowers who need financing before traditional waiting periods expire.

Start your journey back to homeownership today by exploring our mortgage options. Plus, use our Griffin Gold app to compare buying scenarios, access affordability calculators, and receive personalized action plans based on your unique situation.

Find the best loan for you. Reach out today!

Get StartedFrequently Asked Questions

What is the FHA 3-year rule?

The FHA 3-year rule refers to the standard waiting period after foreclosure or short sale events. Borrowers must wait 3 years from the completion date of these credit events before qualifying for a new FHA loan.

However, exceptions exist for extenuating circumstances or borrowers who remained current on payments during a short sale. This rule helps ensure borrowers have time to rebuild their credit and demonstrate financial stability before taking on new mortgage debt.

How long until you can sell your home purchased with an FHA loan?

You can sell your FHA-financed home at any time without restrictions from the FHA program itself. Unlike some other loan programs, FHA loans don't include prepayment penalties or minimum ownership periods.

However, consider that FHA loan limits and market conditions may affect your equity position. If you sell within the first few years, ensure you have sufficient equity to cover selling costs, remaining loan balance, and any potential mortgage insurance premiums that haven't been canceled.

What disqualifies you from getting an FHA loan?

Several factors can disqualify borrowers from FHA loans, including credit scores below 500, high debt-to-income ratios, insufficient employment history (typically less than two years), or being within the waiting periods for bankruptcy, foreclosure, or short sale.

Additionally, property issues like condos not on the FHA-approved list, homes exceeding local loan limits, or properties requiring extensive repairs can cause disqualification.

Recent Posts

HELOC Draw vs Repayment Period

A home equity line of credit is a revolving credit line secured by your home that allows you to borrow money a...

What Is a Non-Traditional Mortgage and When Should I Use One?

What Is a Non-Traditional Mortgage? A non-traditional mortgage, also known as a non-QM loan, is a home loan th...

Griffin Funding vs United Wholesale Mortgage (UWM): Mortgage Lender Comparison

Company Overview: Griffin Funding vs United Wholesale Mortgage (UWM) Let’s look at each company in turn: who...