February Market and Company News!

Jobs report gives Fed green light for more rate hikes

The Federal Reserve is almost certainly raising interest rates in March. The only question now is by how much.

The strong January jobs report is the last piece of evidence the Fed needs to show that inflation pressures are not going away anytime soon. With that in mind, traders are now pricing in a 100% chance of a rate hike next month. “If the Fed is inclined to do a 50-basis-point rate hike in March, this jobs data doesn’t stand in their way,” said Tom Graff, head of fixed income for Brown Advisory. “And there is more space for the Fed to keep hiking over the long term.”

The Fed does have to tread cautiously, though. If it acts too quickly or raises rates too aggressively, it could choke the economic recovery. But sitting by while prices keep rising isn’t a great option either. Read more here.

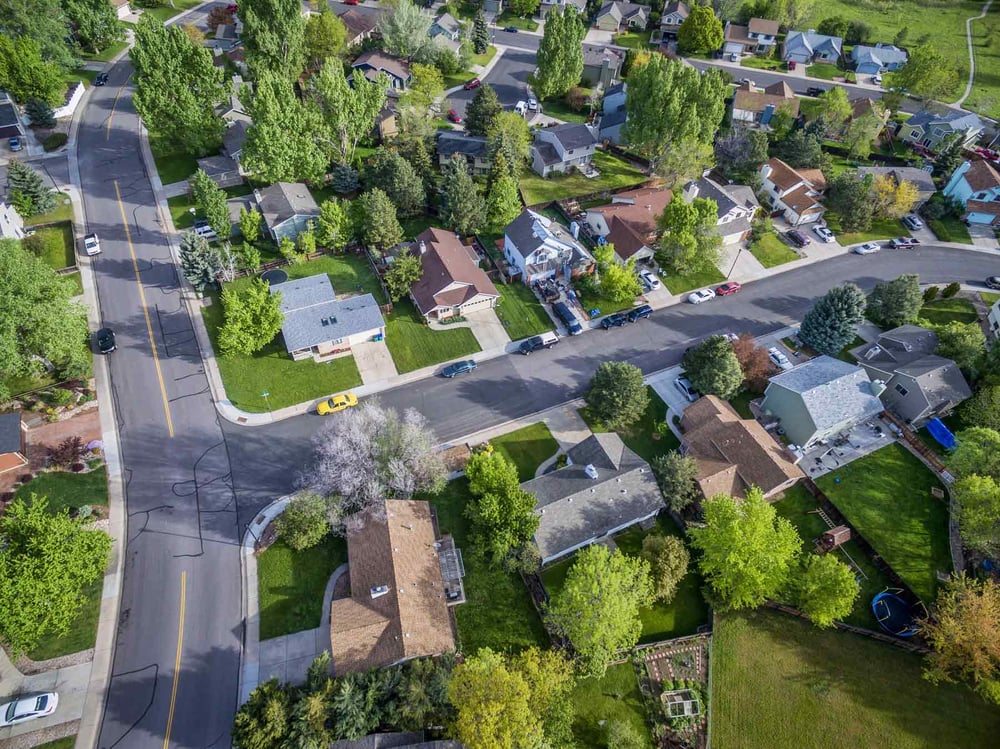

U.S. home sellers made a pretty penny in 2021, with the nationwide realized profit growing by 45% year-over-year, according to a new analysis published by real estate data vendor ATTOM this week. Per ATTOM’s year-end home sales report, on average home sellers raked in a profit of $94,092 on a typical home sale last year, up from $64,931 in 2020. For comparison sake, in 2019 a home seller’s realized profit averaged out to about $55,000, the report said.

ATTOM noted that rising home prices and profits were driven primarily by a combination of historically low interest rates and a desire by many households to trade congested virus-prone areas for the perceived safety and wider spaces of a single-family home. (The national median home price also grew by 16.9% in 2021 to $301,000—an annual record, the report added.) “As [home buyers] chased a tight supply of homes for sale, prices spiked and so did seller profits,” ATTOM said.

If you are haven’t already taken advantage of the equity in your home and would like to consider a cash out refinance, don’t hesitate to contact us today!

Did you know Griffin Funding Offers DSCR Investment Property Loans?

Qualify for a home loan without using your tax returns. As a new or experienced real estate investor, you can avoid high rates and high points of private loans, lengthy approval processes, and strict lending criteria with a debt service coverage ratio loan, which is a type of no-income loan. Qualify for a loan based on your property’s cash flow, not your income.

Securing a debt service coverage ratio loan can help you expand your investment portfolio easier than ever before..png?upscale=true&width=1120&upscale=true&name=DSCR%20Email%20Header%20(2).png)

Interested in learning more?

Get StartedRecent Posts

Bonus Depreciation for Real Estate: What It Is & How It Works

Understanding the concept of bonus depreciation and its practical application can help you capitalize on this ...

No Doc Business Loans: What You Need to Know

While “no doc” is short for “no documentation,” there are actually no true no doc loans. Instead, they...

BRRRR Method: Buy, Rehab, Rent, Refinance, & Repeat

Read on to learn more about BRRRR loans and explore how this approach can open doors to lucrative opportunitie...